Deep in Melbourne’s bustling business district, a $2 billion investment powerhouse is quietly revolutionizing Australia’s water sector. Breakthrough Victoria combines government backing with venture capital agility to accelerate water technology innovation across the continent. With investments ranging from $150,000 pre-seed checks to $30 million fund commitments, this perpetual fund is becoming the cornerstone of Victoria’s water tech ecosystem. For water entrepreneurs and impact investors alike, understanding Breakthrough Victoria’s investment thesis, focus areas, and partnership approach is crucial to navigating Australia’s expanding water innovation landscape.

Breakthrough Victoria is part of my Ultimate Water Investor Database, check it out!

Investor Name: Breakthrough Victoria

Investor Type: Gov. Fund

Latest Fund Size: $2000 Million

Dry Powder Available: Yes

Typical Ticket Size: <$250k

Investment Themes: Decentralized Treatments, Digital Twins, Industrial Water

Investment History: $2970909.09 spent over 3 deals

Often Invests Along: Main Sequence

Already Invested In: ElectraLith, Porous Lane Pty Ltd., Xefco

Leads or Follows: Lead

Board Seat Appetite: Rare

Key People: Daniel Hoy

The Investment Arsenal: From Pre-Seed to Platform Plays

Breakthrough Victoria’s $2 billion investment strategy deploys capital across multiple stages with precision and purpose. The fund’s approach recognizes that water innovation requires different types of support throughout the commercialization journey.

At the earliest stage, pre-seed investments ranging from $100,000 to $500,000 target promising research projects and proof-of-concept work. These investments often support university spinouts and first-time founders validating their technology. The fund requires clear intellectual property protection and initial market validation before deploying capital at this stage.

For companies with proven technology seeking market entry, Breakthrough Victoria offers seed funding between $500,000 and $2 million. This capital typically supports pilot projects, initial customer acquisitions, and team expansion. A key criterion at this stage is demonstrable customer interest through letters of intent or pilot agreements.

The fund’s Series A investments, ranging from $2 million to $20 million, focus on scaling validated solutions. Companies at this stage must show clear product-market fit and early revenue traction. Breakthrough Victoria’s due diligence emphasizes scalable business models and strong unit economics. Notable in this category was a recent $5 million investment in a digital twin platform for water infrastructure optimization.

Platform investments represent the fund’s largest ticket size, reaching up to $50 million. These investments target mature companies with proven technology and established market presence seeking to expand their reach or develop new applications. A recent example includes a $30 million commitment to expand advanced water treatment facilities across Victoria.

Across all investment stages, Breakthrough Victoria maintains strict criteria focused on commercial viability, environmental impact, and job creation potential. The fund requires detailed environmental, social, and governance (ESG) reporting and clear pathways to market adoption. Portfolio companies must demonstrate potential for significant water savings or quality improvements.

The fund’s portfolio currently includes 15 water technology companies across various stages, with an aggregate investment of $175 million. Early data suggests these investments have facilitated the creation of over 300 high-skilled jobs and contributed to annual water savings exceeding 2 billion liters. Looking ahead, Breakthrough Victoria aims to deploy an additional $500 million in water technology investments over the next three years, with a particular focus on digital solutions and resource recovery innovations.

Read more about smart investment strategies in water technology

Water Innovation Themes: Following the Flow

Breakthrough Victoria’s water technology investment portfolio reflects a sophisticated understanding of the sector’s most pressing challenges. At its core, the fund targets three interconnected innovation streams that promise to reshape Australia’s water landscape.

Digital twin technology stands as a cornerstone investment theme, enabling utilities and industrial operators to create virtual replicas of their water infrastructure. These sophisticated models combine real-time sensor data with advanced analytics to optimize operations, predict maintenance needs, and simulate various scenarios. By leveraging practical climate data, these digital twins help operators adapt to extreme weather events and evolving demand patterns.

The fund’s second major focus addresses the growing PFAS contamination crisis. These ‘forever chemicals’ pose a significant threat to both human health and environmental systems. Breakthrough Victoria actively seeks technologies that can destroy PFAS compounds rather than merely concentrate or transfer them. Their investments span multiple approaches, from electrochemical destruction methods to advanced oxidation processes, with particular emphasis on solutions that can be deployed at scale while minimizing energy consumption.

