Deep in the heart of Helsinki, a venture capital firm is quietly revolutionizing water technology investment across the Nordic and Baltic regions. Butterfly Ventures, with its €100M Fund IV and laser focus on deep tech startups, has emerged as a pivotal force in advancing sustainable water solutions. Through strategic investments in companies like Atium and Retein, they’re tackling critical challenges from heavy metal removal to next-generation membrane filtration. With €30M in dry powder and a proven track record of leading early-stage rounds, Butterfly Ventures represents a unique blend of scientific rigor and entrepreneurial vision in the water technology landscape.

Butterfly Ventures is part of my Ultimate Water Investor Database, check it out!

Investor Name: Butterfly Ventures

Investor Type: VC

Latest Fund Size: $100 Million

Dry Powder Available: Yes

Typical Ticket Size: $250k – $1M

Investment Themes: Heavy Metal and Mercury Removal, Membrane Filtration and Advanced Filtration Materials, Industrial Water Treatment and Resource Recovery

Investment History: $371666.67 spent over 3 deals

Often Invests Along: Chalmers Ventures

Already Invested In: 3AWater, Atium, Retein

Leads or Follows: Lead

Board Seat Appetite: Moderate

Key People: Juho Risku, Matti Kanninen, Liina Lehtonen, Anti Kodar

The Nordic Water Innovation Engine

Butterfly Ventures has emerged as a formidable force in the Nordic water technology investment landscape, wielding a €100M fund focused on early-stage innovations across Northern Europe. Their investment thesis centers on identifying and nurturing breakthrough water technologies that address pressing environmental challenges while delivering strong commercial potential.

Operating from their base in Finland, Butterfly Ventures maintains a strategic geographic focus spanning the Nordic and Baltic regions. This territorial scope allows them to tap into the region’s rich tradition of water engineering excellence while leveraging strong ties to academic institutions and research centers. Their current fund has approximately €60M in dry powder available for new investments, enabling them to maintain an active deal flow in the water technology sector.

The firm’s investment strategy follows a methodical three-pillar approach. First, they target solutions that demonstrate clear technological advantages in water treatment, monitoring, or resource recovery. Second, they seek scalable business models that can expand beyond regional markets. Third, they prioritize teams with deep domain expertise and proven ability to execute.

In the water technology vertical specifically, Butterfly Ventures has developed specialized expertise in membrane technologies, advanced oxidation processes, and digital water solutions. Their portfolio construction typically allocates 40-50% of investments to water-related ventures, with individual ticket sizes ranging from €500K to €3M for initial investments.

What sets them apart is their hands-on approach to portfolio company development. Beyond capital deployment, they provide technical validation support, market access guidance, and strategic partnership facilitation. This operational involvement has proven particularly valuable in the water sector, where commercialization pathways often require extensive piloting and regulatory navigation.

Read more about making smart water technology investments

Their investment thesis is heavily influenced by growing water scarcity concerns across Northern Europe and increasingly stringent environmental regulations. By focusing on technologies that improve water treatment efficiency, reduce energy consumption, or enable water reuse, they are positioning their portfolio to capitalize on these macro trends while delivering meaningful environmental impact.

The firm maintains deep relationships with industrial water users, utilities, and technology institutes across the region. These connections not only provide valuable market intelligence but also create potential customer and piloting opportunities for portfolio companies. This ecosystem approach has proven particularly effective in accelerating the adoption of new water technologies in traditionally conservative markets.

From Mercury to Membranes: Portfolio Deep Dive

Butterfly Ventures’ water technology portfolio showcases groundbreaking innovations in industrial water treatment, with Atium and Retein leading the charge in addressing critical environmental challenges. These companies exemplify the fund’s commitment to transformative water technologies across Northern Europe.

Atium’s mercury removal technology represents a quantum leap in treating industrial effluents contaminated with heavy metals. Their proprietary process combines advanced materials science with electrochemical principles to achieve removal rates exceeding 99.9% while operating at ambient temperatures. This breakthrough addresses a crucial environmental concern, as mercury contamination poses severe risks to aquatic ecosystems and human health. The technology’s modest energy requirements and minimal chemical usage have attracted attention from mining operations and power plants across Scandinavia.

