Nestled in the heart of Gothenburg, Chalmers Ventures stands as a beacon for water technology innovation, wielding an evergreen fund structure that has proven particularly potent for nurturing breakthrough water solutions. With investment tickets ranging from €100,000 to €2 million, this Swedish powerhouse has carved out a unique niche in water tech, focusing on advanced purification, smart monitoring, and sustainable industrial solutions. Their venture builder approach, combined with close ties to Chalmers University’s research ecosystem, creates a fertile ground for water entrepreneurs looking to transform laboratory breakthroughs into market-ready solutions.

Chalmers Ventures is part of my Ultimate Water Investor Database, check it out!

Investor Name: Chalmers Ventures

Investor Type: VC

Latest Fund Size: $2 Million

Dry Powder Available: Yes

Typical Ticket Size: $1M – $3M

Investment Themes: Advanced Water Purification/Filtration, Water Monitoring/Digital Sensing, Sustainable Industrial Water Solutions

Investment History: $945000 spent over 5 deals

Often Invests Along: Almi Invest, Butterfly Ventures, Gladium

Already Invested In: Aqua Robur, Atium, Retein

Leads or Follows: Lead

Board Seat Appetite: Moderate

Key People:

The Evergreen Edge: Chalmers Ventures’ Investment Structure

At the heart of Chalmers Ventures’ success in water technology innovation lies its distinctive evergreen fund structure. Unlike traditional venture capital funds that operate on fixed timelines, this perpetual investment model provides crucial advantages for supporting deep tech ventures in the water sector.

The evergreen structure allows Chalmers Ventures to take a genuinely long-term perspective on investments, perfectly aligned with the extended development cycles typical in water technology. Rather than rushing portfolio companies toward exits within 5-7 years, the fund can provide patient capital that matches the natural progression of complex water innovations from research through commercialization.

This patient approach manifests in several practical benefits for portfolio companies. The fund can participate in multiple funding rounds over time, providing steady capital infusion as technologies mature. This reliable funding partner lets entrepreneurs focus on perfecting their solutions rather than constantly pursuing new investors. The evergreen model also enables Chalmers Ventures to reinvest returns from successful exits back into new water technology ventures, creating a sustainable cycle of innovation support.

Beyond just financial backing, the structure facilitates deep operational involvement. The fund’s investment professionals can dedicate substantial time to supporting portfolio companies without the pressure of artificial time constraints. This translates into more comprehensive technical guidance, strategic planning assistance, and access to Chalmers University’s vast research network.

The model particularly shines in supporting university spinouts – a critical source of water innovation. Academic researchers often need extended runway to transform laboratory breakthroughs into market-ready solutions. Chalmers Ventures’ evergreen approach provides this crucial space for development while maintaining strong ties to the university’s research ecosystem.

The structure also enables strategic portfolio construction across different water technology verticals. Rather than concentrating investments in quick-return opportunities, the fund can maintain a balanced mix of near-term and long-horizon innovations. This portfolio diversity helps manage risk while ensuring continued support for groundbreaking but time-intensive water technologies.

As detailed in a recent analysis of venture capital in water, this patient capital approach is increasingly vital for advancing solutions to global water challenges. Chalmers Ventures’ evergreen model demonstrates how investment structures can be optimized to nurture the next generation of water technology innovations.

Water Technology Focus Areas: From Sensors to Sustainability

Chalmers Ventures has strategically positioned itself at the forefront of water technology innovation by focusing on three key investment domains that address critical global water challenges. The fund’s portfolio reflects a deep understanding of how emerging technologies can transform water management and sustainability.

In the realm of water quality monitoring and sensing, Chalmers has backed several groundbreaking ventures developing next-generation sensor technologies. These solutions leverage advanced materials and AI-powered analytics to enable real-time water quality monitoring at unprecedented levels of accuracy and cost-effectiveness. The emphasis is on developing robust sensors that can detect contaminants, from heavy metals to micropollutants, while withstanding harsh industrial environments.

Water purification and treatment represents another crucial focus area, where the fund supports innovations in membrane technology and advanced oxidation processes. Portfolio companies in this space are pioneering energy-efficient approaches to water treatment, with particular attention to addressing emerging contaminants like PFAS and pharmaceutical residues. Several ventures are developing modular, decentralized treatment systems that can be deployed in resource-constrained environments.