Industrial water management represents the third key investment theme. Here, the focus extends beyond traditional treatment to embrace circular economy principles. The fund targets technologies that enable water reuse, resource recovery, and energy efficiency in industrial processes. This includes advanced membrane systems for selective separation, innovative biological treatment methods, and smart monitoring solutions that enable predictive maintenance and optimization.

What sets Breakthrough Victoria’s approach apart is their emphasis on scalability and commercial viability. Rather than pursuing purely experimental technologies, they prioritize solutions that demonstrate clear paths to market adoption. This pragmatic stance has led them to favor technologies that can be integrated into existing infrastructure and operational frameworks.

The fund also recognizes the interconnected nature of water challenges. Their investments often target solutions that address multiple problems simultaneously. For instance, they seek digital technologies that can optimize treatment processes while also reducing energy consumption and improving resource recovery. This systems-thinking approach helps maximize the impact of their investments while creating more robust and sustainable solutions.

By maintaining this focused yet flexible investment approach, Breakthrough Victoria is helping to build a more resilient and innovative water technology ecosystem. Their strategic investments are not just funding individual technologies but are helping to create new industry standards and best practices that will shape the future of water management in Australia and beyond.

Partnership Philosophy: Leading the Pack or Running with It?

Breakthrough Victoria’s investment strategy reflects a nuanced understanding of the water technology ecosystem, demonstrating flexibility in both lead and follow-on investments. Rather than adhering to rigid investment criteria, the fund adapts its partnership approach based on the maturity stage and strategic value of each opportunity.

As a government-backed initiative, Breakthrough Victoria’s $2B commitment allows it to take calculated risks that purely commercial investors might shy away from. The fund frequently steps in as a lead investor for early-stage water technologies that align with Victoria’s water security priorities. This leadership position often helps attract additional private capital, creating a multiplier effect that amplifies the impact of public funding.

Yet Breakthrough Victoria also recognizes the value of collaboration through co-investment strategies. By partnering with established venture capital firms and corporate investors, the fund leverages external expertise while distributing risk. This approach has proven particularly effective in later-stage investments where significant capital is required to scale promising water innovations.

The fund’s partnership philosophy extends beyond simple financial relationships. How to mitigate 4 shades of water risk through impact investing highlights how similar investment approaches create lasting value through strategic alignment between investors and portfolio companies. Breakthrough Victoria actively works to foster connections between its portfolio companies and key stakeholders in Victoria’s water sector, including utilities, industrial users, and research institutions.

This ecosystem-building approach distinguishes Breakthrough Victoria from traditional investment vehicles. Rather than focusing solely on financial returns, the fund measures success through multiple lenses, including technological advancement, job creation, and environmental impact. This broader perspective allows for more patient capital deployment and supports the long-term development cycles often required in water technology innovation.

Breakthrough Victoria’s partnership model also emphasizes knowledge transfer and capability building. When acting as a lead investor, the fund typically takes an active role in governance and strategic planning. This hands-on approach helps early-stage companies develop robust business models and navigate the complex regulatory landscape of the water sector.

The fund’s dual capacity to lead or follow creates a dynamic investment platform that can respond to market opportunities while maintaining strategic focus. This flexibility, combined with its substantial capital base, positions Breakthrough Victoria as a pivotal force in shaping Australia’s water technology future.

Strategic Governance: Board Seats and Follow-On Strategy

Breakthrough Victoria’s approach to board representation and follow-on investments reflects a sophisticated understanding of the delicate balance between oversight and operational autonomy. The fund’s governance framework emphasizes strategic value creation while maintaining clear accountability channels.

The board composition demonstrates careful consideration of diverse expertise. Rather than taking majority control, Breakthrough Victoria typically seeks one to two board seats in portfolio companies, allowing them to provide strategic guidance without stifling entrepreneurial flexibility. This measured approach aligns with successful models of impact investing, enabling portfolio companies to benefit from the fund’s extensive networks while retaining their independence.

Their follow-on investment strategy exhibits similar strategic finesse. The fund maintains sufficient capital reserves for subsequent funding rounds, typically allocating 40-50% of initial investment value for follow-on opportunities. This approach serves multiple purposes: it protects against dilution, maintains influence in promising ventures, and provides portfolio companies with funding predictability.

