Deep in the heart of Maisons-Alfort, a stone’s throw from Paris, sits an institution that’s quietly revolutionizing how we fund water innovation. Bpifrance, France’s public investment bank, has emerged as a pivotal force in scaling water technology solutions, with billions in dry powder and an impressive track record of catalyzing growth. Through strategic investments spanning infrastructure modernization to cutting-edge water tech, this financial powerhouse is helping shape tomorrow’s water landscape. For entrepreneurs and impact investors alike, understanding Bpifrance’s approach, investment themes, and partnership models isn’t just interesting – it’s essential.

BPI France is part of my Ultimate Water Investor Database, check it out!

Investor Name: Bpifrance

Investor Type: Gov. Fund

Latest Fund Size: $120 Million

Dry Powder Available: Yes

Typical Ticket Size: $10M – $30M

Investment Themes: Water infrastructure, Water technology, Industrial water management

Investment History: $9807222.22 spent over 5 deals

Often Invests Along:

Already Invested In: Adionics, Elicit Plant, Etteliot, Kumulus Water, Luniwave

Leads or Follows: Follow

Board Seat Appetite: High

Key People: Nicolas Dufourcq

The Investment Arsenal: Funds and Firepower

Bpifrance has assembled a formidable array of investment vehicles specifically targeting water technology innovation and infrastructure development. Their investment strategy combines direct equity investments, venture debt facilities, and specialized funds to support water entrepreneurs at every stage of growth.

At the core of their water technology portfolio lies a €1 billion fund dedicated to ecological transition investments, with water solutions representing a significant portion. The fund provides flexible capital ranging from €500,000 to €15 million per investment, allowing startups to scale operations while maintaining strategic control. This aligns with Bpifrance’s mandate to foster French innovation while generating sustainable returns.

For early-stage water technology companies, Bpifrance operates an accelerator program providing seed funding of up to €500,000 alongside technical support and industry connections. This program has already supported over 50 water startups, with a remarkable 75% survival rate after 5 years – significantly above industry averages.

The bank’s venture debt offering provides an attractive alternative to pure equity funding. These loans, typically ranging from €1-5 million with 3-5 year terms, allow growing water tech companies to fund expansion without diluting existing shareholders. The debt often includes warrants giving Bpifrance modest equity upside while keeping the cost of capital reasonable for borrowers.

Most notably, Bpifrance has pioneered blended finance structures that combine public and private capital to de-risk water infrastructure investments. Through public-private partnerships, they can offer patient capital with 15-20 year horizons – essential for major water treatment and distribution projects requiring substantial upfront investment.

The bank maintains strict investment criteria focused on technological differentiation, market validation, and environmental impact. However, they take a notably founder-friendly approach, often accepting minority positions and offering significant operational autonomy. This has made them a preferred partner for water entrepreneurs seeking growth capital while maintaining their vision and independence.

As highlighted in a recent analysis of water venture capital dynamics, Bpifrance’s latest fund deployment data shows over €300 million in dry powder specifically earmarked for water investments through 2025. This positions them to continue leading major deals in the sector while maintaining their selective investment approach.

For water technology entrepreneurs, accessing Bpifrance’s capital requires demonstrating clear technological advantages, proven market traction, and measurable environmental benefits. The bank’s sector specialists conduct thorough due diligence but aim to move efficiently, typically completing investment decisions within 3-4 months of initial engagement.

