In the heart of Cambridge’s innovation ecosystem, Carbon13 is redefining how we approach water technology investment. With a laser focus on ventures capable of reducing 10 million tonnes of CO2e annually, this venture builder isn’t just funding water startups – it’s engineering a blueprint for climate-resilient water solutions. Their £150,000 equity investments act as catalysts, transforming promising water innovations into scalable climate tech ventures. Whether you’re a water entrepreneur with a groundbreaking solution or an impact investor seeking the next wave of climate-tech opportunities, Carbon13’s unique approach to venture building offers a compelling pathway to meaningful environmental impact.

Carbon13 is part of my Ultimate Water Investor Database, check it out!

Investor Name: Carbon13

Investor Type: VC

Latest Fund Size: $32 Million

Dry Powder Available: Yes

Typical Ticket Size: <$250k

Investment Themes: Climate-aligned water infrastructure, Decarbonisation of freshwater systems, Industrial water solutions for net zero

Investment History: $140000 spent over 2 deals

Often Invests Along:

Already Invested In: Bluemethane, Open Hydro

Leads or Follows: Lead

Board Seat Appetite: Rare

Key People:

The Carbon13 Investment Thesis

Carbon13’s investment philosophy stems from a deep understanding that water infrastructure modernization represents one of the most significant opportunities for climate impact. Their thesis centers on identifying and nurturing ventures that can deliver measurable carbon reduction while transforming water systems.

At the core of Carbon13’s approach lies their commitment to decarbonizing water infrastructure through technological innovation. They recognize that water and wastewater operations account for roughly 2% of global greenhouse gas emissions. By focusing investments on solutions that address this challenge, Carbon13 aims to achieve both environmental and financial returns.

Their venture selection process employs a rigorous methodology to identify startups with the highest potential for carbon reduction. Carbon13 specifically seeks out founding teams that combine deep technical expertise with commercial acumen. This dual focus ensures that innovative solutions can successfully transition from concept to market-ready applications.

What distinguishes Carbon13’s investment approach is their emphasis on quantifiable carbon impact. Their framework for evaluating water technology investments aligns closely with best practices for impact assessment. Each potential investment undergoes thorough carbon accounting to estimate its emissions reduction potential. This data-driven approach helps ensure that portfolio companies deliver genuine climate benefits rather than merely superficial environmental claims.

Beyond capital deployment, Carbon13 takes an active role in venture development. Their support extends to technical validation, market access, and strategic partnerships. This hands-on approach helps de-risk investments while accelerating the path to commercialization.

The firm places particular emphasis on solutions that can scale rapidly across global markets. They prioritize technologies that demonstrate potential for exponential impact through replication and adaptation across different geographic and regulatory contexts. This scalability focus ensures that successful ventures can maximize their climate impact while building sustainable business models.

Carbon13’s portfolio reflects their commitment to transformative water technologies. They invest across the water value chain, from advanced treatment processes to smart infrastructure solutions. Priority areas include energy-efficient treatment technologies, digital optimization platforms, and circular economy approaches to water resource management.

Through their investment thesis, Carbon13 is helping reshape the water technology landscape. Their focus on measurable carbon reduction, combined with commercial viability, positions them to drive meaningful progress in addressing both climate change and water infrastructure challenges.

From Innovation to Impact: The Venture Builder Journey

Carbon13’s venture builder journey transforms promising water innovations into funded climate impact startups through a carefully orchestrated three-phase process. This systematic approach bridges the critical gap between ideation and market readiness while maintaining a laser focus on carbon reduction potential.

The first phase centers on founder matching and venture validation. Technical entrepreneurs with water expertise are paired with commercial co-founders to create balanced founding teams. These teams rigorously validate their proposed solutions against Carbon13’s core criteria: the potential for significant emissions reduction, technical feasibility, and market viability. Only ventures demonstrating credible pathways to reducing emissions by at least 10 million tonnes of CO2e annually advance to the next stage.

Phase two focuses on venture development and prototype creation. Teams receive intensive support to refine their technical approach, develop minimum viable products, and conduct initial customer discovery. This phase emphasizes rapid iteration and testing of core assumptions about the technology’s performance and market fit. Water entrepreneurs particularly benefit from Carbon13’s deep sector expertise and connections to testing facilities and potential pilot customers.

The final phase prepares ventures for external investment. Teams build comprehensive financial models, refine their pitch narratives, and develop detailed technical roadmaps. Carbon13 leverages its investor network to facilitate introductions to relevant funding partners, with a particular focus on investors who understand both climate tech and water infrastructure. Successful ventures typically emerge ready to raise seed rounds of £1-2 million to scale their solutions.

