From its headquarters in Palo Alto, Capricorn Investment Group has quietly emerged as a pioneering force in impact investing, managing $12 billion in assets with a laser focus on sustainability and climate solutions. While the firm maintains a low profile, its approach to water technology investments reveals a sophisticated strategy that balances financial returns with measurable environmental impact. By partnering with mission-driven entrepreneurs and established players alike, Capricorn is helping shape the future of water innovation through strategic minority investments and collaborative deal structures.

Capricorn Investment Group is part of my Ultimate Water Investor Database, check it out!

Investor Name: Capricorn Investment Group

Investor Type: Impact

Latest Fund Size: $12000 Million

Dry Powder Available: Yes

Typical Ticket Size: $3M – $10M

Investment Themes: Access to safe water and sanitation, Water and sanitation microfinance, Climate and poverty intersection

Investment History: $13039682.54 spent over 4 deals

Often Invests Along: BDC Capital Climate Tech Fund, Evok Innovations, Xora Innovation

Already Invested In: Larq, Magrathea, Summit Nanotech Corporation

Leads or Follows: Follow

Board Seat Appetite: Moderate

Key People: Dipender Saluja, Ion Yadigaroglu, Eric Techel, Mathilde Fournier

The Capricorn Philosophy: Impact Through Scale

At the heart of Capricorn Investment Group’s water technology strategy lies a transformative vision that challenges traditional investment paradigms. The firm’s $12 billion portfolio demonstrates how environmental impact and financial returns can harmoniously coexist, particularly in the water sector where innovation meets urgent global needs.

Capricorn’s investment thesis rests on three foundational pillars. First, they seek technologies that can scale exponentially while maintaining operational efficiency. Second, they prioritize solutions that address multiple challenges simultaneously – water scarcity, energy consumption, and climate resilience. Third, they focus on innovations that can deliver measurable environmental benefits alongside attractive financial returns.

When evaluating water technology opportunities, Capricorn employs a rigorous framework that examines both technical innovation and market potential. Their due diligence process scrutinizes not just the technology’s effectiveness, but its ability to achieve widespread adoption. The firm has particularly shown interest in solutions that can transform existing infrastructure rather than requiring complete system overhauls.

What sets Capricorn apart is their long-term perspective on value creation. Unlike traditional investors seeking quick exits, they recognize that water technology solutions often require patience to achieve meaningful scale. This approach has proven especially valuable in the water sector, where adoption cycles can be longer but ultimately lead to more sustainable outcomes.

The firm’s commitment to sustainability extends beyond mere rhetoric. They actively measure and track the environmental impact of their investments, developing sophisticated metrics that quantify water savings, energy reduction, and pollution prevention. This data-driven approach helps validate their thesis that environmental stewardship and profitable growth are not mutually exclusive.

Capricorn’s portfolio companies must demonstrate clear pathways to scale their solutions globally. They look for technologies that can be replicated across different markets and regulatory environments, understanding that water challenges vary significantly by region. This scalability requirement ensures that successful investments can maximize both their environmental impact and financial returns.

Their investment strategy also emphasizes collaborative innovation. Capricorn often facilitates partnerships between portfolio companies and established industry players, creating symbiotic relationships that accelerate technology adoption. This ecosystem approach has proven particularly effective in overcoming the water sector’s traditionally conservative nature.

Through this distinctive philosophy, Capricorn is redefining what success looks like in water technology investment. Their portfolio demonstrates that when properly structured, sustainability-focused investments can deliver superior returns while addressing critical environmental challenges. This approach has positioned them as a leading force in shaping the future of water technology innovation.