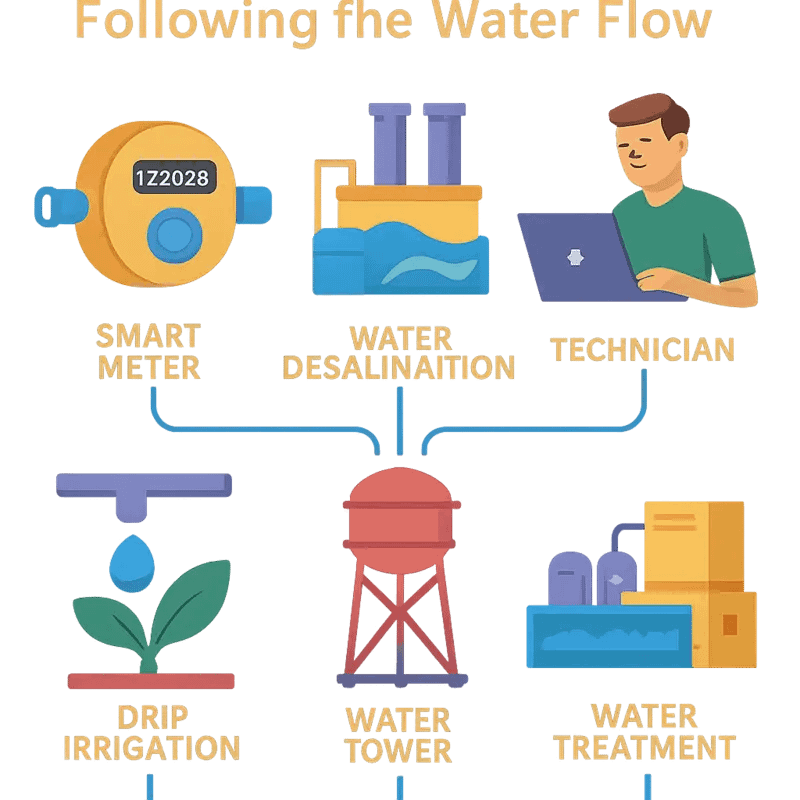

Investment Themes: Following the Water Flow

Bpifrance’s investment strategy in the water sector reflects a comprehensive understanding of the industry’s evolving needs and challenges. The bank has strategically positioned itself across three primary investment themes that address critical water infrastructure and technology gaps.

The first investment focus centers on water infrastructure modernization. Recognizing France’s aging water networks, Bpifrance prioritizes projects that enhance system resilience and reduce water losses. Their portfolio includes significant investments in smart monitoring systems and pipe rehabilitation technologies that help utilities achieve better operational efficiency while preserving valuable water resources.

Digital transformation represents the second major investment theme. As discussed in “how to cleverly embrace the digital craze in the water industry”, Bpifrance has committed substantial capital to startups developing AI-powered solutions for predictive maintenance, advanced metering infrastructure, and real-time water quality monitoring. These investments aim to bridge the gap between traditional water management and Industry 4.0 capabilities.

The third investment theme focuses on circular economy solutions in water treatment. Bpifrance shows particular interest in technologies that enable water reuse, resource recovery, and energy optimization in treatment processes. This includes backing companies developing innovative membrane technologies, advanced oxidation processes, and energy-neutral treatment solutions.

What sets Bpifrance’s approach apart is its long-term perspective on market development. Rather than chasing quick returns, the bank’s investment strategy acknowledges the extended commercialization cycles typical in the water sector. This patient capital approach has proven crucial for technologies requiring extensive pilot testing and regulatory approval.

The investment themes also reflect Bpifrance’s commitment to environmental, social, and governance (ESG) criteria. Water investments are evaluated not just on financial returns but also on their potential to reduce carbon emissions, improve resource efficiency, and enhance community resilience to climate change.

Bpifrance’s investment criteria within these themes emphasize scalability and market readiness. Technologies must demonstrate clear commercial potential and the ability to address specific market needs. The bank’s due diligence process particularly values solutions that can be deployed across multiple geographies and market segments, maximizing the impact of their investments while managing risk.

Partnership Dynamics: Leading vs Following

Bpifrance’s investment approach in the water sector reflects its unique position as both a public institution and a sophisticated financial player. The bank has developed a nuanced strategy that balances its role as a market catalyst with the need to attract private co-investors and maximize impact.

As a lead investor, Bpifrance typically takes significant minority stakes ranging from 10% to 35% in water technology companies. This measured approach allows the bank to maintain substantial influence while ensuring entrepreneurs retain meaningful ownership and private investors have room to participate. The bank’s presence as lead investor often serves as a powerful signal to the market, helping to attract additional capital and strategic partners.

When it comes to board participation, Bpifrance pursues an active governance model. The bank usually secures board seats in companies where it leads investment rounds, allowing it to provide strategic guidance while monitoring performance and protecting public interests. However, Bpifrance’s board members operate with a distinct philosophy – they aim to support management teams rather than control them, focusing on strategic guidance, network access, and risk management.