Retein’s innovative membrane filtration system tackles industrial wastewater treatment through a novel biomimetic approach. By incorporating naturally-inspired surface modifications, their membranes demonstrate remarkable resistance to fouling – a persistent challenge that typically increases energy consumption and maintenance costs in conventional systems. The company’s smart membrane technology achieves 40% higher flux rates while reducing cleaning frequency by 60%, delivering substantial operational savings for industrial clients.

The synergistic impact of these portfolio companies extends beyond their individual technological achievements. Together, they’re reshaping industrial water treatment paradigms across Northern Europe. Atium’s installations have already prevented several tons of mercury from entering waterways, while Retein’s systems have helped facilities reduce their water footprint by enabling increased recycling rates.

Both companies exemplify Butterfly Ventures’ strategic focus on scalable solutions that deliver measurable environmental benefits while maintaining strong commercial viability. Their success validates the fund’s thesis that water technology innovation can simultaneously address pressing environmental challenges and generate attractive returns.

The partnership between Butterfly Ventures and these portfolio companies goes beyond capital investment. The fund’s hands-on approach includes strategic guidance, industry connections, and operational support that has accelerated technology commercialization. This collaborative model has proven particularly effective in the water sector, where market entry barriers often pose significant challenges for emerging technologies.

Looking ahead, both Atium and Retein are positioned for international expansion, with pilot projects underway in multiple European markets. Their growth trajectories align with Butterfly Ventures’ vision of creating global impact through localized innovation in the Nordic water technology ecosystem.

Leading the Charge: Investment Approach

As a cornerstone investor in Nordic water technology, Butterfly Ventures has developed a distinctive approach to leading investment rounds that maximizes impact while managing risk. The firm typically deploys initial investments ranging from €500,000 to €2 million, strategically positioning itself as the lead investor to shape deal terms and governance structures.

Butterfly’s co-investment strategy relies on cultivating strong partnerships with both regional and international venture capital firms. This approach has proven particularly effective in water technology, where technical complexity often requires pooling expertise across multiple investors. By assembling complementary investor syndicates, Butterfly enhances portfolio companies’ access to diverse market insights and strategic relationships.

The firm’s follow-on investment philosophy centers on milestone-based capital deployment. Rather than committing all capital upfront, Butterfly reserves substantial dry powder for subsequent rounds, typically maintaining a 1:2 ratio between initial and follow-on investments. This approach enables the fund to double down on successful ventures while maintaining flexibility to support companies through challenging periods.

At the board level, Butterfly takes an actively engaged stance that goes beyond traditional governance. Their approach mirrors successful strategies outlined in “How to Take Mid-Market Green Tech Companies to the Next Level”. The firm assigns dedicated investment professionals who combine water industry expertise with operational experience. These board representatives work closely with management teams on key strategic decisions, from product development roadmaps to market entry strategies.

Particularly noteworthy is Butterfly’s emphasis on commercial validation. Before leading any investment round, the firm conducts extensive customer discovery, engaging potential end-users to verify market demand and refine go-to-market strategies. This commercial due diligence often involves facilitating pilot projects with industrial water users, creating early proof points that de-risk subsequent scaling efforts.

Through board participation, Butterfly maintains active involvement in recruitment decisions for key executive positions. The firm leverages its network to identify talented leaders who can drive growth while maintaining technological innovation. This hands-on approach to talent acquisition has proven especially valuable in water technology, where finding executives who combine technical knowledge with commercial acumen remains challenging.

The firm’s investment thesis particularly values technologies that can demonstrate rapid commercial traction. While maintaining high standards for technical innovation, Butterfly prioritizes solutions that can achieve market validation within 12-18 months of investment. This focus on commercial velocity helps portfolio companies maintain momentum and attract follow-on capital from larger investors.

