The European Circular Bioeconomy Fund (ECBF) stands as a €300 million testament to the growing momentum behind sustainable water technologies. With ticket sizes ranging from €2.5-10 million, this Bonn-based powerhouse targets growth-stage water companies ready to scale their proven innovations across Europe. Beyond mere capital deployment, ECBF brings a hands-on approach to portfolio support, often taking board seats to actively guide companies through their expansion journey. For water entrepreneurs and impact investors alike, understanding ECBF’s investment thesis and operational approach is crucial for navigating Europe’s evolving water technology landscape.

The European Circular Bioeconomy Fund (long name!) is part of my Ultimate Water Investor Database, check it out!

Investor Name: ECBF

Investor Type: VC

Latest Fund Size: $320 Million

Dry Powder Available: Yes

Typical Ticket Size: $3M – $10M

Investment Themes: Water quality/quantity, Industrial water solutions, Circular Economy

Investment History: $15660000 spent over 2 deals

Often Invests Along: Sofinnova Partners

Already Invested In: Elicit Plant

Leads or Follows: Lead

Board Seat Appetite: Moderate

Key People:

The Architecture of ECBF’s Investment Strategy

The European Circular Bioeconomy Fund (ECBF) stands as a pioneering €300 million growth-stage fund reshaping water innovation across Europe through a meticulously structured investment framework. At its core, the fund targets companies developing breakthrough technologies and solutions in the water sector, with ticket sizes ranging from €5-30 million per investment.

The fund’s architecture rests on three fundamental pillars. First, ECBF focuses exclusively on growth-stage companies that have proven their technology and business model but require capital to scale operations. This strategic positioning allows the fund to minimize technology risk while maximizing impact potential. The sweet spot typically includes companies with €2-30 million in annual revenue demonstrating strong market traction.

Second, ECBF employs a comprehensive due diligence process that evaluates not just financial metrics but also circular economy principles and water impact potential. The fund prioritizes technologies that enable water reuse, resource recovery, and improved treatment efficiency. This approach aligns with Europe’s ambitious water sustainability goals while ensuring robust commercial returns.

Third, the fund’s investment thesis emphasizes scalability and replicability across European markets. Rather than focusing on single-market solutions, ECBF seeks technologies with pan-European or global potential. This strategic choice reflects the fund’s commitment to creating lasting impact in the water sector while generating attractive returns for investors.

The fund’s position in Europe’s water technology landscape is unique, bridging the critical gap between early-stage venture capital and traditional private equity. This focus on the growth stage addresses a crucial funding gap that has historically hampered the scaling of promising water technologies. By providing not just capital but also strategic guidance and industry connections, ECBF helps portfolio companies navigate the complex European water market landscape.

A distinctive feature of ECBF’s strategy is its active role in portfolio companies. The fund typically takes significant minority stakes and secures board representation to actively support growth initiatives. This hands-on approach extends beyond capital provision to include operational support, market access facilitation, and strategic partnership development.

In line with its mission to catalyze innovation in the water sector, ECBF maintains strong collaborative relationships with research institutions, industry partners, and public sector stakeholders. This network approach amplifies the fund’s ability to identify promising technologies and accelerate their market adoption across Europe.

Syndication Dynamics: Leading vs Following

ECBF’s syndication approach reflects a sophisticated balance between leading investments and participating as a strategic co-investor. The fund’s deal leadership strategy emphasizes taking controlling positions in water technology companies where their sector expertise can drive meaningful value creation.

As a lead investor, ECBF typically secures board seats and maintains significant influence over strategic decisions. This hands-on approach allows them to actively shape portfolio companies’ growth trajectories and facilitate connections across their network of water industry partners. The fund’s leadership role often involves structuring investment terms, conducting thorough due diligence, and coordinating with co-investors to ensure aligned interests.

In their co-investment activities, ECBF demonstrates strategic flexibility by partnering with both financial and strategic investors. Their approach mirrors successful examples of active venture capital engagement in the water sector. Key syndicate partners typically include specialized environmental funds, corporate venture arms of water industry leaders, and regional development banks focused on sustainable infrastructure.