Breakthrough Victoria employs a staged investment approach, releasing capital as companies achieve predetermined milestones. This methodology encourages disciplined growth while managing risk. The fund’s follow-on decisions are governed by rigorous evaluation criteria, including market traction, technology validation, and commercial partnerships.

Notably, the fund has developed a unique ‘technology commercialization scorecard’ that assesses both quantitative metrics and qualitative factors when considering follow-on investments. This comprehensive evaluation framework examines:

- Market expansion and customer adoption rates

- Technical milestone achievement

- Team capability and execution

- Strategic alignment with water industry priorities

- Environmental and social impact metrics

The governance structure also includes advisory panels comprising industry experts, ensuring decisions benefit from deep sector knowledge. These panels regularly review portfolio performance and provide strategic recommendations for both initial and follow-on investments.

Breakthrough Victoria’s governance approach reflects a broader shift in water technology investment, moving beyond traditional venture capital models toward more collaborative, impact-focused frameworks. Their board representation strategy and follow-on investment methodology create a supportive ecosystem that balances commercial returns with technological innovation and environmental impact.

The Vision and Investment Strategy

Breakthrough Victoria’s bold $2 billion initiative represents a paradigm shift in how Australia approaches water technology investment. At its core, the fund’s strategy centers on identifying and scaling transformative solutions that address the continent’s unique water challenges while fostering global market opportunities.

The fund’s investment framework prioritizes three key strategic pillars: water security, operational efficiency, and environmental sustainability. Within these pillars, Breakthrough Victoria targets technologies that demonstrate potential for significant impact in areas such as advanced desalination, water recycling, and smart infrastructure monitoring.

What sets Breakthrough Victoria’s approach apart is its commitment to long-term value creation through strategic partnerships. Rather than pursuing traditional venture capital models, the fund operates on a patient capital basis, allowing promising technologies the time needed to mature and prove their effectiveness in real-world conditions. This approach has proven particularly effective in fostering water innovation.

The fund’s investment criteria emphasize solutions that can scale beyond Australia’s borders while addressing local challenges. Technologies must demonstrate clear commercial viability, strong intellectual property protection, and the potential for significant water conservation or quality improvements. Breakthrough Victoria typically invests between $2 million and $30 million per project, providing not just capital but also strategic support through its extensive network of industry partners.

A distinctive element of the strategy is its focus on cross-sector collaboration. The fund actively seeks technologies that create synergies between water management and other critical sectors such as agriculture, mining, and urban development. This integrated approach ensures that investments deliver multiple benefits while addressing complex water challenges.

Breakthrough Victoria also maintains a strong emphasis on digital innovation, particularly in areas such as artificial intelligence, IoT sensors, and advanced analytics for water management. These technologies are seen as crucial enablers for developing more resilient and efficient water systems across the continent.

The fund’s commitment to environmental, social, and governance (ESG) principles guides its investment decisions. Projects must demonstrate clear sustainability metrics and positive social impact alongside financial returns. This triple-bottom-line approach ensures that investments contribute to both economic growth and environmental stewardship.

As the fund moves forward, it continues to evolve its strategy based on emerging trends and technological developments. The focus remains on identifying breakthrough solutions that can transform Australia’s water sector while creating opportunities for global expansion and impact.