The Future of Water Tech Investment

The water technology investment landscape stands at a pivotal crossroads where industrial digitalization, resource recovery, and sustainability converge. Nordic venture capital firms like Butterfly Ventures are strategically positioning their portfolios to capture value from these emerging trends.

Industrial water treatment presents particularly compelling opportunities as manufacturing facilities face mounting pressure to reduce their environmental footprint while optimizing operational costs. Advanced treatment technologies incorporating artificial intelligence and automation are enabling predictive maintenance, real-time monitoring, and autonomous optimization of industrial processes. This shift toward “smart” water management systems aligns perfectly with Butterfly Ventures’ focus on digitalization and Industry 4.0 technologies.

Resource recovery represents another frontier ripe for innovation and investment. The concept of “waste-to-value” is gaining traction as new technologies enable the extraction of valuable materials from wastewater streams. Phosphorus recovery from municipal treatment plants, rare earth element extraction from mining effluents, and energy harvesting through biogas generation exemplify how waste streams can become revenue sources. The circular economy aspects of these technologies make them especially attractive to impact-focused investors.

Looking ahead, several trends will likely shape future investment decisions. Climate resilience solutions, including technologies for water reuse and desalination, will become increasingly critical as regions face water scarcity. The growing focus on environmental, social, and governance (ESG) factors is driving interest in solutions that help industries measure and reduce their water footprint. Additionally, the emergence of water quality monitoring technologies that can detect contaminants of emerging concern, such as microplastics and PFAS, presents significant market potential.

Butterfly Ventures’ investment thesis appears well-aligned with these trends, particularly in their focus on scalable solutions that can be deployed across multiple industrial sectors. Their emphasis on companies developing proprietary technologies with strong intellectual property protection positions them to capitalize on the increasing industrialization of water treatment processes. The firm’s expertise in facilitating international expansion could prove especially valuable as water technology companies seek to scale beyond their home markets.

As highlighted in the article on how to take mid-market green tech companies to the next level, successful scaling of water technology companies requires not just capital, but also strategic support in areas like market entry, partnership development, and regulatory navigation. Butterfly Ventures’ hands-on investment approach and deep industry networks position them well to provide this crucial support to their portfolio companies.

The Nordic Water Technology Advantage

The Nordic region has long been a powerhouse of water innovation, building on centuries of expertise in managing abundant water resources sustainably. Butterfly Ventures strategically positions itself at the intersection of this rich heritage and emerging water technologies, leveraging the region’s unique advantages to identify promising startups.

At the heart of the Nordic water advantage lies a deep understanding of water systems integration. From Norway’s hydropower excellence to Finland’s groundbreaking water quality monitoring systems, the region has consistently pushed boundaries in water technology. This technical foundation allows Butterfly Ventures to evaluate startups with unprecedented precision, identifying those with truly innovative approaches to water challenges.

The fund’s investment strategy is deeply rooted in the Nordic ecosystem’s collaborative nature. Research institutions, utilities, and technology companies maintain close relationships, creating an environment where new ideas can be tested and refined rapidly. This network effect proves invaluable for startups, offering them access to world-class testing facilities and potential early adopters.

Beyond technical prowess, the Nordic region’s commitment to sustainability and circular economy principles shapes Butterfly Ventures’ investment lens. The fund particularly values solutions that address water efficiency, resource recovery, and energy optimization – areas where Nordic expertise has historically excelled.

The region’s strong regulatory framework for water quality and environmental protection also plays a crucial role. These stringent standards have fostered a culture of innovation, pushing companies to develop solutions that not only meet current requirements but anticipate future challenges. As noted in a recent analysis (https://dww.show/how-to-mitigate-4-shades-of-water-risk-through-impact-investing/), this regulatory foresight helps identify technologies with global scaling potential.

Butterfly Ventures capitalizes on the Nordic region’s proven track record in water technology commercialization. The area’s history of successful water technology exports demonstrates an understanding of how to transform innovative ideas into viable products. This experience helps the fund evaluate not just technical merit, but also market potential and scalability.