Deal Structure & Investment Approach

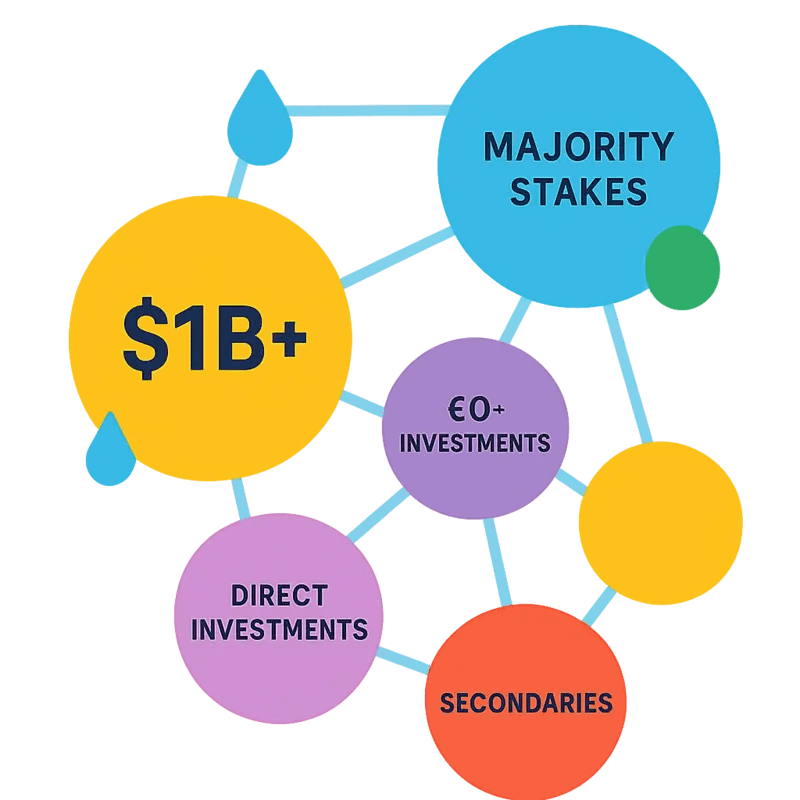

Capricorn Investment Group has developed a sophisticated investment framework that balances financial returns with lasting environmental impact in the water technology sector. The firm typically takes strategic minority positions, investing between $10-50 million in growth-stage companies that demonstrate both technological innovation and scalable business models.

The investment approach emphasizes partnership over control, with Capricorn acting as an engaged minority investor that provides strategic guidance while allowing management teams to maintain operational autonomy. This collaborative model has proven particularly effective in the water sector, where deep technical expertise must be balanced with commercial execution.

Capricorn structures its water technology investments through a combination of equity and structured capital solutions. The firm frequently employs convertible notes and revenue-based financing instruments that provide portfolio companies with growth capital while preserving flexibility. This hybrid approach allows Capricorn to tailor investment terms to each company’s specific needs and development stage.

The firm’s deal structures typically include board representation and strategic rights, enabling active involvement in key decisions while avoiding operational control. This balanced governance framework has allowed Capricorn to support management teams through critical growth phases while maintaining alignment with other stakeholders.

A key differentiator in Capricorn’s investment approach is its long-term orientation. Unlike traditional venture capital funds with fixed investment horizons, Capricorn can hold positions for extended periods, often 7-10 years or longer. This patient capital approach is particularly valuable in the water sector, where technology adoption cycles can be lengthy and market development requires sustained commitment.

Capricorn also leverages its broader network to create value for portfolio companies. The firm actively facilitates commercial partnerships, technology validation, and follow-on funding through its relationships with strategic players, research institutions, and co-investors. This ecosystem approach has proven especially valuable for water technology companies seeking to accelerate market adoption and scale operations.

The firm maintains strict investment criteria focused on companies with proven technology, clear competitive advantages, and scalable business models that can deliver both environmental impact and attractive financial returns. This disciplined approach, combined with active post-investment support, has helped Capricorn establish itself as a leading impact investor in the water technology sector.

Focus Areas in Water Innovation

Capricorn Investment Group has strategically positioned itself at the intersection of impact and innovation in the water technology sector, focusing on key themes that address critical water challenges while capturing significant market opportunities.

A primary focus area is decentralized water access and treatment solutions that serve communities traditionally overlooked by centralized infrastructure. These investments target technologies enabling local water sourcing, purification, and recycling – particularly important for remote and underserved populations. The emphasis here combines social impact with the growing market for distributed systems.

In the industrial sector, Capricorn prioritizes advanced treatment technologies that enable water reuse and resource recovery. This includes innovations in membrane filtration, electrochemical processes, and bio-based treatment methods that help industries reduce their water footprint while extracting valuable materials from waste streams. The drive toward circular water use aligns with both environmental goals and increasing regulatory pressure on industrial water management.

Digital water solutions represent another key investment theme, focusing on technologies that enhance system efficiency and decision-making. This encompasses smart metering, predictive analytics for infrastructure maintenance, and AI-driven optimization of treatment processes. These innovations address the critical need for better data-driven water management while tapping into the digital transformation of the water sector.

Resource recovery and energy efficiency innovations form a crucial focus area, targeting technologies that transform wastewater treatment from an energy-intensive process into a resource-generating opportunity. This includes investments in technologies for biogas production, nutrient recovery, and energy-neutral treatment processes, addressing both environmental impact and operational cost challenges.

Capricorn also maintains a strong focus on climate resilience solutions, investing in technologies that help water systems adapt to climate change impacts. This includes advanced flood management systems, drought-resistant water supply solutions, and technologies for managing extreme weather events. The increasing frequency of climate-related water challenges creates significant market potential for these innovations.