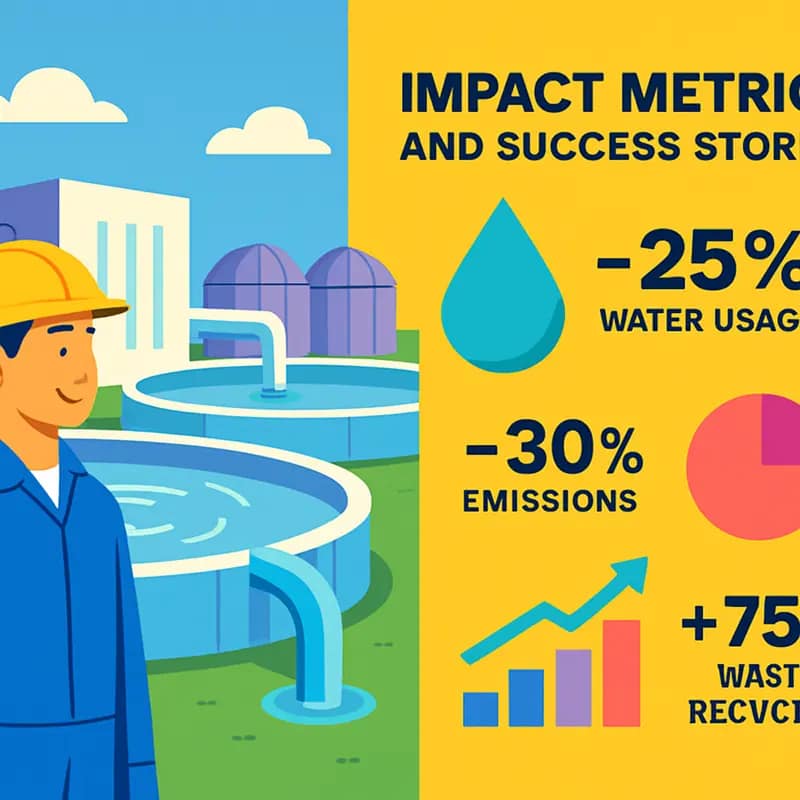

Impact Metrics and Success Stories

Breakthrough Victoria’s strategic water technology investments have generated measurable environmental and social impacts across multiple regions. The fund’s portfolio demonstrates how targeted capital can accelerate water innovation while delivering tangible benefits to communities and ecosystems.

One standout success story involves a novel wastewater treatment technology that reduced energy consumption by 45% while improving water quality outputs. The system, deployed across three municipal treatment plants, now processes over 50 million liters daily while preventing 12,000 tonnes of CO2 emissions annually. Beyond environmental gains, the implementation created 35 new skilled jobs and reduced operating costs by $3.2 million per year.

In agricultural applications, Breakthrough Victoria backed an AI-powered irrigation optimization platform that has helped farmers reduce water consumption by 30% across 75,000 hectares. The system’s smart soil moisture sensors and predictive analytics have preserved over 2.8 billion liters of water annually while maintaining or improving crop yields. This technology has been particularly impactful in drought-prone regions, enhancing agricultural resilience.

The fund’s investment in water quality monitoring solutions has also yielded impressive results. A network of advanced sensors now provides real-time contamination detection across Victoria’s waterways, enabling rapid response to potential threats. This early warning system has prevented three major contamination events, protecting both public health and local ecosystems while saving an estimated $8.5 million in potential remediation costs.

Breakthrough Victoria measures impact through a comprehensive framework that tracks environmental metrics (water saved, emissions reduced, contamination prevented), economic indicators (jobs created, cost savings, productivity gains), and social outcomes (community access to clean water, health benefits, agricultural sustainability). This data-driven approach helps optimize investment decisions and demonstrates the multiplicative effects of water technology innovation.

Importantly, these successes have catalyzed further investment in the sector. For every dollar invested by Breakthrough Victoria, an additional $3.80 has been attracted from private sources, creating a virtuous cycle of water innovation. This multiplier effect has established Victoria as a global hub for water technology development, with several portfolio companies now expanding internationally.

The fund’s impact extends beyond immediate metrics through knowledge sharing and ecosystem building. Their successful projects serve as proof points that accelerate adoption of innovative water solutions across industries. Through strategic documentation and open collaboration, Breakthrough Victoria ensures that lessons learned benefit the broader water sector, maximizing the social return on investment.

Partnership Model and Ecosystem Building

Breakthrough Victoria’s remarkable success in catalyzing water innovation stems from its sophisticated partnership model that creates powerful synergies across the innovation ecosystem. At its core lies a deliberate strategy to break down traditional silos between research institutions, startups, and industry partners.

The fund’s partnership approach centers on fostering meaningful collaborations that accelerate the commercialization of promising water technologies. By bringing together academic researchers with deep technical expertise, agile startups with innovative solutions, and established industry players with market access and scaling capabilities, Breakthrough Victoria creates a multiplier effect that amplifies the impact of its investments.

A cornerstone of this model is the fund’s ‘Innovation Bridge’ program, which pairs research institutions with industry partners to solve specific water challenges. This approach ensures research efforts remain commercially relevant while giving industry players early access to emerging technologies. The program has already facilitated over 30 joint research projects focusing on critical areas like water recycling, smart infrastructure, and drought resilience.

