In the depths of Australia’s investment landscape, Perennial Value Management has carved out a unique position at the intersection of water infrastructure and sustainable returns. From their Sydney headquarters, this astute team combines rigorous analysis with environmental stewardship, focusing on core water infrastructure assets that promise both financial performance and positive impact. Their approach reflects a deep understanding that water isn’t just a commodity – it’s the foundation of our environmental and economic future. As water entrepreneurs and impact investors seek partners who grasp both the technical and strategic dimensions of water investments, Perennial Value Management’s methodology offers valuable insights into how institutional capital can flow towards water sustainability.

Perennial Value Management is part of my Ultimate Water Investor Database, check it out!

Investor Name: Perennial Value Management

Investor Type: PE

Latest Fund Size: $ Million

Dry Powder Available: No

Typical Ticket Size: <$250k

Investment Themes: Core Water Infrastructure, Water Management, Environmental Services

Investment History: $7130000 spent over 4 deals

Often Invests Along: Pathfinder Asset Management

Already Invested In: De.mem Limited

Leads or Follows: Follow

Board Seat Appetite: Moderate

Key People:

Strategic Investment Focus

Perennial Value Management has cultivated a distinctive approach to water infrastructure investment, anchored in established assets and sustainable solutions. The firm’s strategy centers on identifying mature water infrastructure projects that demonstrate proven operational track records while harboring significant potential for technological enhancement and efficiency gains.

A cornerstone of Perennial’s investment philosophy is their commitment to projects with quantifiable environmental and social benefits. Their portfolio heavily favors established water treatment facilities, distribution networks, and sustainable water management solutions that have successfully operated for at least 3-5 years. This focus on operational maturity helps mitigate risk while providing clear pathways for value creation through strategic upgrades and optimization.

The fund maintains strict minimum investment thresholds, typically requiring projects to demonstrate annual revenues exceeding $5 million and EBITDA margins above 15%. This disciplined approach ensures that portfolio companies have sufficient scale and financial stability to warrant institutional investment. Can private capital change the world of water for the better?

Perennial shows a marked preference for late-stage investments in water infrastructure, particularly focusing on expansion capital for proven technologies and established operations. Rather than pursuing early-stage ventures or unproven technologies, the firm targets businesses that have successfully navigated their growth phase and require capital for scaling operations, implementing efficiency improvements, or expanding into new markets.

Their investment criteria emphasize projects with clear regulatory compliance records and robust environmental management systems. The firm particularly values opportunities where sustainable water management practices can be enhanced through strategic capital deployment, such as implementing advanced monitoring systems, reducing energy consumption, or improving water recovery rates.

This strategic orientation allows Perennial to maintain a focused portfolio of water infrastructure assets that not only generate stable returns but also contribute meaningfully to water conservation and sustainable resource management. Their approach balances commercial viability with environmental stewardship, ensuring that investments serve both financial and sustainability objectives.

Water Infrastructure Themes

Perennial Value Management has developed a sophisticated investment thesis centered around critical water infrastructure themes that address both immediate needs and long-term sustainability goals. The fund’s strategic focus encompasses three core pillars that shape their allocation decisions.

The first pillar targets foundational water infrastructure, including treatment facilities, distribution networks, and storage systems. These investments aim to modernize aging assets while expanding capacity to meet growing urban demands. A particular emphasis is placed on technologies and solutions that enhance operational efficiency, such as advanced filtration systems and smart monitoring capabilities.

The second investment theme focuses on sustainable water solutions that promote resource conservation and circular economy principles. This includes water recycling and reuse systems, precision irrigation technologies, and innovative approaches to stormwater management. The fund recognizes that sustainable solutions not only deliver environmental benefits but also generate compelling financial returns through operational cost savings and regulatory compliance.

Environmental impact considerations form the third pillar of Perennial’s water infrastructure strategy. The firm carefully evaluates potential investments through an environmental lens, prioritizing projects that reduce carbon emissions, minimize chemical usage, and protect natural water bodies. This focus aligns with rising demand for environmentally responsible infrastructure solutions and helps future-proof investments against tightening regulations.