The third strategic pillar centers on industrial water applications, where Chalmers Ventures recognizes the growing need for water-efficient manufacturing processes. The fund’s investments include technologies for water recycling in industrial operations, zero-liquid discharge systems, and smart process control solutions that optimize water usage in manufacturing. These innovations are particularly relevant for water-intensive industries like mining, petrochemicals, and food processing.

What sets Chalmers Ventures apart is their emphasis on scalable solutions that combine technological innovation with commercial viability. Their portfolio companies must demonstrate not only technical excellence but also clear paths to market adoption. This approach has led to several successful commercialization stories, with technologies now deployed across multiple continents.

The fund’s commitment to sustainability extends beyond environmental impact to include economic sustainability. Backed ventures must show potential for significant water savings while offering compelling cost advantages over existing solutions. This dual focus on environmental and economic benefits has proven crucial for market acceptance and rapid scaling.

By maintaining close ties with Chalmers University’s research ecosystem, the fund ensures a continuous pipeline of cutting-edge water technologies. This university connection provides portfolio companies with access to world-class research facilities and expertise, accelerating the development and validation of new solutions.

Learn more about how strategic water technology investments can drive sustainability and returns

From Lab to Market: The Venture Builder Approach

At the heart of Chalmers Ventures’ success lies a sophisticated venture builder methodology that transforms promising research into commercial water technology solutions. This hands-on approach combines deep technical expertise with business acumen to bridge the challenging gap between academic innovation and market adoption.

The process begins with rigorous screening of research projects emerging from Chalmers University’s labs. Technical teams work closely with researchers to validate core technologies and identify commercial applications in the water sector. Rather than simply providing capital, Chalmers Ventures embeds experienced entrepreneurs who help shape the business model and go-to-market strategy.

This venture builder model provides critical support during the precarious early stages of company formation. Technical founders receive guidance on intellectual property protection, product development roadmaps, and initial customer discovery. The hands-on approach helps avoid common pitfalls that often derail university spinouts.

A key differentiator is Chalmers Ventures’ focus on building complete founding teams. Technical researchers are paired with business talent who bring complementary skills in areas like sales, operations, and finance. This balanced team approach significantly improves the odds of successful commercialization.

The venture builder program follows a structured process with clear milestones and deliverables. Early-stage teams must validate both technical feasibility and market demand before receiving additional investment. This disciplined methodology helps ensure scarce resources are allocated to the most promising opportunities.

Chalmers Ventures maintains active involvement well beyond the initial company formation phase. Portfolio companies receive ongoing support with recruitment, strategic planning, and subsequent fundraising rounds. This sustained engagement helps ventures navigate the many challenges of scaling water technology businesses.

The success of this approach is evident in Chalmers Ventures’ track record of commercializing water innovations. Their methodology aligns with best practices for bringing research to market, as explored in “Passing the Baton: How to Bring Innovation to Market Faster & More Reliably”. By providing both capital and hands-on support, they have established themselves as a leading force in water technology commercialization.

Beyond individual company success, this venture builder approach helps strengthen the broader water innovation ecosystem. The program creates valuable connections between researchers, entrepreneurs, and industry partners while developing repeatable processes for technology commercialization. This systematic methodology continues to evolve based on lessons learned from each new venture.