Throughout this journey, Carbon13 provides structured support through expert mentoring, technical resources, and access to their network of industry partners. This comprehensive approach helps water entrepreneurs navigate common pitfalls while maintaining momentum toward commercialization. As detailed in a recent analysis of water innovation pathways, this structured process significantly increases the odds of success for technical founders.

The venture builder’s emphasis on rapid validation and iteration, combined with its focus on emissions impact, creates a unique environment where water innovations can mature into investable businesses. This approach has proven particularly effective for deep tech solutions targeting industrial water use and treatment, where both technical excellence and commercial viability are essential for success.

The £150k Catalyst: Understanding Carbon13’s Investment Strategy

At the heart of Carbon13’s approach lies a strategic £150,000 initial investment, meticulously designed to catalyze promising water technology ventures through their critical early stages. This investment strategy represents more than just capital – it embodies Carbon13’s commitment to accelerating climate impact through water innovation.

The venture builder’s investment thesis centers on pre-seed and seed-stage companies, where £150,000 can make a tangible difference in validating core technologies and business models. This focused approach allows Carbon13 to maximize impact while managing risk across their portfolio. Rather than spreading resources thinly, they concentrate on fewer, high-potential ventures that align with their climate mission.

As lead investors, Carbon13 takes an active role in shaping their portfolio companies’ trajectories. The £150,000 investment typically secures a meaningful equity stake, usually between 7-12%, providing sufficient ownership to justify their hands-on support while leaving room for future funding rounds. This structure helps attract follow-on investment by demonstrating serious institutional backing.

What sets Carbon13’s investment approach apart is their emphasis on commercial viability alongside climate impact. The venture builder seeks water technologies with clear paths to scale and proven potential for significant carbon reduction. Their investment committee evaluates opportunities through a dual lens: the ability to generate substantial financial returns and the capacity to meaningfully address climate challenges.

Beyond the initial £150,000, Carbon13 leverages its network to facilitate access to follow-on funding. Their reputation as lead investors helps portfolio companies secure additional capital from climate-focused venture funds and strategic industry partners. This multiplier effect often enables ventures to raise several multiples of the initial investment within 12-18 months.

The investment strategy aligns closely with how to take mid-market green tech companies to the next level, creating a pathway for promising water technologies to scale beyond initial proof of concept. By combining capital with deep sector expertise and a robust support network, Carbon13 positions itself as more than just a financial backer – they become strategic partners in their portfolio companies’ success.

Their investment approach reflects a deep understanding of the unique challenges facing water technology startups. The £150,000 ticket size precisely targets the funding gap many early-stage ventures face between initial concept and commercial validation. This strategic positioning has enabled Carbon13 to build a portfolio of innovations addressing critical water infrastructure challenges while maintaining strong potential for commercial success.

Building Tomorrow’s Water Solutions

Carbon13’s vision for water infrastructure innovation centers on developing and scaling breakthrough technologies that address both critical water challenges and climate impacts. Their approach recognizes that water infrastructure modernization represents one of the most significant opportunities for emissions reduction and climate resilience.

At the core of their strategy is identifying and nurturing solutions that transform how we manage, treat, and distribute water resources. The venture builder specifically seeks out technologies that can demonstrate measurable carbon reduction potential alongside water efficiency improvements. This dual focus allows them to support innovations that deliver immediate operational benefits while contributing to long-term sustainability goals.

Their portfolio reflects an emphasis on scalable solutions across key areas including smart water monitoring, advanced treatment processes, and resource recovery systems. How to cut wastewaters energy-related carbon emissions in two at no cost demonstrates the type of transformative solutions they aim to scale. By focusing on technologies that can be readily integrated into existing infrastructure, Carbon13 ensures faster adoption and real-world impact.

The venture builder’s methodology for scaling these solutions involves a systematic approach to validation and deployment. They work closely with water utilities, industrial users, and regulatory bodies to understand implementation challenges and create pathways for widespread adoption. This collaborative model helps de-risk new technologies while accelerating their path to market.

Beyond individual technologies, Carbon13 is architecting a new paradigm for water infrastructure that embraces circularity and resource efficiency. Their supported ventures often combine multiple innovations – from advanced materials to AI-powered controls – creating integrated solutions that maximize both water and carbon benefits.

Their vision extends to reimagining traditional water business models. By supporting solutions that enable water-as-a-service approaches and performance-based contracting, they’re helping transform how water infrastructure improvements are financed and delivered. This focus on commercial innovation alongside technical advancement ensures their portfolio companies can achieve meaningful scale.