Across these themes, Perennial maintains strict investment criteria centered on proven technologies and established business models. Rather than pursuing speculative ventures, the fund targets infrastructure assets with demonstrable track records and clear paths to profitability. This approach allows them to deliver both environmental and financial returns while managing risk exposure.

The integration between these investment themes creates powerful synergies. For example, when evaluating traditional water treatment facilities, Perennial actively seeks opportunities to incorporate sustainable technologies and environmental safeguards. This holistic approach has proved particularly effective in Australia’s water-stressed environment, where resource efficiency and environmental protection are increasingly critical.

Importantly, these themes are not viewed in isolation but rather as interconnected elements of a comprehensive water infrastructure strategy that recognizes the evolving needs of communities and ecosystems. By maintaining this integrated perspective, Perennial has positioned itself to capitalize on the growing demand for sustainable water infrastructure while contributing to improved water security and environmental outcomes.

Geographic Focus and Partnership Approach

Perennial Value Management has strategically concentrated its water infrastructure investments in the Australian market, leveraging deep local knowledge and established relationships within the region. This geographic focus allows the firm to maintain closer oversight of assets and capitalize on Australia’s unique water challenges and opportunities.

The fund’s partnership approach emphasizes collaborative investments alongside experienced operators and local authorities. Rather than pursuing outright control, Perennial often takes meaningful minority positions that enable significant influence while benefiting from partners’ operational expertise. This strategy has proven particularly effective in regional water infrastructure projects, where local knowledge and relationships are crucial.

Perennial’s investment stance balances leading and following roles based on the specific opportunity. In core infrastructure assets, they frequently join consortiums as a supportive partner, contributing capital and governance expertise while deferring to operators’ technical knowledge. However, in emerging areas like sustainable water solutions, Perennial has shown willingness to take leading positions, particularly when they identify transformative opportunities aligned with their environmental impact goals.

The firm’s partnership model extends beyond capital allocation. Perennial actively engages with water utilities, technology providers, and environmental stakeholders to develop comprehensive solutions to water challenges. This network-based approach enhances their ability to identify and execute on opportunities while managing risks through diversified expertise.

In line with their sustainable investment mandate, Perennial carefully evaluates potential partners’ environmental credentials and governance frameworks. They seek alignment on sustainability objectives and operational standards, often incorporating specific environmental targets into partnership agreements.

Their geographic concentration in Australia has not prevented the firm from incorporating global best practices. Perennial maintains relationships with international water infrastructure investors and operators, allowing them to apply worldwide innovations and standards to their Australian investments while remaining focused on their core market.

This balanced approach to partnerships and market focus has enabled Perennial to build a robust portfolio of water infrastructure assets while maintaining the flexibility to adapt to evolving market conditions and opportunities. Their strategy demonstrates that geographic focus, when combined with strategic partnerships, can create substantial value in sustainable water infrastructure investment.

Governance and Value Creation

Perennial Value Management’s governance approach in water infrastructure investments reflects a delicate balance between active oversight and operational autonomy. The fund manager has developed a sophisticated framework for board representation that emphasizes strategic guidance while empowering management teams to execute day-to-day operations effectively.

At the core of Perennial’s governance strategy lies a commitment to maintaining meaningful board positions in their portfolio companies. They typically secure one to two board seats, strategically positioning experienced water infrastructure professionals who bring deep sector expertise. This approach allows them to influence key decisions while avoiding micromanagement of operational details.

Value creation under Perennial’s model operates through three primary channels. First, they leverage their extensive network to facilitate strategic partnerships and commercial relationships, opening new revenue streams for portfolio companies. Second, they provide specialized expertise in operational efficiency, particularly in areas like asset optimization and maintenance scheduling. Third, they assist in developing robust environmental, social, and governance (ESG) frameworks that enhance long-term sustainability and stakeholder relationships.

Their engagement strategy emphasizes regular, structured interaction between board representatives and management teams. Monthly operational reviews focus on key performance indicators, while quarterly strategic sessions address longer-term initiatives and market positioning. This cadence ensures consistent oversight while maintaining management’s operational flexibility.

Perennial has shown particular skill in aligning management incentives with long-term value creation. Their compensation structures typically combine traditional metrics like EBITDA growth with sustainability targets and customer satisfaction indicators. This holistic approach ensures management teams focus on both financial performance and broader stakeholder outcomes.