The fund maintains a deliberate ratio between lead and follow-on investments, targeting approximately 60% of deals as lead investor while participating as a co-investor in the remaining 40%. This balanced approach enables ECBF to optimize resource allocation while maintaining a diverse portfolio footprint.

A distinctive aspect of ECBF’s syndication strategy is their emphasis on building complementary investor consortiums. When leading deals, they actively seek co-investors who bring specific geographic expertise, technical knowledge, or downstream market access that complements their own capabilities. This approach creates powerful synergies that benefit portfolio companies beyond just capital provision.

In water technology deals specifically, ECBF has developed a reputation for bridging the gap between early-stage venture capital and later-stage growth equity. Their ability to syndicate deals across this spectrum has helped address a critical funding gap in the European water innovation ecosystem. The fund’s collaborative approach with co-investors has been particularly effective in supporting companies through the challenging scale-up phase, where capital requirements often exceed the capacity of single investors.

Their syndication framework also incorporates specific provisions for follow-on funding rounds, ensuring portfolio companies have clear paths to future capital. This forward-looking approach helps minimize funding risks and provides entrepreneurs with greater visibility into their growth trajectory.

Geographic Focus and Investment Themes

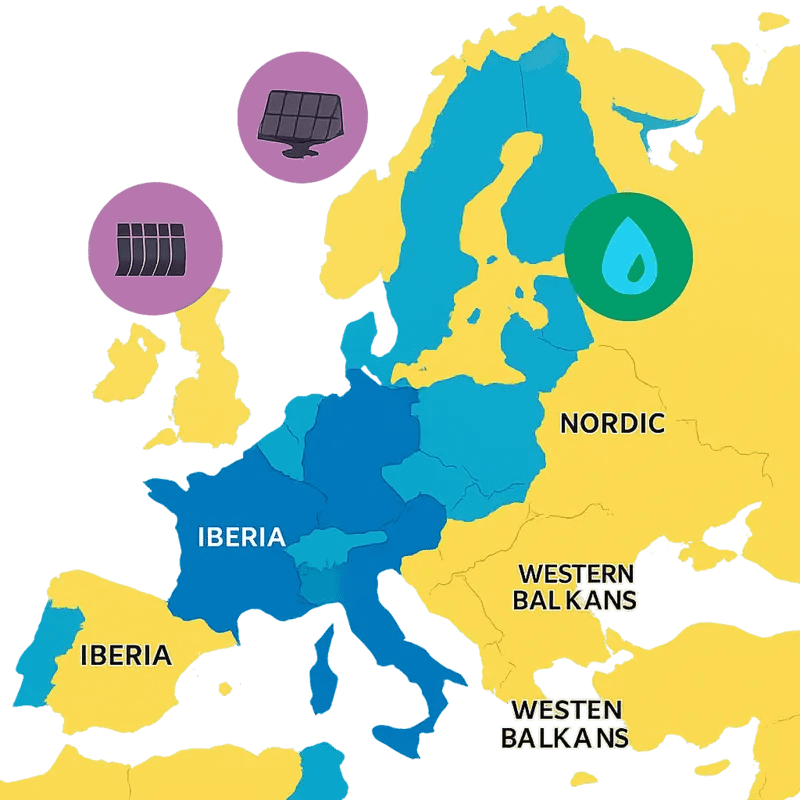

The European Circular Bioeconomy Fund (ECBF) maintains a strategic geographic focus across the European Union, with particular emphasis on regions demonstrating strong water innovation potential. Their investment mandate covers the entire EU-27, while also considering opportunities in associated countries like Norway, Switzerland, and the UK where compelling water technology solutions emerge.

The fund’s thematic priorities in water technology span several key areas aligned with Europe’s pressing water challenges. Central to their strategy is advancing solutions for water reuse and recycling, particularly in water-stressed regions of Southern Europe. This includes technologies enabling industrial water circularity and innovations that bridge the gap between municipal wastewater treatment and water reuse applications.

ECBF demonstrates particular interest in breakthrough water treatment technologies that address emerging contaminants like PFAS and microplastics. The fund’s approach mirrors broader industry trends around tackling persistent pollutants, while maintaining strict requirements for energy efficiency and operational sustainability.

Digital water solutions represent another core investment theme, encompassing smart monitoring systems, predictive analytics for infrastructure management, and AI-driven optimization tools. The fund recognizes that digital transformation is crucial for modernizing Europe’s aging water infrastructure and improving resource efficiency.