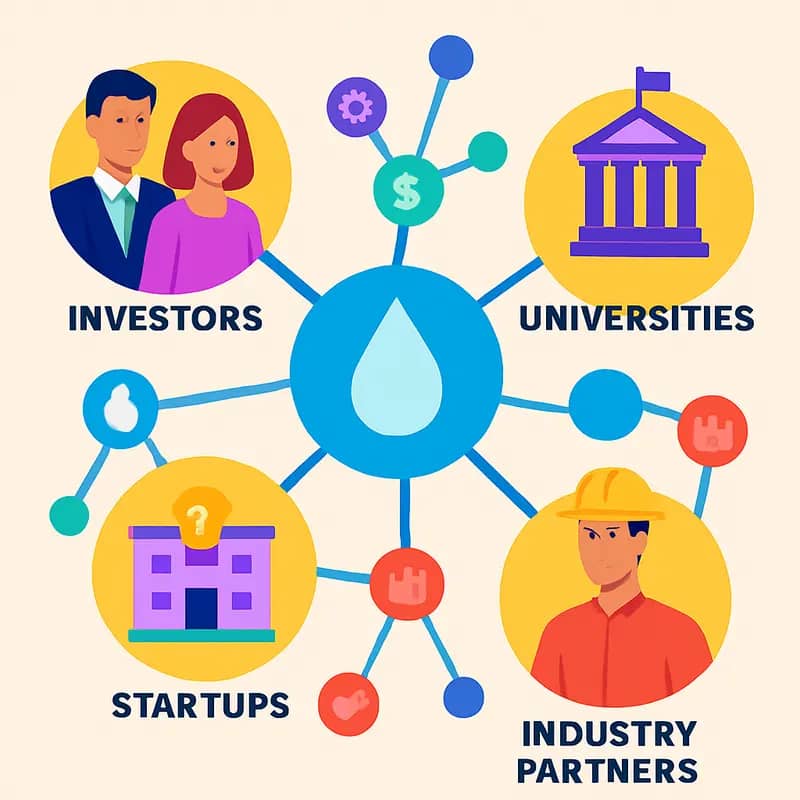

Strategic Partnerships and Investment Syndicates

Chalmers Ventures has cultivated a sophisticated network of co-investment partnerships that amplifies its impact in the water technology sector. Building on its position within Sweden’s innovation ecosystem, the fund strategically leverages these relationships to provide portfolio companies with both capital and market access advantages.

As a lead investor, Chalmers Ventures typically takes a pioneering role in early funding rounds, particularly for university spinouts with promising water technologies. The fund’s deep technical expertise and track record in water innovation make it a credible partner for larger venture capital firms and corporate investors who may lack specialized knowledge in this domain. This leadership position allows Chalmers to structure deals that protect founders’ interests while attracting follow-on capital.

The fund’s syndication strategy extends beyond traditional venture capital partnerships. Through strategic alliances with industrial players, Chalmers creates pathways for pilot projects and commercial validation. These partnerships often evolve into commercial agreements, providing portfolio companies with crucial early revenue and market validation. The fund’s relationship with municipal water utilities, for instance, has enabled several startups to conduct real-world testing of their solutions.

When acting as a follower investor, Chalmers Ventures brings unique value through its technical due diligence capabilities and extensive network within the water sector. The fund’s participation often signals technology validation to other investors, particularly in complex deep tech deals. This role has proven especially valuable in later funding rounds where industry expertise becomes critical for scaling operations.

Chalmers has also pioneered innovative partnership models that blur the lines between financial and strategic investment. By coordinating with impact investors and environmental funds, the venture fund helps create investment structures that balance commercial returns with environmental impact. This approach has proven particularly effective for water technologies that address both sustainability and profitability objectives.

The fund’s partnership strategy extends to international markets, with established relationships across Europe’s water technology hubs. These connections facilitate market entry for portfolio companies while providing access to complementary expertise and resources. Through careful orchestration of these partnerships, Chalmers Ventures has created a multiplier effect that enhances its ability to scale water technology innovations beyond Sweden’s borders.

The Innovation Pipeline: From Lab to Market

At the intersection of academic research and commercial potential lies Chalmers Ventures’ systematic approach to identifying and developing breakthrough water technologies. The evergreen fund’s unique position within Sweden’s premier technical university provides privileged access to cutting-edge research, while its refined validation process ensures only the most promising innovations advance toward commercialization.

The journey begins in Chalmers University’s research laboratories, where Chalmers Ventures’ technology scouts maintain close relationships with research groups focused on water-related challenges. Rather than passively waiting for innovations to emerge, scouts actively participate in research discussions, helping identify commercial applications for novel scientific discoveries. This proactive approach allows early identification of promising technologies before they reach traditional technology transfer offices.

Once a potential innovation is identified, Chalmers Ventures deploys its proprietary three-phase validation framework. The first phase focuses on technical validation, where independent experts assess the technology’s fundamental capabilities, scalability potential, and any technical risks that could impede commercialization. This rigorous technical assessment helps filter out innovations that may work in laboratory conditions but face significant scaling challenges.