Nature-based solutions and green infrastructure represent an emerging focus area, recognizing the potential of biomimicry and ecological approaches to water management. These investments target innovations that harness natural processes for water treatment and management, offering sustainable alternatives to traditional infrastructure.

Across these focus areas, Capricorn prioritizes scalable solutions with demonstrable impact metrics and clear paths to market adoption. Their investment approach reflects an understanding that successful water innovation must balance technical effectiveness, economic viability, and measurable environmental and social benefits.

Partnership Strategy & Value Creation

Capricorn Investment Group has developed a sophisticated approach to accelerating growth and impact across its water technology portfolio companies. The firm’s partnership strategy extends far beyond simply providing capital, focusing instead on building deep, collaborative relationships that create lasting value.

At the core of Capricorn’s post-investment engagement is active board participation. The firm typically takes board seats in portfolio companies, allowing them to provide strategic guidance while maintaining strong governance oversight. Senior investment team members leverage their extensive industry experience to help shape company strategy, evaluate key hires, and navigate critical decision points.

Beyond the boardroom, Capricorn takes a hands-on approach to value creation through several key mechanisms. The firm maintains a dedicated operations team that works directly with portfolio companies to strengthen organizational capabilities, optimize processes, and identify operational efficiencies. This team brings specialized expertise in areas like supply chain management, manufacturing scale-up, and go-to-market execution.

One of Capricorn’s most powerful value-adds is its ability to facilitate strategic partnerships and ecosystem collaboration. The firm actively connects portfolio companies with potential customers, technology partners, and industry experts across its broader network. These introductions often lead to commercial partnerships, joint development agreements, and other collaborative opportunities that accelerate market adoption.

The firm has also built specialized capabilities around helping water technology companies navigate the complex regulatory landscape and secure necessary certifications and approvals. This expertise proves particularly valuable for companies developing novel treatment technologies or entering new geographic markets.

Capricorn places significant emphasis on impact measurement and management post-investment. The firm works with portfolio companies to establish clear impact metrics aligned with both business objectives and broader sustainability goals. This data-driven approach helps companies optimize their solutions for maximum environmental and social benefit while building credibility with impact-focused customers and stakeholders.

As highlighted in a recent analysis on impact investing approaches, Capricorn’s hands-on partnership model has proven especially effective in helping early-stage water technology companies bridge the critical gap between innovation and widespread market adoption. The firm’s ability to provide both strategic guidance and practical operational support helps portfolio companies overcome common scaling challenges while maintaining their impact focus.

This comprehensive approach to post-investment partnership has enabled Capricorn to build a strong track record of successful exits while demonstrating that financial returns and environmental impact can be mutually reinforcing when supported by the right engagement strategy.

The Patient Capital Philosophy

Capricorn Investment Group has cultivated a distinctive approach to water technology investments, grounded in their steadfast commitment to long-term value creation and transformative impact. Rather than chasing quick returns, Capricorn’s patient capital philosophy enables them to partner with water entrepreneurs through the extended development cycles often required to bring breakthrough solutions to market.

This long-term perspective has proven particularly vital in the water sector, where technologies frequently require 5-10 years of development and validation before achieving widespread commercial adoption. By providing stable, mission-aligned capital, Capricorn empowers portfolio companies to focus on thoughtful technology development rather than rushed commercialization that could compromise long-term success.

Their investment thesis centers on identifying technologies with the potential to fundamentally transform how we manage, treat, and conserve water resources. The firm’s deep technical expertise allows them to evaluate early-stage innovations that many traditional investors might view as too complex or risky. Rather than making scattered bets across the water landscape, they maintain laser focus on breakthrough approaches that could drive step-change improvements in critical areas like water reuse, contaminant removal, and energy efficiency.

Capricorn’s portfolio reflects this methodology of backing potentially transformative technologies while maintaining patience through development phases. The firm has demonstrated particular interest in advanced materials and process technologies that can dramatically improve the economics and environmental impact of water treatment. Their investments often target solutions that can deliver order-of-magnitude improvements in performance or cost-effectiveness compared to incumbent approaches.

Critically, Capricorn’s patient capital approach extends beyond just providing funding. The firm takes an active role in helping portfolio companies navigate the unique challenges of the water sector, from pilot testing and regulatory approval to building credibility with conservative utility customers. This hands-on partnership model, combined with their long-term orientation, has helped numerous water technology companies successfully bridge the gap between innovation and real-world impact.