The fund’s governance preferences lean toward majority ownership positions, though they maintain flexibility for significant minority stakes when co-investing with aligned partners. This control-oriented approach allows them to implement their value creation strategies more effectively, particularly in situations requiring significant operational or strategic transformation.

In terms of board dynamics, Perennial emphasizes the importance of diverse expertise. They typically seek to complement their water infrastructure specialists with directors bringing complementary skills in areas like digital transformation, regulatory affairs, and community engagement. This diversity of perspective strengthens decision-making and risk management across their portfolio.

Their approach to value creation extends beyond traditional financial metrics to encompass broader impact objectives. Portfolio companies are encouraged to develop comprehensive sustainability strategies, including water conservation initiatives, renewable energy adoption, and community benefit programs. This integrated approach has proven effective in building long-term value while addressing critical environmental and social challenges.

The Value Investing DNA

At the core of Perennial Value Management’s water investment strategy lies a deeply embedded value investing philosophy, meticulously adapted for the water technology sector. This approach combines traditional value investing principles with a nuanced understanding of water infrastructure dynamics.

The firm’s methodology begins with identifying fundamentally sound water technology companies trading below their intrinsic value. However, unlike conventional value investing that focuses primarily on price-to-book ratios and earnings multiples, Perennial has developed a specialized framework that accounts for the unique characteristics of water assets.

This framework emphasizes three critical components: infrastructure resilience, regulatory alignment, and operational efficiency. Infrastructure resilience measures an asset’s ability to maintain consistent performance across various climate and demand scenarios. Regulatory alignment evaluates how well positioned an asset is to benefit from evolving water regulations and environmental standards. Operational efficiency examines the asset’s capacity to deliver sustainable returns while managing operational costs.

Perennial’s analysts dig deep into technical specifications, examining factors like water treatment capacity, energy consumption metrics, and maintenance requirements. This technical evaluation is balanced against market dynamics, including regional water scarcity trends, regulatory developments, and demographic shifts that could impact demand patterns.

A distinguishing feature of Perennial’s approach is their patience in position building. Rather than seeking quick gains, they typically establish positions over extended periods, allowing them to average into investments at attractive valuations. This methodical approach helps mitigate the impact of market volatility while building meaningful stakes in promising water technology companies.

The firm also places significant emphasis on identifying catalysts that could unlock value in underappreciated assets. These catalysts often include technological breakthroughs, regulatory changes, or market structure developments that could drive revaluation of water assets. Read more about water technology investment evaluation.

Risk management is embedded throughout the investment process, with particular attention paid to technology risk, regulatory risk, and market adoption timelines. This comprehensive risk assessment framework helps ensure that apparent value opportunities don’t become value traps, particularly crucial in the water sector where technology adoption cycles can be lengthy.

Water Tech Due Diligence Mastery

Perennial Value Management has developed a sophisticated multi-layered framework for evaluating water technology investments that seamlessly blends financial analysis with impact measurement. This approach builds upon traditional value investing principles while incorporating specialized water sector metrics.

At the core of their technical evaluation process lies a comprehensive assessment of three critical dimensions: technology validation, market fit, and impact potential. For technology validation, Perennial’s engineers conduct detailed reviews of pilot data, examining key performance indicators across various operating conditions. They particularly focus on scalability parameters, energy efficiency metrics, and operational reliability indicators.

Their market evaluation framework employs a unique scoring system that weighs market size against addressable opportunities. Within this analysis, Perennial assigns weighted values to factors such as regulatory tailwinds, competitive moats, and adoption barriers. This systematic approach helps identify opportunities where market dynamics align with technological capabilities.

The firm has developed a proprietary water impact measurement tool that quantifies both direct and indirect effects of water technologies. This framework evaluates water savings, quality improvements, and broader environmental benefits through standardized metrics. The tool considers factors such as gallons of water conserved, contaminant removal efficiency, and energy consumption reduction.

A distinctive aspect of Perennial’s due diligence process is their collaborative verification approach. Rather than relying solely on internal analysis, they actively engage with water utilities, industrial end-users, and research institutions to validate technology claims and market assumptions. This network-based validation provides crucial real-world insights that pure financial analysis might miss.