The second phase examines market fit and commercial potential. The team conducts extensive customer discovery interviews, market analysis, and competitive landscape mapping. This phase often reveals unexpected applications for technologies – what might start as a solution for municipal water treatment could find its true calling in industrial processes. The team’s deep understanding of water industry pain points helps identify the most promising market entry points.

The final validation phase addresses implementation feasibility, examining factors like manufacturing complexity, regulatory requirements, and supply chain considerations. This comprehensive approach helps anticipate and address potential commercialization hurdles early in the development process.

What sets Chalmers Ventures apart is its iterative approach to validation. Rather than treating these phases as rigid gates, the process allows for continuous refinement of both technology and business model. This flexibility enables entrepreneur teams to pivot based on market feedback while maintaining focus on addressing real-world water challenges.

Particularly noteworthy is the fund’s emphasis on demonstration projects. By leveraging relationships with municipal utilities and industrial partners within Sweden’s water technology ecosystem, Chalmers Ventures helps portfolio companies secure critical early pilot opportunities. These real-world implementations provide valuable validation data while helping startups build credibility with potential customers.

The success of this approach is evident in how Chalmers Ventures’ portfolio companies consistently progress from pilot to commercial scale faster than industry averages. By combining rigorous technical validation with market-driven development and strategic piloting support, Chalmers Ventures has created an innovation pipeline that effectively bridges the gap between laboratory breakthrough and market impact.

Investment Strategy: The Triple Bottom Line

At the heart of Chalmers Ventures’ investment philosophy lies a sophisticated approach that interweaves environmental stewardship, financial viability, and societal impact. This ‘triple bottom line’ framework guides every investment decision, particularly in water technology innovations emerging from Sweden’s premier technical university ecosystem.

The fund’s environmental impact metrics focus on quantifiable water conservation, energy efficiency improvements, and emissions reduction potential. Rather than treating sustainability as a checkbox exercise, Chalmers Ventures integrates environmental performance into their due diligence process. Portfolio companies must demonstrate how their technologies can scale to create measurable ecological benefits.

Financial sustainability remains crucial, as Chalmers Ventures operates as an evergreen fund that must generate returns to support ongoing investments. Their approach balances patient capital with strategic exit timelines, typically ranging from 5-8 years. This longer-term perspective allows water technology startups to properly validate their solutions and establish market traction without premature pressure to exit.

Uniquely, Chalmers Ventures leverages impact investing principles to create multiplier effects in the water sector. Beyond direct investments, they actively foster partnerships between portfolio companies and established industry players, creating value chains that amplify both environmental and financial returns.

The social dimension manifests through job creation in the Swedish water technology sector and the development of solutions addressing water access and quality challenges. Portfolio companies must demonstrate how their innovations can improve living standards or working conditions, whether through safer drinking water, more efficient industrial processes, or enhanced wastewater treatment.

This holistic investment approach has proven particularly effective in water technology, where environmental benefits often directly translate to cost savings and social improvements. For instance, innovations in water reuse not only conserve resources but also reduce operational expenses for industrial users while improving community water security.

Chalmers Ventures’ success in balancing these three dimensions stems from their deep technical expertise combined with strong industry networks. Their investment committee includes both academic experts and seasoned water industry professionals, ensuring that funded technologies have both scientific merit and commercial potential while delivering tangible environmental and social benefits.

Global Partnerships: Scaling Swedish Innovation

Chalmers Ventures has masterfully transformed its local water technology innovations into global solutions through strategic international partnerships. By leveraging Sweden’s reputation for environmental stewardship and technological excellence, the fund has created pathways for its portfolio companies to scale beyond Scandinavian borders.

At the core of their international strategy lies a network of carefully cultivated relationships with water utilities, industrial end-users, and technology validators across Europe, North America, and Asia. These partnerships serve multiple purposes – they provide real-world testing environments for emerging technologies, offer market validation, and create direct channels to major customers.

The fund’s partnership model follows a three-tiered approach. First, they establish connections with leading research institutions and universities worldwide, enabling knowledge exchange and collaborative R&D. This academic network helps portfolio companies refine their technologies while gaining credibility in new markets. Second, they forge strategic alliances with established water technology companies and utilities in target markets, providing their startups with local market expertise and distribution channels. Third, they maintain close relationships with international investors and industry associations, creating funding opportunities and advocacy platforms for their portfolio companies.