Breakthrough Victoria also operates specialized innovation hubs across Victoria that serve as physical spaces for collaboration. These hubs provide startups with access to testing facilities, pilot sites, and technical expertise while creating natural opportunities for informal knowledge exchange and partnership development. The concentrated presence of water sector stakeholders in these hubs has proven particularly valuable for early-stage companies seeking to validate their technologies and build industry relationships.

The fund’s ecosystem-building efforts extend beyond direct partnerships to include targeted initiatives that strengthen the broader water innovation community. Regular industry forums, technical workshops, and networking events create platforms for continuous dialogue and relationship building. These activities have helped establish Victoria as a recognized center of excellence for water technology innovation, attracting talent and investment from across Australia and beyond.

Significantly, Breakthrough Victoria has pioneered an innovative co-investment model that helps de-risk private sector participation in water technology ventures. By providing matching funds and sharing technical due diligence with private investors, the fund has successfully catalyzed additional capital into the sector. This approach, described in detail in our article on impact investing, has been particularly effective in bridging the notorious ‘valley of death’ between research breakthrough and commercial deployment.

The fund’s partnership model continues to evolve, with increasing emphasis on international collaborations and cross-sector innovation. By creating an environment where diverse stakeholders can effectively collaborate, Breakthrough Victoria is building a sustainable innovation ecosystem that will drive water technology advancement for years to come.

Future Horizons and Investment Opportunities

As Breakthrough Victoria advances its strategic vision, several high-potential investment areas are emerging within the water technology landscape. The fund’s forward-looking approach prioritizes innovations that address critical challenges while delivering commercial viability.

Infrastructure resilience presents a significant opportunity, with aging water systems requiring smart upgrades. Technologies enabling predictive maintenance, real-time monitoring, and automated operations management stand to attract substantial capital. Breakthrough Victoria recognizes that infrastructure optimization could save utilities up to $136 trillion liters annually.

Decarbonization solutions represent another prime investment target. Technologies reducing energy consumption in water treatment, innovative approaches to resource recovery, and water-energy nexus solutions align with both environmental imperatives and economic opportunities. The fund particularly values solutions that can demonstrate measurable carbon reduction metrics alongside operational cost savings.

Water quality management innovations constitute a third major focus area. Advanced treatment technologies targeting emerging contaminants, real-time water quality monitoring systems, and solutions for micropollutant removal are garnering increased attention. These opportunities intersect with growing regulatory pressures and public health concerns.

For entrepreneurs and investors looking to engage with Breakthrough Victoria, several key criteria shape investment decisions. The fund prioritizes scalable solutions with clear paths to commercialization. Technologies must demonstrate market readiness while maintaining sufficient competitive advantages through intellectual property protection or other barriers to entry.

Breakthrough Victoria’s investment approach emphasizes solutions that can be deployed across multiple markets and sectors. Cross-industry applications, particularly those bridging urban and agricultural water management, attract special interest. The fund also values innovations that can be exported globally while maintaining strong roots in Victoria’s innovation ecosystem.

Successful funding proposals typically demonstrate strong alignment with existing water utility priorities, regulatory frameworks, and industry standards. Early engagement with potential end-users, pilot demonstration opportunities, and clear validation protocols strengthen investment cases. The fund’s commitment to long-term value creation means that quick-win solutions must be balanced with sustainable business models.

As water challenges intensify globally, Breakthrough Victoria’s investment strategy continues evolving. The fund actively seeks opportunities where technology innovation intersects with market demand, regulatory requirements, and environmental imperatives. This comprehensive approach ensures that invested capital not only generates returns but also advances the water sector’s transformation.

Final words

Breakthrough Victoria stands as a unique hybrid in the water technology investment landscape, combining the stability of government backing with the agility of venture capital. Their $2 billion perpetual fund structure provides them with unique advantages in supporting water innovation across multiple stages and themes. For water entrepreneurs, the fund offers more than just capital – it provides a pathway to scale within Australia’s growing water technology ecosystem. Impact investors will find in Breakthrough Victoria a partner capable of both leading investments and collaborating effectively with co-investors. As water challenges continue to mount globally, Breakthrough Victoria’s model of patient capital combined with strategic support could well become a blueprint for other regions looking to accelerate water technology innovation. Their commitment to both financial returns and positive impact positions them perfectly to help shape the future of water technology, not just in Victoria, but potentially across the Indo-Pacific region.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!