The firm has integrated advanced risk assessment protocols specifically calibrated for water technology investments. These protocols account for regulatory risks, implementation challenges, and market adoption curves unique to the water sector. Each investment undergoes stress testing against various scenarios, including drought conditions, regulatory changes, and competitive pressures.

Perennial’s evaluation process also incorporates a detailed assessment of intellectual property strength and competitive positioning. Their IP analysis extends beyond patent counts to examine the strategic value of technology portfolios and their alignment with market needs. This approach helps identify truly defensible innovations rather than mere technological novelties.

Linking to their broader investment thesis, Perennial has established clear benchmarks for financial returns balanced against water impact metrics. Investment decisions require meeting both sets of criteria, ensuring that portfolio companies deliver not just financial returns but meaningful contributions to water sustainability goals. Their approach mirrors elements explored in how to mitigate 4 shades of water risk through impact investing, though with proprietary adaptations.

This comprehensive framework enables Perennial to identify opportunities that others might overlook, particularly in cases where traditional financial metrics fail to capture the full value proposition of water technologies.

Portfolio Synergies and Support

Perennial Value Management’s approach to water technology investment extends far beyond simple capital allocation. The firm has developed a sophisticated ecosystem that creates value through strategic portfolio connections and hands-on operational support for its water technology companies.

At the heart of their strategy lies a deliberate focus on building complementary capabilities across portfolio companies. Rather than viewing each investment in isolation, Perennial actively identifies and nurtures synergistic relationships. For instance, when backing companies developing advanced membrane technologies, they simultaneously invest in firms specializing in pretreatment solutions and process optimization software, creating natural partnership opportunities that benefit all parties.

Perennial’s hands-on support manifests in several key areas. Their technical advisory board, comprising industry veterans and subject matter experts, provides portfolio companies with deep domain expertise and strategic guidance. This proves particularly valuable for early-stage companies navigating complex regulatory environments or scaling manufacturing operations.

The firm has demonstrated particular success in helping portfolio companies establish strategic partnerships. In one notable case, Perennial facilitated a collaboration between a membrane technology developer and a large industrial water treatment company, accelerating commercial adoption while providing valuable market feedback. This partnership led to a 300% increase in pilot projects within 18 months.

Beyond technical support, Perennial leverages its extensive network to help portfolio companies build robust management teams. The firm maintains relationships with experienced water industry executives who can step into leadership or advisory roles as needed. This talent pipeline has proven crucial for companies transitioning from R&D-focused operations to commercial scale.

The firm’s approach to commercialization support is similarly comprehensive. Rather than pushing for rapid market entry, Perennial helps companies develop methodical go-to-market strategies that consider specific industry dynamics. This includes identifying ideal early adopters, structuring pilot programs, and developing pricing models that align with customer value creation.

Perennial’s portfolio companies also benefit from shared resources and best practices across the network. Regular portfolio company summits facilitate knowledge exchange and relationship building among CEOs and technical teams. These interactions have spawned numerous collaborative projects, from joint research initiatives to shared pilot programs.

Perennial’s commitment to fostering these connections while providing sustained operational support has translated into concrete results. Portfolio companies consistently outperform industry averages in key metrics like time-to-market and customer acquisition costs. More importantly, this approach has helped create sustainable water technology businesses that deliver both environmental impact and financial returns.