The combination of technical excellence, collaborative ecosystems, and commercial success creates a unique environment for water technology investment. By understanding and leveraging these regional advantages, Butterfly Ventures positions itself to identify and nurture the next generation of water technology leaders.

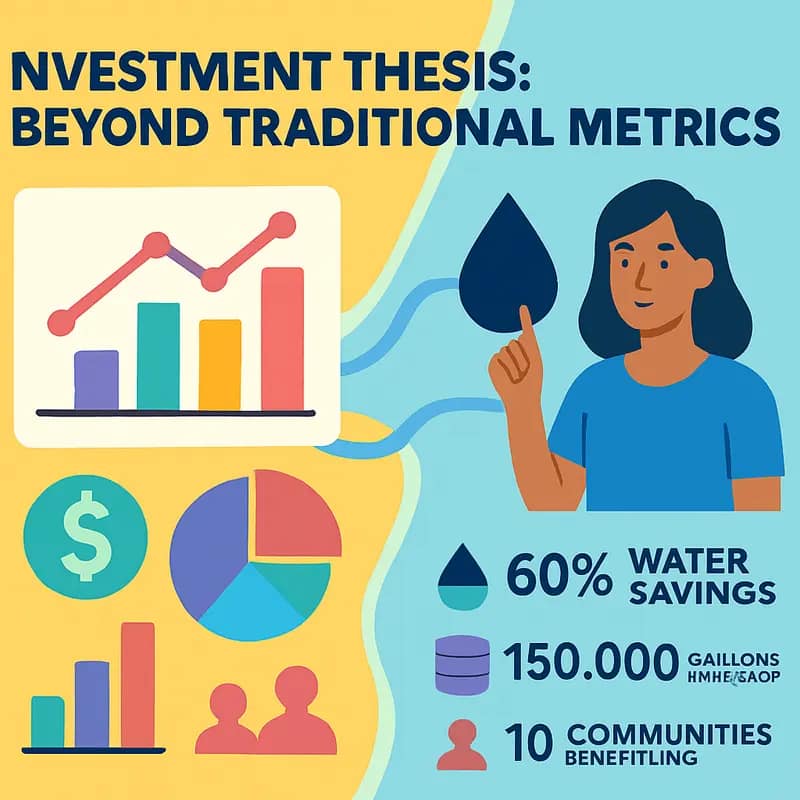

Investment Thesis: Beyond Traditional Metrics

Butterfly Ventures’ distinctive approach to water technology investments stems from a carefully calibrated framework that weaves together financial returns, water impact metrics, and technical innovation potential. Rather than viewing these elements in isolation, the fund has developed an integrated assessment methodology that recognizes their inherent interconnectedness.

At the core of their investment thesis lies the understanding that genuine water impact directly correlates with sustainable financial returns. The fund evaluates potential investments through a dual lens that quantifies both the scale of water-related challenges addressed and the technological sophistication of proposed solutions. This approach allows them to identify opportunities where environmental impact and commercial success reinforce each other.

Their technical innovation assessment goes beyond conventional metrics like patents or R&D spending. Instead, they focus on a solution’s potential to create paradigm shifts in water management practices. Key evaluation criteria include resource efficiency gains, operational cost reductions, and scalability across different contexts. Technologies that can demonstrate measurable improvements in multiple dimensions – such as simultaneous reductions in energy consumption, chemical usage, and waste generation – receive particular attention.

Butterfly Ventures has also pioneered the integration of water-specific impact metrics into their investment framework. These include measurements of water saved or treated, contaminants removed, and ecosystem services preserved or enhanced. The fund recognizes that how to mitigate 4 shades of water risk through impact investing requires sophisticated assessment tools that can capture both immediate and long-term effects.

Critically, the fund’s thesis emphasizes the importance of market timing and adoption readiness. They actively seek technologies that align with evolving regulatory frameworks, changing customer preferences, and emerging industry needs across the Nordic region. This forward-looking perspective helps ensure that portfolio companies not only develop innovative solutions but also find receptive markets ready to embrace them.