The bank’s co-investment strategy is equally sophisticated. Bpifrance actively cultivates relationships with private venture capital firms, corporate venture arms, and family offices specializing in water technology. These partnerships serve multiple purposes: they provide validation of investment theses, bring complementary expertise, and create pathways for follow-on funding. The bank typically seeks to maintain a 1:2 or 1:3 ratio between its capital and private co-investment, effectively leveraging public funds to maximize impact.

Bpifrance has also pioneered innovative co-investment structures. For early-stage water technology companies, it often uses convertible instruments that allow private investors to participate on the same terms. For growth-stage investments, the bank may create dedicated co-investment vehicles that enable smaller investors to participate alongside it.

Notably, Bpifrance’s partnership approach extends beyond financial relationships. The bank actively facilitates connections between portfolio companies and potential customers, particularly French water utilities and industrial water users. This commercial support often proves as valuable as the financial investment itself, helping young companies achieve critical early revenues and market validation.

Crucial to this partnership model is Bpifrance’s long-term orientation. Unlike traditional venture investors who typically seek exits within 5-7 years, the bank can maintain investments for extended periods when strategically appropriate. This patience allows water technology companies to develop their solutions properly and build sustainable businesses rather than pursuing premature exits.

Navigating Bpifrance: A Practical Guide

Successfully engaging with Bpifrance requires understanding their distinct investment approach and navigating their structured processes effectively. The public investment bank maintains rigorous standards while supporting water innovation through various funding mechanisms and partnership opportunities.

The first step in approaching Bpifrance is thoroughly preparing your business case. Beyond standard financial projections, they specifically look for clear environmental and social impact metrics tied to water conservation, quality improvement, or infrastructure resilience. Companies should quantify their solution’s contribution to France’s water security and sustainability goals.

Bpifrance offers multiple entry points based on a company’s stage and needs. Early-stage ventures typically start with innovation grants and seed funding programs, requiring detailed technical documentation and market validation. Growth-stage companies can access larger equity investments, often structured as co-investments with private partners.

The due diligence process deserves special attention. Bpifrance conducts extensive technical and commercial evaluations, frequently involving external water industry experts. Prepare comprehensive documentation about your technology’s readiness level, regulatory compliance pathway, and scalability potential. They particularly value demonstrated pilot results and reference customers.

When structuring deals, Bpifrance shows flexibility in investment instruments but maintains strict governance requirements. They typically seek board observation rights and detailed reporting frameworks focused on both financial and impact metrics. Their investment committees expect clear exit strategies, though they can be patient capital partners.

To optimize your chances of success, leverage Bpifrance’s extensive network of water industry contacts. Their portfolio companies often collaborate on pilot projects and commercial partnerships. Regular attendance at their water technology showcase events helps build relationships with key decision-makers.

Be prepared for longer evaluation timelines compared to private investors. Government oversight means additional procedural steps, but this thoroughness also brings credibility that can attract follow-on investment. Learn more about navigating public-private water partnerships.

Maintaining open communication throughout the process is crucial. Bpifrance assigns dedicated investment managers who appreciate regular updates on technical progress, market developments, and potential challenges. Their team can often provide valuable strategic guidance and industry introductions even before formal investment.

The Blueprint: Understanding Bpifrance’s Water Strategy

Bpifrance has positioned itself as a cornerstone investor in France’s water technology landscape through a carefully crafted strategy that balances innovation, sustainability, and economic growth. At the heart of their approach lies a deep understanding that water challenges require both technological advancement and sustainable development frameworks.

The bank’s water technology investment strategy revolves around three key pillars: infrastructure modernization, breakthrough innovation, and circular economy solutions. For infrastructure, Bpifrance prioritizes projects that address aging water systems while incorporating smart monitoring capabilities. This includes supporting companies developing advanced leak detection systems, asset management platforms, and predictive maintenance solutions.

In the innovation sphere, Bpifrance has demonstrated particular interest in technologies that promise step-changes in water treatment efficiency. The bank applies rigorous assessment criteria focused on scalability, market potential, and technological readiness. Projects must demonstrate clear competitive advantages and robust intellectual property protection. Read more about what investors look for in water technologies

Bpifrance’s commitment to sustainable development manifests through their emphasis on circular economy principles. Investment decisions heavily weigh a project’s potential to reduce water consumption, recover resources, or enable water reuse. The bank actively seeks technologies that can help industrial clients achieve their environmental targets while maintaining economic viability.