One particularly effective element of their global strategy has been the creation of “innovation bridges” – formal collaboration frameworks with water technology hubs in other regions. These arrangements facilitate technology transfer, market entry support, and cross-border investment opportunities. Through these bridges, Chalmers Ventures’ portfolio companies can access local expertise, regulatory guidance, and customer networks in new markets while maintaining their Swedish operational base.

The fund has also pioneered a unique “soft landing” program that helps their portfolio companies establish physical presence in key markets. This program provides temporary office space, local business development support, and introductions to relevant stakeholders in target regions. This structured approach to internationalization has significantly reduced the time and resources required for Swedish water technologies to gain traction in new markets.

Leveraging its position in Europe’s water technology landscape, Chalmers Ventures has become particularly adept at helping portfolio companies navigate the complex EU funding and regulatory environment. This expertise has proven invaluable for startups seeking to expand across European markets while maintaining compliance with varying national and EU-wide water quality standards.

As explored in how to foster innovation and agility when you’re the world’s largest water company, such strategic partnerships are crucial for scaling water innovations. Chalmers Ventures’ approach demonstrates how a regional fund can create global impact by building the right relationships and support structures for its portfolio companies.

Success Stories: Making Waves in Water Tech

Chalmers Ventures has established itself as a powerhouse in nurturing groundbreaking water technology innovations. Their portfolio showcases remarkable success stories of companies addressing critical water challenges through cutting-edge solutions.

A standout achievement emerged from their early-stage investment in advanced membrane technology for industrial water treatment. This venture developed a revolutionary ceramic membrane system that reduces energy consumption by 40% compared to conventional technologies while extending operational lifetimes threefold. The company has since expanded operations across Northern Europe and Asia, treating over 50 million cubic meters of industrial wastewater annually.

Another portfolio company pioneered smart sensors for real-time water quality monitoring in municipal systems. Their AI-powered technology detects contaminants and predicts potential system failures before they occur. This predictive capability has helped utilities reduce response times by 60% and maintenance costs by 35%. The company’s impact caught the attention of major international water utilities, leading to implementations in over 200 cities globally.

In the field of water resource recovery, a Chalmers-backed startup developed an innovative process for extracting valuable minerals from wastewater streams. Their technology simultaneously addresses water pollution and resource scarcity – recovering critical materials while purifying water. The company now operates facilities in three countries and has prevented over 1,000 tons of harmful minerals from entering water systems while generating significant revenue from recovered resources.

Perhaps most impressively, several portfolio companies have achieved successful exits through acquisitions by global water technology leaders. These exits have not only provided substantial returns for Chalmers Ventures but also facilitated the scaling of innovative solutions to reach broader markets and create greater impact.

The success of these ventures stems from Chalmers Ventures’ unique approach that combines technical expertise with commercial acumen. Their deep understanding of water challenges, strong industry networks, and hands-on support have been crucial in helping startups navigate the complex water sector landscape.

As discussed in How to admit value and actually overcome the economic risk of water, these companies demonstrate how innovative technology coupled with sound business models can successfully address water challenges while building sustainable enterprises. Their achievements validate Chalmers Ventures’ thesis that water technology innovation can deliver both environmental impact and financial returns.

The ripple effects of these success stories extend beyond individual company achievements. They have helped establish Sweden’s reputation as a water innovation hub, attracting international talent and investment while inspiring the next generation of water entrepreneurs.

Final words

Chalmers Ventures represents a distinctive model in the water technology investment landscape, one that combines the patience of evergreen capital with the innovation potential of university research. Their approach to nurturing water technology startups demonstrates that successful commercialization requires more than just capital – it demands a comprehensive ecosystem of support, expertise, and strategic partnerships. For water entrepreneurs, particularly those working on deep tech solutions, Chalmers Ventures offers a compelling pathway to market that balances technological sophistication with commercial viability. For impact investors, their track record in water technology investments showcases the potential for generating both environmental impact and financial returns through carefully structured early-stage investments. As water challenges continue to grow globally, Chalmers Ventures’ model of integrated support and patient capital may well prove to be a blueprint for successfully scaling the next generation of water technology solutions.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my ‘(don’t) Waste Water’ platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!