As explored in how to mitigate 4 shades of water risk through impact investing, this patient yet focused investment strategy demonstrates how thoughtful capital deployment can accelerate the adoption of sustainable water solutions while generating attractive returns. The firm’s approach serves as a model for how investors can effectively support water innovation while maintaining the patience and conviction needed for transformative technologies to reach their full potential.

Due Diligence Excellence

Capricorn Investment Group’s meticulous due diligence process stands as a cornerstone of their water technology investment strategy. Their evaluation framework integrates technical innovation assessment with commercial viability analysis, creating a comprehensive approach that has proven instrumental in identifying breakthrough opportunities.

At the technical core of their due diligence, Capricorn deploys a multi-layered validation process. Their engineering team conducts detailed technical audits, examining not just the theoretical foundations but also the practical scalability of proposed solutions. This involves rigorous testing protocols, pilot program analyses, and thorough examination of intellectual property portfolios. The firm particularly scrutinizes technologies that demonstrate potential for exponential impact scaling while maintaining operational efficiency.

The commercial evaluation runs parallel to technical assessment, with a unique focus on market fit and growth potential. Capricorn’s analysts examine market size, competitive dynamics, and regulatory landscapes. They place special emphasis on understanding adoption barriers and catalysts in the water sector, recognizing that even superior technologies can fail without proper market timing and positioning.

What sets Capricorn’s approach apart is their dual-impact framework. Rather than treating environmental impact and financial returns as separate considerations, they’ve developed an integrated scoring system that weights both factors equally. This methodology examines how a technology’s impact metrics correlate with its revenue potential, ensuring that environmental benefits drive rather than hinder commercial success.

The firm’s risk assessment process deserves particular attention. Unlike traditional investors who might shy away from early-stage water technologies, Capricorn has developed expertise in evaluating and mitigating water-specific risks. They assess factors such as regulatory compliance pathways, operational scalability, and supply chain resilience. This approach enables them to take calculated risks on promising technologies while maintaining portfolio stability.

Capricorn also emphasizes the importance of team evaluation in their due diligence process. They look beyond traditional metrics like track record and expertise, focusing on adaptability and problem-solving capabilities. This human element has proven crucial in the water sector, where navigating complex stakeholder relationships often determines success.

The firm’s due diligence timeline typically spans three to six months, reflecting their commitment to thorough evaluation. This patient approach, while potentially longer than industry standards, has resulted in a portfolio of water technologies that consistently deliver both environmental impact and financial returns.

Breakthrough Technologies

Capricorn Investment Group’s portfolio showcases groundbreaking water technologies that address critical global challenges through innovative approaches to treatment, monitoring, and resource recovery. Their investments demonstrate a keen understanding of how breakthrough solutions can scale to create meaningful environmental impact while generating substantial returns.

One notable advancement comes in the form of advanced membrane technology that fundamentally reimagines water filtration. Using biomimetic principles and novel materials science, these membranes achieve up to 30% higher flux rates while consuming significantly less energy than conventional options. This breakthrough has particular relevance for desalination and industrial water treatment, where energy costs often constitute the primary operational expense.

Capricorn has also backed transformative developments in water quality monitoring through artificial intelligence and advanced sensors. These systems provide real-time, continuous analysis of water quality parameters, enabling predictive maintenance and early contamination detection. The technology reduces testing costs by up to 60% while dramatically improving response times to potential issues.

In the realm of resource recovery, portfolio companies have pioneered methods to extract valuable materials from wastewater streams. One technology can simultaneously treat industrial effluent while recovering critical minerals and reducing disposal costs. This approach transforms what was once a costly waste stream into a revenue-generating opportunity while advancing circular economy principles.

Perhaps most promising are advances in decentralized water treatment systems that operate at a fraction of the energy cost of centralized facilities. These modular units incorporate smart controls and remote monitoring capabilities, making them ideal for serving underserved communities or responding to humanitarian crises. Early deployments have demonstrated 40% lower installation costs and 50% reduced operational expenses compared to traditional infrastructure.

The common thread across these innovations is their potential for exponential impact. Rather than incremental improvements, Capricorn targets step-change advances that can fundamentally alter the economics and accessibility of water treatment and management. This approach aligns with their dual mandate of generating strong financial returns while driving meaningful environmental and social impact.

These breakthrough technologies represent more than isolated innovations – they form part of a comprehensive strategy to address water scarcity, quality, and access challenges through market-driven solutions. By focusing on scalable platforms rather than point solutions, Capricorn’s portfolio companies are positioned to drive systematic change in how we manage our most precious resource.