Their investment criteria also place significant weight on a startup’s ability to validate their technology’s performance through pilot projects and early customer implementations. Rather than relying solely on laboratory results or theoretical projections, Butterfly Ventures prioritizes real-world evidence of effectiveness and market acceptance. This practical validation requirement helps minimize technology risk while providing valuable insights into scaling potential.

The fund’s approach to valuation similarly reflects this integrated perspective. Traditional financial metrics are complemented by assessments of strategic value, including potential synergies with existing portfolio companies, contribution to regional water technology ecosystems, and ability to address multiple sustainability challenges simultaneously. This comprehensive evaluation framework enables them to identify opportunities where environmental impact and financial returns can be mutually reinforcing rather than competing objectives.

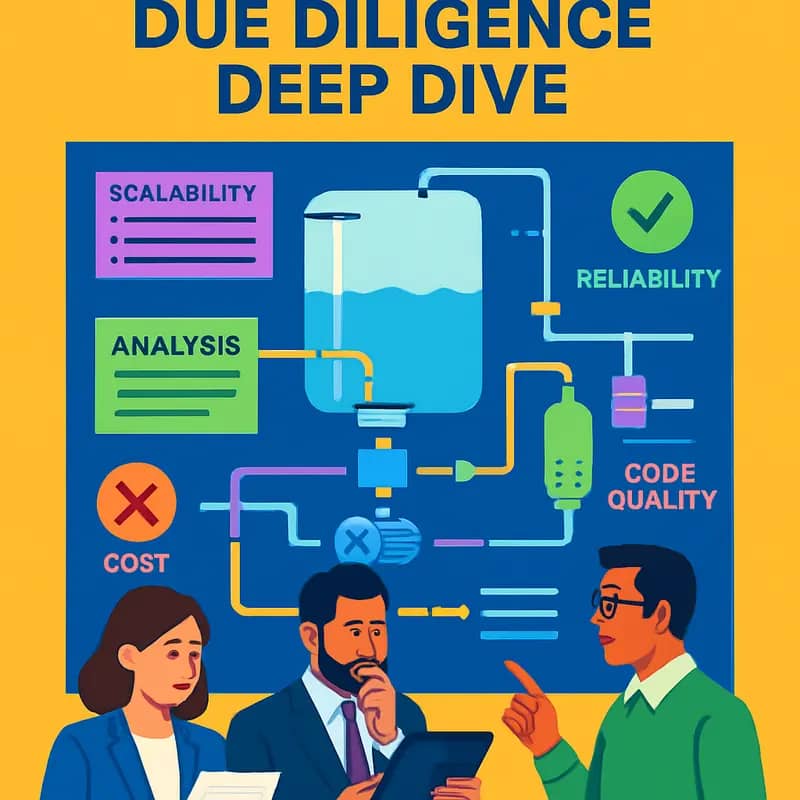

Technical Due Diligence Deep Dive

Butterfly Ventures employs a comprehensive six-stage technical evaluation framework that sets a new standard for water technology assessment in the Nordic region. At the framework’s core lies a unique combination of technical validation and market readiness scoring that helps identify truly transformative solutions.

The process begins with an in-depth analysis of the underlying water technology principles. Butterfly’s technical experts, including PhD-level water scientists and veteran process engineers, scrutinize the fundamental mechanisms of action. They evaluate factors like mass transfer efficiency, reaction kinetics, and energy requirements against established benchmarks and theoretical limits.

Moving beyond pure science, the second stage examines practical engineering considerations. The team assesses design robustness, operational complexity, and maintenance requirements. A proprietary scoring matrix weighs attributes like process control needs, chemical consumption, and mechanical reliability. This helps identify technologies that can excel not just in controlled environments but in real-world applications.

The third stage focuses on scalability potential, where many promising water technologies historically falter. Engineers model key performance parameters across different scales, analyzing how efficiencies might shift from bench to pilot to full-scale implementation. They pay particular attention to identifying possible scale-up bottlenecks early in the evaluation process.