What sets Bpifrance’s strategy apart is their holistic approach to risk assessment. Beyond traditional financial metrics, they evaluate water technology investments through an impact lens that considers environmental benefits, social outcomes, and contribution to regional development. This comprehensive framework helps identify projects that not only promise financial returns but also advance France’s broader sustainability goals.

Their investment criteria have evolved to emphasize solutions that demonstrate climate resilience and adaptation potential. Companies seeking Bpifrance’s support must show how their technologies address both immediate water challenges and long-term climate change impacts. This forward-looking stance has positioned the bank to catalyze innovations that will shape the future of water management.

Their strategy also recognizes the importance of ecosystem building. Bpifrance actively fosters connections between startups, established companies, research institutions, and public utilities. This collaborative approach helps accelerate technology development and adoption while creating robust market opportunities for innovative solutions.

Show Me the Money: Funding Programs and Support Mechanisms

Bpifrance’s comprehensive funding arsenal transforms promising water technologies into market-ready solutions through strategically layered financial instruments. At the foundation lies their Innovation Grant Program, which provides non-dilutive funding of up to €3 million for early-stage research and development initiatives in water technology.

The bank’s signature Innovation Loan program offers flexible financing with delayed repayment terms, allowing water technology companies to bridge the critical valley of death between prototype and commercialization. These loans typically range from €50,000 to €5 million and feature interest rates tied to project risk profiles rather than traditional collateral requirements.

For scaling companies, Bpifrance deploys a powerful equity investment strategy through direct investments and fund-of-funds programs. As examined in can private capital change the world of water for the better, their matched funding approach amplifies private investment while providing crucial validation for water technology ventures.

The bank’s Export Credit program specifically targets water technology companies pursuing international expansion, offering guarantees and working capital facilities to mitigate risks in new markets. This support proves particularly valuable for companies addressing water challenges in developing regions where traditional financing proves scarce.

Beyond individual instruments, Bpifrance excels at combining multiple funding mechanisms to create comprehensive support packages. A typical growth-stage water technology company might simultaneously access an innovation loan for product development, export credit support for international sales, and equity investment for scaling operations.

Their Water Tech Accelerator Fund provides specialized financing for promising water startups, combining capital with technical assistance. This program focuses on technologies addressing critical challenges like water reuse, energy efficiency, and digital transformation.

Bpifrance also pioneers innovative financing structures like revenue-based financing and project finance facilities tailored to water infrastructure projects. These mechanisms allow companies to align repayment obligations with project cash flows, reducing financial strain during deployment phases.

The bank maintains dedicated pools of capital for water-specific initiatives, ensuring sector expertise guides investment decisions. Their water technology assessment framework evaluates not just financial returns but also environmental impact, technological innovation, and market potential, creating a holistic view of investment opportunities.

This sophisticated financing ecosystem has established Bpifrance as a cornerstone institution in water technology development, providing crucial support across the entire commercialization journey from concept to market leadership.

Beyond Capital: The Bpifrance Ecosystem Advantage

While financial support forms the foundation of Bpifrance’s assistance to water technology companies, its true strength lies in creating a comprehensive ecosystem that nurtures innovation and accelerates market entry. The bank has strategically positioned itself as more than just a funding source—it’s an active catalyst for collaboration and growth in France’s water sector.

At the heart of Bpifrance’s ecosystem approach is its extensive networking platform. The bank organizes regular industry-specific events, connecting water technology startups with established utilities, industrial end-users, and fellow innovators. These carefully curated connections often lead to pilot projects, commercial partnerships, and knowledge exchange that prove invaluable for early-stage companies.

Bpifrance’s acceleration programs deliver structured support through intensive mentoring and expertise sharing. Water technology companies receive guidance from seasoned industry veterans who help navigate regulatory compliance, market entry strategies, and scaling challenges. This mirrors successful models like Imagine H2O’s approach to ecosystem building, but with the added advantage of Bpifrance’s deep ties to French industry.