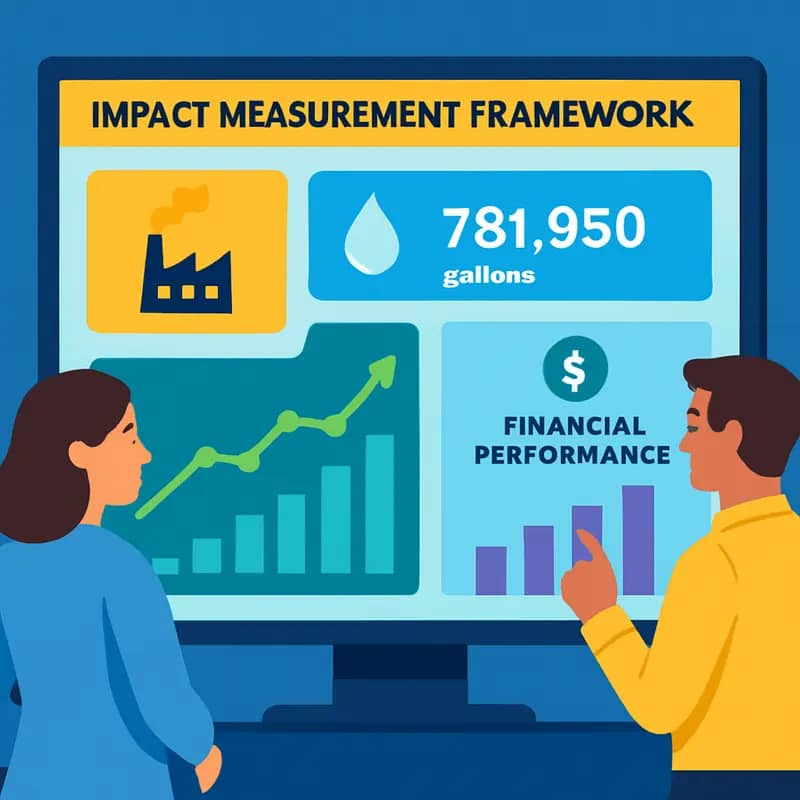

Impact Measurement Framework

Capricorn Investment Group has developed a sophisticated dual-lens approach to measuring impact across its water technology investments. The framework systematically tracks both environmental metrics and financial performance to ensure portfolio companies deliver measurable progress toward water sustainability while maintaining strong returns.

At the core of their methodology lies a set of standardized key performance indicators (KPIs) that quantify water-related impacts. These include gallons of water saved or treated, reduction in water pollution levels, improvements in water quality parameters, and metrics around access to clean water. The framework also incorporates carbon emissions avoided through more efficient water treatment and distribution.

What sets Capricorn’s approach apart is their emphasis on data-driven validation. Portfolio companies must establish baseline measurements and conduct regular independent audits to verify impact claims. This rigorous approach helps mitigate concerns around impact washing while providing investors with tangible proof of environmental returns.

The financial metrics are equally comprehensive, tracking traditional measures like revenue growth, profitability, and return on investment. However, Capricorn also evaluates the correlation between impact performance and financial success. Their data suggests companies achieving the strongest environmental impacts often see corresponding gains in market share and operational efficiency.

The framework takes a long-term view, recognizing that some water technologies require extended periods to demonstrate both impact and financial viability. Key milestones are established across different time horizons – from early-stage proof points to scaled implementation. This patient capital approach, backed by clear success metrics, has helped Capricorn identify and nurture breakthrough solutions.

Portfolio companies receive extensive support in implementing the measurement framework, including standardized reporting templates, monitoring protocols, and access to third-party verification partners. Regular portfolio reviews assess progress against targets and identify opportunities to amplify impact through operational improvements or strategic partnerships.

This systematic approach to impact measurement has proven valuable not just for Capricorn’s internal decision-making, but also for demonstrating the viability of water technology investments to the broader market. The framework provides a replicable model for how investors can rigorously evaluate both the sustainability and commercial potential of water solutions.

Final words

Capricorn Investment Group’s approach to water technology investment represents a masterclass in balancing impact and returns in the sustainability sector. Their strategic positioning as collaborative minority investors, coupled with a deep understanding of water innovation, has enabled them to build a portfolio that addresses critical environmental challenges while delivering competitive financial performance. The firm’s emphasis on scalable solutions and partnership-driven growth suggests a mature understanding of what it takes to succeed in the water technology space. For entrepreneurs and co-investors alike, Capricorn’s model offers valuable lessons in how patient capital, strategic support, and unwavering focus on impact can create lasting value in the water sector. As water challenges continue to grow globally, Capricorn’s investment thesis and execution strategy provide a compelling blueprint for mobilizing private capital toward sustainable water solutions.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!