Through this comprehensive approach to water innovation, Carbon13 is laying the groundwork for a more resilient and sustainable water future. Their work demonstrates that addressing water challenges and climate goals need not be mutually exclusive – rather, they can and must be solved together.

The Carbon13 Model: Where Water Meets Climate Action

Carbon13’s venture builder approach represents a paradigm shift in how water technology startups are selected, developed, and scaled for maximum climate impact. At its core, the model integrates rigorous carbon reduction assessment with water innovation expertise to identify and accelerate solutions that deliver measurable environmental benefits.

The selection process begins with a deep analysis of each startup’s potential carbon impact. Ventures must demonstrate their ability to reduce emissions by at least 10 million tonnes of CO2e annually. For water technology startups, this means quantifying both direct emissions reductions through improved water and wastewater treatment processes and indirect benefits like reduced energy consumption or chemical usage.

What sets Carbon13’s methodology apart is its dual focus on commercial viability and environmental impact. Water startups undergo extensive technical validation while simultaneously proving their business model can scale. This includes detailed analysis of market opportunities, regulatory landscape, and implementation barriers. The program prioritizes solutions that can achieve rapid adoption while maintaining high environmental standards.

Particularly innovative is Carbon13’s emphasis on cross-sector collaboration. Water technology startups are deliberately paired with ventures from other sectors like energy, agriculture, and manufacturing. This creates unique opportunities to address water challenges while delivering cascade benefits across multiple industries. For instance, a water treatment technology might simultaneously reduce energy consumption in industrial processes while enabling water reuse.

The venture builder provides comprehensive support through a structured development process that includes technical expertise, market access, and connections to pilot opportunities. Startups receive guidance from industry veterans who understand both the technical complexities of water systems and the practical challenges of scaling new technologies.

By focusing on measurable climate impact alongside water innovation, Carbon13 is helping reshape how the water sector approaches environmental challenges. The model demonstrates that significant carbon reductions are achievable through smart water technology deployment when properly supported by expertise, resources and market access.

This integrated approach to water and climate action represents an evolution in how we develop environmental solutions. Rather than treating water challenges in isolation, Carbon13’s model recognizes the intricate connections between water systems, energy use, and carbon emissions. As detailed in a recent analysis of water technology assessment, this holistic perspective is essential for developing truly sustainable solutions.

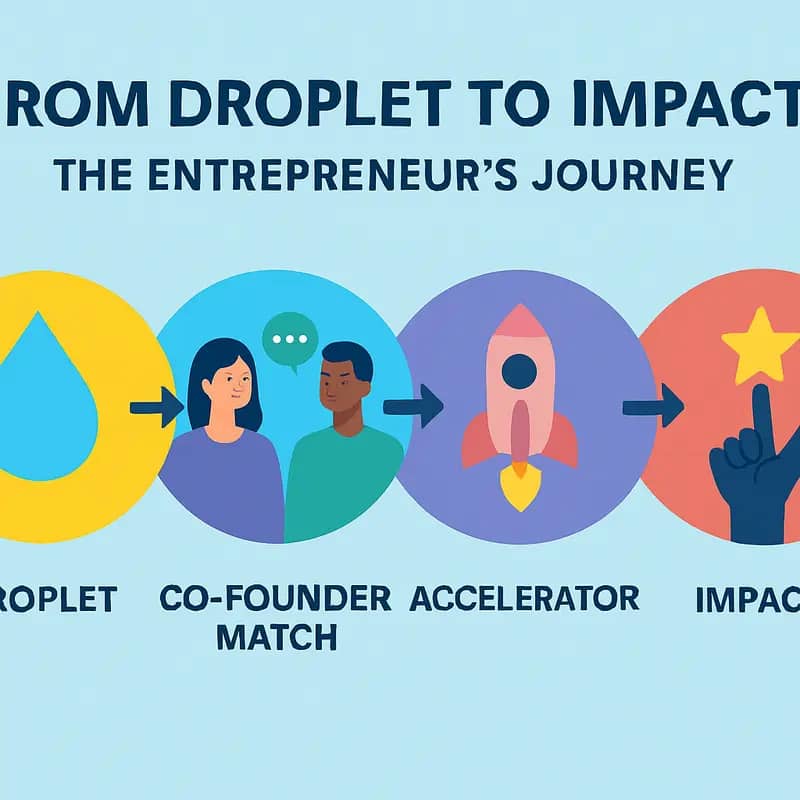

From Droplet to Impact: The Entrepreneur’s Journey

The entrepreneurial journey at Carbon13 transforms promising water innovations into climate-focused ventures through a structured yet dynamic process that emphasizes both environmental impact and commercial viability.