Resource recovery from wastewater stands out as a key focus area, aligning with circular economy principles. This includes technologies for extracting valuable materials like nutrients, metals, and bio-based products from water streams, creating new value chains within the water sector.

The fund’s investment approach carefully considers regional variations in water challenges and regulatory frameworks across European territories. While maintaining consistent evaluation criteria, ECBF adapts its support strategy based on local market dynamics and specific regional needs. This nuanced understanding of geographic differences enables more effective deployment of capital and strategic support.

In terms of development stages, ECBF primarily targets scale-up opportunities where water technologies have proven their efficacy through pilot demonstrations and require growth capital to achieve commercial scale. This focus helps bridge the critical gap between innovation and widespread market adoption in the European water sector.

Through this geographic and thematic strategy, ECBF aims to catalyze the development of sustainable water solutions while generating attractive returns for investors. Their approach recognizes that water challenges vary significantly across Europe, requiring a flexible yet focused investment strategy that can adapt to regional contexts while advancing broader sustainability goals.

Value Addition Beyond Capital

The European Circular Bioeconomy Fund (ECBF) distinguishes itself through an active value creation approach that extends far beyond mere capital injection. At the core of their strategy lies deep operational involvement through board participation, coupled with comprehensive strategic guidance and follow-on funding support.

As an engaged investor, ECBF typically seeks board representation in portfolio companies, placing experienced investment professionals who bring decades of sector expertise. These board members take an active role in shaping strategic decisions, from business model refinement to market expansion strategies. Rather than adopting a passive oversight position, ECBF’s board representatives regularly engage with management teams to address operational challenges and identify growth opportunities.

The fund’s commitment to follow-on funding represents another crucial pillar of their value-add strategy. Understanding that water technology companies often require multiple funding rounds to achieve commercial scale, ECBF maintains significant capital reserves for subsequent investments in high-performing portfolio companies. This approach provides founders with funding predictability and allows them to focus on execution rather than continuous fundraising.

Perhaps most notably, ECBF leverages its extensive network across Europe’s water innovation ecosystem to deliver strategic value to portfolio companies. This includes facilitating introductions to potential customers, identifying strategic partners, and enabling knowledge transfer between portfolio companies. The fund’s deep connections with research institutions, industry players, and regulatory bodies help portfolio companies navigate complex market dynamics and accelerate commercialization.

Beyond traditional support areas, ECBF provides specialized assistance in critical domains such as regulatory compliance, intellectual property strategy, and talent acquisition. Their in-house expertise helps portfolio companies build robust environmental, social, and governance (ESG) frameworks – increasingly crucial for successful exits and long-term value creation.

This comprehensive support system has proven particularly valuable for water technology companies facing the unique challenges of the European market, where regulatory frameworks and market structures vary significantly across regions. By combining financial backing with hands-on operational support and strategic guidance, ECBF helps portfolio companies navigate these complexities while maintaining focus on sustainable growth.

As explored in our analysis of how impact investing can mitigate various water risks, this holistic approach to value creation has become increasingly important in the water sector, where technical excellence alone often proves insufficient for market success.

The ECBF Investment Thesis: Where Water Meets Bioeconomy

The European Circular Bioeconomy Fund’s approach to water technology investment centers on a crucial insight: water innovation and circular bioeconomy principles are inherently interconnected. The fund strategically targets solutions that leverage biological processes to address water challenges while promoting resource recovery and circularity.

At the core of ECBF’s water investment thesis lies the recognition that nature’s own mechanisms often provide the most efficient and sustainable water treatment solutions. The fund prioritizes technologies that harness microorganisms, enzymes, and biomimetic processes to purify water and recover valuable resources. This biological approach offers significant advantages over conventional chemical and physical treatment methods, including lower energy consumption, reduced chemical usage, and enhanced resource recovery potential.

Resource recovery represents a particularly compelling focus area for ECBF’s water investments. The fund actively seeks technologies that can extract nutrients, energy, and high-value compounds from wastewater streams. Of special interest are solutions that can transform what was once considered waste into marketable products – from biopolymers and specialty chemicals to renewable energy sources. This aligns perfectly with ECBF’s broader mission of accelerating the transition to a circular bioeconomy.