Impact Measurement and Future Vision

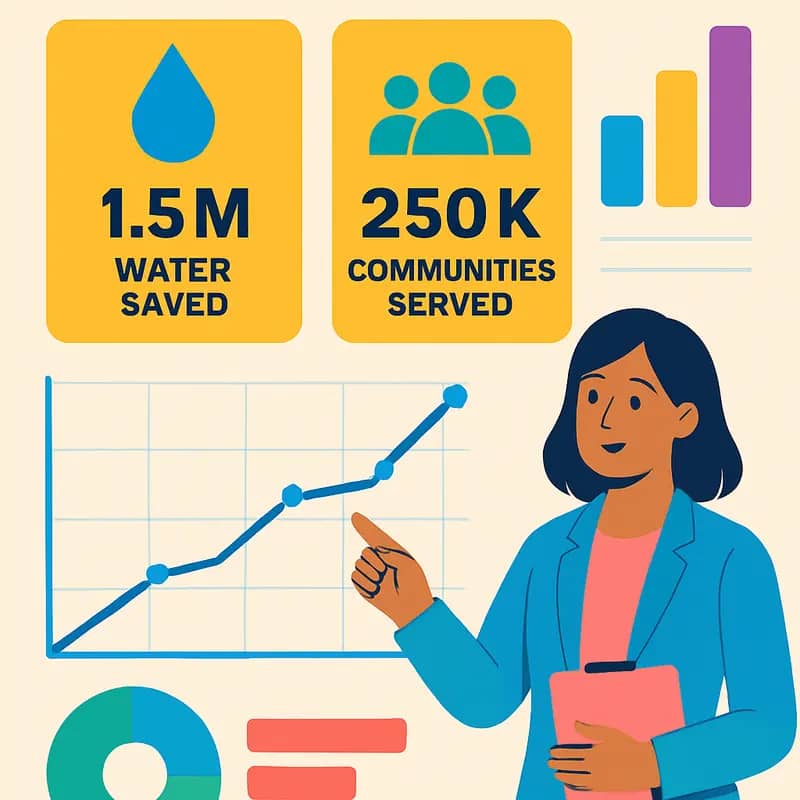

Perennial Value Management has developed a sophisticated framework for measuring both environmental and financial impacts across their water technology investments. Their approach combines quantifiable metrics like water savings, energy reduction, and emissions avoidance with broader indicators of ecosystem health and community resilience.

The fund employs a dual-lens evaluation system that tracks direct operational impacts alongside downstream effects. For instance, when assessing water treatment technologies, they measure immediate efficiency gains while also analyzing long-term watershed improvements. This comprehensive view helps identify solutions that deliver compounding benefits over time.

Critically, Perennial has moved beyond traditional ESG scoring to develop proprietary impact measurement tools. Their system weights different outcomes based on local contexts and urgent needs. A water-saving innovation deployed in an arid region, for example, receives appropriate impact multipliers reflecting the heightened value of conservation in water-stressed areas.

The fund’s future vision centers on scaling proven solutions while nurturing breakthrough technologies. Their roadmap prioritizes three key areas: advanced materials for water purification, AI-enabled infrastructure optimization, and nature-based treatment systems. This balanced portfolio approach allows them to deliver near-term results while maintaining exposure to potentially transformative innovations.

Perennial sees particular promise in technologies that create positive feedback loops. For instance, they actively seek solutions that simultaneously reduce energy consumption, improve water quality, and generate valuable byproducts. These win-win innovations help build momentum for wider adoption while strengthening the business case for sustainable water management.

Looking ahead, the fund is positioning itself to capitalize on emerging opportunities in water technology convergence. They anticipate increasing overlap between water solutions and adjacent sectors like renewable energy, agriculture, and circular economy initiatives. This cross-sector perspective informs both their impact measurement evolution and future investment thesis.

Drawing from lessons highlighted in their detailed analysis of impact investing approaches, Perennial continues refining their framework to better capture and communicate the full value their portfolio companies create. This ongoing measurement innovation helps attract additional capital while providing portfolio companies with powerful tools to demonstrate their impact.

Final words

Perennial Value Management’s approach to water investment reflects a sophisticated understanding of both the opportunities and responsibilities in this crucial sector. Their focus on sustainable water infrastructure, coupled with their strategic approach to governance and value creation, positions them uniquely in the Australian market. While they maintain flexibility in their investment approach, their commitment to environmental impact alongside financial returns demonstrates a forward-thinking strategy that resonates with both water entrepreneurs and impact investors. The firm’s emphasis on established infrastructure and sustainable solutions, combined with their selective approach to board representation, suggests a mature understanding of how to drive value in water investments. For entrepreneurs and investors in the water sector, Perennial’s model offers valuable lessons in balancing impact with returns, and technical expertise with strategic vision. As water infrastructure continues to demand significant capital investment, Perennial’s approach provides a template for how institutional investors can meaningfully participate in this crucial sector.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!