Entrepreneurs begin with a rigorous validation phase, where they test their initial hypotheses about water-related climate challenges. Working closely with Carbon13’s technical experts, they quantify their solution’s potential carbon reduction impact – a critical metric that guides all future development. This early assessment helps entrepreneurs refine their focus and ensure their innovation can deliver meaningful climate benefits.

Once the core concept proves promising, founders enter an intensive development sprint. Here, they build minimum viable products while simultaneously mapping their solution’s complete environmental footprint. Learn more about evaluating environmental impact in water innovation. This dual focus on product development and impact assessment creates a powerful feedback loop, allowing teams to optimize both technical performance and carbon reduction potential.

The venture development phase introduces entrepreneurs to Carbon13’s network of industry partners, who provide invaluable insights into real-world implementation challenges. These relationships often evolve into pilot opportunities, allowing founders to validate their solutions in authentic operational environments. Throughout this stage, entrepreneurs refine their business models to ensure scalability while maintaining their core focus on climate impact.

Carbon13’s process emphasizes the intersection of technical innovation and practical implementation. Entrepreneurs must demonstrate not only that their solution works, but that it can be deployed at scale to achieve meaningful carbon reduction. This includes developing robust financial models that account for both traditional metrics and environmental benefits.

As ventures mature, they undergo increasingly sophisticated impact assessments. Teams work with Carbon13’s specialists to model their solution’s potential carbon savings across different deployment scenarios. This data-driven approach helps entrepreneurs articulate their value proposition to both environmentally conscious customers and impact investors.

The journey culminates in a comprehensive venture package that combines validated technology, proven carbon impact, and a clear path to market. However, this isn’t the end – it’s where the real work of scaling climate solutions begins. Carbon13 continues supporting entrepreneurs through their growth phase, helping them navigate the challenges of expanding their impact while maintaining their environmental integrity.

This methodical progression from idea to impact exemplifies Carbon13’s commitment to developing water innovations that deliver measurable climate benefits. By combining rigorous technical validation with comprehensive impact assessment, they’re creating a new generation of water entrepreneurs equipped to tackle our most pressing environmental challenges.

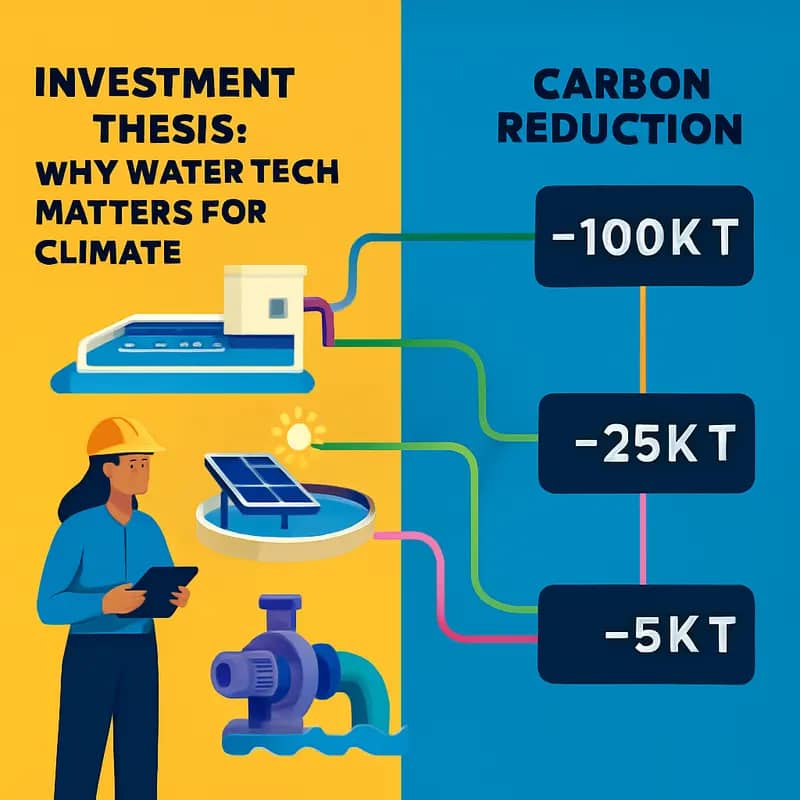

Investment Thesis: Why Water Tech Matters for Climate

The intersection of water technology and climate action represents one of the most compelling investment opportunities of our time. Water systems account for roughly 2% of global carbon emissions – equivalent to the airline industry. Yet within this challenge lies unprecedented potential for impact-driven returns.

Carbon13’s investment thesis in water technology rests on three fundamental pillars. First, water and wastewater operations represent a significant source of greenhouse gas emissions through energy consumption, chemical usage, and direct methane releases. Innovative technologies that improve efficiency and reduce these operational impacts can drive meaningful carbon reductions while delivering cost savings.