The fund’s water technology portfolio emphasizes three key innovation domains: advanced biological treatment systems, resource recovery platforms, and water-efficient bioprocessing technologies. In biological treatment, ECBF targets next-generation solutions that optimize bacterial communities for enhanced performance and stability. For resource recovery, the focus extends to technologies that can selectively extract and purify valuable components from complex water matrices. The bioprocessing angle explores water-efficient fermentation systems and closed-loop industrial applications.

What sets ECBF’s investment approach apart is its emphasis on scalability and market readiness. Rather than pursuing early-stage research projects, the fund focuses on proven technologies ready for commercial deployment. This strategy allows ECBF to bridge the critical gap between innovation and market implementation, accelerating the adoption of sustainable water solutions across Europe.

Beyond individual technologies, ECBF looks for solutions that create systemic impact. The fund prioritizes investments that can transform entire value chains, fostering collaboration between water utilities, industrial users, and technology providers. This systems-thinking approach recognizes that the most effective water innovations often require ecosystem-wide changes.

Portfolio Success Stories: Water Innovation in Action

ECBF’s portfolio showcases several groundbreaking water technology companies that are revolutionizing resource recovery and treatment processes through biological innovation. These success stories demonstrate how strategic funding can accelerate the commercialization of circular solutions.

One standout portfolio company has developed an enzymatic treatment process that breaks down persistent organic pollutants in industrial wastewater streams. By harnessing naturally occurring enzymes and optimizing their activity through protein engineering, this technology achieves removal rates exceeding 99% while generating valuable byproducts that can be recovered and reused. The solution has been successfully deployed at several major chemical manufacturing facilities, reducing treatment costs by 40% compared to conventional methods.

Another portfolio company is pioneering the use of specialized microorganisms to extract valuable minerals and metals from mining wastewater. Their bioleaching process not only treats contaminated water but also recovers critical raw materials like copper, nickel and rare earth elements with high efficiency. This circular approach transforms what was previously a waste stream into a revenue source while dramatically reducing the environmental impact of mining operations.

In the municipal water sector, an ECBF-backed enterprise has commercialized a biological phosphorus removal and recovery system that produces high-grade fertilizer products. The process leverages specific bacteria strains to accumulate phosphorus, which is then harvested and refined into agricultural nutrients. Multiple utilities have adopted this solution to meet stringent discharge limits while generating new revenue streams.

What unites these success stories is their strategic alignment with ECBF’s investment thesis around circular bioeconomy solutions. By targeting companies that harness biological processes to solve water challenges while creating valuable outputs, the fund is accelerating the transition to more sustainable water management practices.

These portfolio companies have validated that bio-based water technologies can deliver both strong environmental benefits and attractive financial returns. Their achievements demonstrate how targeted growth capital combined with deep sector expertise can help scale promising innovations into commercially viable solutions.

As highlighted in How to Almost Double Treatment Capacity in About No Time, the water sector is ripe for transformative solutions that increase efficiency while recovering resources. ECBF’s portfolio companies are turning this potential into reality through nature-inspired innovations that close the loop between waste and value.

Investment Criteria and Due Diligence Process

The European Circular Bioeconomy Fund (ECBF) employs a rigorous evaluation framework to identify and assess promising water technology investments. At its core, the fund seeks solutions that demonstrate clear potential for both environmental impact and commercial viability in the circular bioeconomy space.

Prospective portfolio companies must first meet fundamental eligibility criteria. The fund targets European businesses, typically at growth stage, with proven technology readiness levels (TRL 6-9) and clear paths to market adoption. Water technology ventures should demonstrate innovative approaches to challenges like water reuse, resource recovery, or efficiency improvements. The fund particularly values solutions that enable circular water use while reducing energy consumption and chemical inputs.

The due diligence process unfolds across multiple phases, beginning with an initial screening of the business plan and technology validation. Companies must provide comprehensive documentation of their intellectual property position, market analysis, and financial projections. The ECBF team pays special attention to scalability potential and whether the solution can be deployed across multiple geographies and industries.