The technical assistance provided extends beyond conventional business support. Companies gain access to specialized laboratories, testing facilities, and research institutions through Bpifrance’s partnerships with universities and technical centers. This infrastructure sharing significantly reduces development costs and accelerates the validation of new water technologies.

International expansion support represents another crucial ecosystem benefit. Bpifrance leverages its global network to help French water technology companies enter new markets. This includes organizing trade missions, facilitating connections with foreign partners, and providing market intelligence about international opportunities.

The bank’s ecosystem approach also includes dedicated support for talent acquisition and development. Through partnerships with educational institutions and industry associations, Bpifrance helps companies access skilled professionals and provides training programs to develop existing workforce capabilities in specialized water technology areas.

Perhaps most importantly, Bpifrance’s ecosystem creates a powerful feedback loop. Success stories and lessons learned are systematically shared across the network, helping other companies avoid common pitfalls and replicate proven strategies. This knowledge sharing accelerates the overall development of France’s water technology sector while building resilience against market challenges.

By fostering these multilayered connections and support systems, Bpifrance has created an environment where water technology companies can thrive beyond their initial funding rounds. The ecosystem approach ensures that innovation in water technology isn’t just funded but is actively nurtured, validated, and brought to market efficiently.

Success Stories: Making Waves in Water Innovation

Bpifrance’s strategic investments have catalyzed remarkable transformations in France’s water technology landscape. Through targeted financial support and ecosystem development, several companies have emerged as pioneers in addressing critical water challenges.

A standout success story involves a wastewater treatment innovator that developed a groundbreaking biological process for removing micropollutants. With €2.5 million in early-stage funding from Bpifrance, the company scaled its technology from laboratory testing to full commercial deployment. Within three years, their solution achieved a 95% reduction in treatment energy consumption while removing over 99% of target contaminants. The company now operates in 12 countries and has created over 100 high-skilled jobs in France.

Another compelling case demonstrates Bpifrance’s ability to accelerate digital transformation in the water sector. A smart water analytics startup received both seed funding and technical support through Bpifrance’s innovation programs. Their AI-powered platform for leak detection and network optimization has since been adopted by major utilities across Europe, helping save an estimated 50 million cubic meters of water annually. The company’s valuation has increased tenfold since Bpifrance’s initial investment.

In the desalination space, Bpifrance backed a company developing energy-efficient membrane technology. The investment enabled crucial pilot projects that validated the technology’s ability to reduce energy consumption by 40% compared to conventional systems. This innovation has positioned France as a leader in sustainable desalination solutions, with the technology now being exported to water-stressed regions globally.

Bpifrance’s impact extends beyond individual companies to entire market segments. In the industrial water reuse sector, coordinated investments in multiple complementary technologies have helped establish France as a hub for circular water solutions. One portfolio company’s zero-liquid discharge system has been particularly transformative, enabling industrial facilities to recycle up to 98% of their process water while recovering valuable materials.

These success stories share common threads: breakthrough technologies addressing urgent environmental challenges, strong commercial validation, and significant scaling potential. Read more about how water technologies mitigate CO2 emissions. Bpifrance’s comprehensive support model, combining financial instruments with technical and market expertise, has proven instrumental in helping these innovations reach their full potential.

Final words

As we’ve explored throughout this analysis, Bpifrance stands as a formidable force in water technology investment, wielding significant capital and influence to accelerate innovation in this critical sector. With €1.7 billion in new subscriptions for 2024 alone and substantial dry powder across various funds, the institution demonstrates both the means and the commitment to drive meaningful change in water infrastructure and technology. For water entrepreneurs, Bpifrance represents not just a source of capital, but a strategic partner that can provide legitimacy and open doors to broader opportunities. Their preference for co-investment and minority stakes, combined with their strategic approach to board representation, makes them an attractive partner for both startups and co-investors. However, success in engaging with Bpifrance requires understanding their investment themes, governance expectations, and partnership dynamics. As water challenges continue to mount globally, Bpifrance’s role in fostering innovation and scaling solutions becomes increasingly crucial. For entrepreneurs and investors alike, the key lies in aligning with their strategic priorities while leveraging their unique position as a public investment bank with private sector discipline.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my ‘(don’t) Waste Water’ platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!