Second, climate change fundamentally disrupts the water cycle through increased droughts, floods, and water quality degradation. Technologies that enhance water system resilience and enable adaptive management become critical for climate adaptation. This creates opportunities in areas like smart water infrastructure, water reuse systems, and precision agriculture solutions.

Third, water plays an essential role in enabling the broader transition to a low-carbon economy. From clean energy production to sustainable manufacturing, water innovation helps unlock decarbonization across sectors. Read more about the connection between water technologies and carbon reduction in these 5 examples that mitigate CO2 emissions 5000x better than trees.

This thesis has already yielded promising results in Carbon13’s portfolio. Early-stage companies are developing breakthrough solutions in areas like low-energy treatment processes, smart network optimization, and resource recovery from wastewater. Many have demonstrated potential carbon reductions of over 100,000 tonnes annually while building sustainable business models.

The success stories emerging from Carbon13’s water technology investments highlight how targeted innovation can simultaneously address climate challenges and create value. As water stress intensifies globally, technologies that reduce emissions while enhancing water security will become increasingly critical. This positions water technology at the forefront of climate impact investing – where doing good for the planet aligns perfectly with doing well financially.

By taking an integrated view of water and climate challenges, Carbon13’s investment approach helps accelerate the development and deployment of solutions we urgently need. The venture builder’s focus on quantifiable carbon reduction ensures that water innovation delivers measurable climate benefits alongside operational improvements and financial returns.

Building the Future: Water Tech Portfolio Deep Dive

Carbon13’s water technology portfolio showcases breakthrough innovations that address critical water-climate challenges while delivering measurable carbon reduction impacts. At the heart of their selection criteria lies a dual focus: solutions must demonstrate significant potential for both water conservation and greenhouse gas mitigation.

Among the standout ventures is a pioneering wastewater treatment technology that leverages microbial fuel cells to generate clean energy while purifying water. This innovation reduces treatment plant energy consumption by 60% while capturing methane that would otherwise contribute to atmospheric warming. Early pilot results indicate potential carbon savings of 2.5 tons CO2e per million liters treated.

Another portfolio company has developed an AI-powered leak detection system that combines acoustic sensors with machine learning algorithms. When deployed across water distribution networks, this technology has demonstrated the ability to reduce water losses by up to 30% while simultaneously decreasing the energy required for pumping and treatment. The associated carbon benefit extends beyond direct energy savings, as every cubic meter of water saved represents approximately 0.5 kg of avoided CO2 emissions.

The portfolio also includes an innovative desalination technology that harnesses waste heat from industrial processes. This approach slashes the energy intensity of conventional desalination by 70% while enabling water-stressed coastal communities to create freshwater supplies without increasing their carbon footprint. The solution has already been validated at pilot scale, treating 500,000 liters per day with zero direct emissions.

What sets these ventures apart is their holistic approach to impact measurement. Each company maintains detailed environmental performance metrics, tracking not only immediate operational benefits but also indirect emissions reductions throughout the water-energy nexus. This data-driven approach has helped secure additional funding and accelerate market adoption.

The combined potential of Carbon13’s water technology portfolio represents annual carbon reduction capabilities exceeding 100,000 tons CO2e when deployed at scale. More importantly, these innovations demonstrate how water stewardship and climate action can be synergistically advanced through thoughtful technology development and commercialization.

Looking ahead, Carbon13 continues to scout for and support water technology ventures that can deliver outsized environmental impact. Their portfolio companies are proving that solving water challenges creates opportunities for meaningful climate action, while building sustainable businesses that attract both impact and traditional investors.

Final words

Carbon13 stands as a beacon for water entrepreneurs and impact investors alike, offering more than just capital – they’re providing a structured pathway to scale climate-positive water innovations. Their £150,000 equity investments, while significant, are just the beginning of a comprehensive support system that includes expert mentorship, market access, and preparation for future funding rounds. For water entrepreneurs, Carbon13 represents an opportunity to transform innovative solutions into scalable ventures while maintaining a clear focus on climate impact. For impact investors, the venture builder’s rigorous selection process and emphasis on measurable carbon reduction make it a valuable partner in identifying and nurturing the next generation of water technology leaders. As we face increasingly complex water challenges, Carbon13’s model demonstrates how targeted investment, combined with intensive support, can accelerate the development and deployment of climate-aligned water solutions. Whether you’re developing breakthrough water technology or seeking to invest in sustainable water futures, Carbon13 offers a proven platform for turning climate-positive innovations into market-ready solutions.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!