Technical assessment forms a crucial component, with external experts evaluating the robustness and differentiation of the core technology. Projects undergo thorough examination of their environmental credentials, including quantifiable metrics for water savings, emissions reduction, or resource recovery. The fund places significant emphasis on validating both technical performance claims and commercial viability.

Beyond technical merits, ECBF scrutinizes management team capabilities, business model strength, and market positioning. The fund seeks companies with strong intellectual property protection and defensible competitive advantages. Financial analysis covers detailed unit economics, working capital requirements, and projected returns. Companies should demonstrate clear paths to profitability and ability to achieve significant scale.

The final investment decision weighs multiple factors including technology validation, market opportunity size, execution capability, and alignment with ECBF’s impact objectives. Successful candidates typically receive investments ranging from €5-30 million, structured as equity or quasi-equity instruments. The fund aims to be an active investor, providing not just capital but also strategic guidance and access to its broader network of industry partners.

For water technology entrepreneurs seeking ECBF funding, thorough preparation across all evaluation dimensions is essential. Companies should be prepared to demonstrate not just technological innovation, but also clear business model validation, strong unit economics, and measurable environmental impact metrics. Early engagement with the fund’s team can help align expectations and streamline the due diligence process.

Future Outlook: ECBF’s Vision for Water Innovation

ECBF’s strategic vision for water technology extends well beyond traditional investment horizons, focusing on transformative solutions that will reshape Europe’s water landscape over the next decade. The fund recognizes that water challenges require long-term thinking and sustained capital deployment to drive meaningful innovation.

At the core of ECBF’s forward-looking strategy is the belief that water technology must evolve from standalone solutions to integrated circular systems. This vision sees water treatment, resource recovery, and reuse working in harmony through digitally-enabled infrastructure. The fund anticipates that artificial intelligence and advanced analytics will become fundamental to optimizing these systems, reducing energy consumption while maximizing resource recovery.

Looking toward 2030 and beyond, ECBF expects several key trends to dominate the water technology landscape. Climate resilience will become a central focus, with technologies that help utilities and industries adapt to extreme weather events gaining prominence. The fund is particularly interested in solutions that combine climate adaptation with resource efficiency, such as energy-neutral treatment systems and technologies that transform waste streams into valuable products.

A significant focus area in ECBF’s long-term strategy is the convergence of water technology with other sectors. The fund sees tremendous potential in solutions that bridge water management with renewable energy, agriculture, and industrial processes. This cross-sector approach reflects the growing recognition that water challenges cannot be solved in isolation.

ECBF’s investment thesis also anticipates a shift in how water services are delivered and monetized. The fund expects to see more water-as-a-service business models emerge, where technology providers take on operational responsibilities and share performance risks. This evolution could unlock new financing mechanisms and accelerate the adoption of innovative solutions.

Regulatory developments will play a crucial role in shaping the water technology landscape. ECBF positions its investments to capitalize on anticipated regulatory changes, particularly around micropollutants, resource recovery, and carbon emissions. The fund’s portfolio companies are being prepared to meet these future requirements while creating sustainable competitive advantages.

Particularly promising are technologies that enable decentralized treatment and resource recovery, which ECBF believes will become increasingly important as urban infrastructure evolves. The fund is actively seeking innovations that can help communities develop more resilient and localized water management systems.

Ultimately, ECBF’s vision for water innovation centers on creating scalable, sustainable solutions that deliver both environmental and economic returns. The fund sees tremendous opportunity in technologies that can demonstrate measurable impact while building profitable, growing businesses that attract follow-on investment.

Final words

ECBF’s €300 million fund represents more than just capital availability for Europe’s water technology sector – it embodies a comprehensive approach to scaling proven innovations. Their sweet spot of €2.5-10 million investments, coupled with active board participation and strategic support, positions them uniquely in the market. For water entrepreneurs, ECBF offers not just funding but a partner capable of navigating the complexities of European expansion. Impact investors can find in ECBF a co-investment partner with deep sector expertise and a proven track record of nurturing sustainable technologies. As water challenges continue to mount globally, ECBF’s model of combining financial firepower with hands-on support may well prove to be the blueprint for successful water technology investments. Their emphasis on growth-stage companies ensures that proven solutions get the boost they need to achieve meaningful scale and impact.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my ‘(don’t) Waste Water’ platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!