Environmental impact forms the fourth evaluation pillar. The team conducts abbreviated life cycle assessments examining energy intensity, chemical usage, waste streams, and carbon footprint. Technologies scoring high on sustainability metrics earn additional consideration, aligning with Butterfly’s mandate to drive positive environmental impact.

The fifth stage examines intellectual property positioning through both technical and legal lenses. Beyond basic patent analysis, experts evaluate the technology’s ability to maintain competitive advantages as it scales. They assess how robust the IP protection is against potential workarounds and whether it can sustain differentiation in target markets.

The final stage synthesizes technical findings with market analysis to determine commercial viability. The team evaluates whether the technology can deliver sufficient performance improvements or cost reductions to drive adoption in conservative water markets. As detailed in how to take mid-market green tech companies to the next level, they specifically look for solutions that can demonstrate clear economic benefits alongside technical superiority.

This rigorous framework allows Butterfly Ventures to identify water technologies with the highest probability of both technical and commercial success. The process typically eliminates over 90% of evaluated opportunities but yields a portfolio of validated solutions ready for scale-up funding and market entry.

Portfolio Success Stories

Butterfly Ventures’ strategic investments in water technology have yielded remarkable breakthroughs that are reshaping water management across Northern Europe. Through targeted funding and hands-on support, several portfolio companies have achieved significant environmental and commercial impact.

One standout success emerged from a startup developing advanced membrane filtration technology for industrial wastewater treatment. By incorporating novel biomimetic materials, the system achieved 40% higher throughput while reducing energy consumption by 30% compared to conventional methods. The technology has been deployed at three major industrial facilities in Finland and Sweden, preventing over 500,000 cubic meters of contaminated water from entering local watersheds annually.

Another portfolio company pioneered an AI-powered leak detection platform that has transformed utility operations. Using machine learning algorithms to analyze sensor data, the system can predict potential infrastructure failures up to two weeks in advance with 92% accuracy. Municipal partners using this technology have reduced water losses by an average of 27% while cutting maintenance costs by €2.1 million annually.

Perhaps most impressive is a breakthrough in nutrient recovery technology that transforms wastewater treatment from a cost center into a revenue generator. The system extracts valuable compounds like phosphorus and nitrogen with unprecedented efficiency, creating commercial-grade fertilizer products. Early adopters have reported payback periods under 18 months while significantly reducing their environmental footprint.

A fourth portfolio company developed a revolutionary water quality monitoring platform that provides real-time contaminant detection at one-tenth the cost of traditional lab testing. The technology has been particularly impactful in remote Nordic communities, enabling rapid response to potential drinking water threats and ensuring regulatory compliance.

Critically, these innovations have demonstrated strong commercial viability alongside their environmental benefits. Three portfolio companies have secured follow-on funding exceeding €40 million, while two have established international partnerships to scale their solutions globally. This combination of technological innovation and business success validates Butterfly Ventures’ thesis that sustainable water solutions can generate both environmental and financial returns.

Collectively, these portfolio companies showcase how targeted investment in water technology can drive meaningful change. Their innovations are not just theoretical – they’re delivering measurable improvements in water efficiency, quality, and sustainability across the Nordic region and beyond.

Final words

As water scarcity and quality challenges intensify globally, Butterfly Ventures stands at the forefront of driving technological solutions through strategic investment. Their specialized approach to water technology investment, combining deep technical understanding with strong financial backing, positions them uniquely in the Nordic and Baltic innovation ecosystem. With €30M in dry powder and a proven track record of successful investments in companies like Atium and Retein, they continue to demonstrate the potential for venture capital to accelerate water technology advancement. Their focus on industrial applications and resource recovery, coupled with their hands-on investment approach, suggests a promising future for water technology innovation in Northern Europe. For entrepreneurs and co-investors alike, Butterfly Ventures represents not just a source of capital, but a partner in building the next generation of water technology solutions.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!