In the heart of Montreal, AQC Capital has quietly established itself as a pivotal force in early-stage water technology investments. With over $150 million under management and a laser focus on Quebec-based innovators, this venture firm has mastered the art of strategic co-investment to nurture groundbreaking water solutions. Their portfolio showcases an impressive array of sustainable technologies, from wave-powered desalination to cutting-edge water treatment systems, demonstrating their commitment to addressing global water challenges while fostering local entrepreneurial talent. Their unique approach of partnering with sector-specific angel investors ensures deep technical expertise guides every investment decision.

AQC Capital is part of my Ultimate Water Investor Database, check it out!

Investor Name: AQC Capital

Investor Type: VC

Latest Fund Size: $50.56 Million

Dry Powder Available: Yes

Typical Ticket Size: $250k – $1M

Investment Themes: Desalination, Climate/Green Tech Water Solutions, Sustainable Freshwater Access

Investment History: $2300000 spent over 2 deals

Often Invests Along:

Already Invested In: Oneka Technologies

Leads or Follows: Follow

Board Seat Appetite: Unknown

Key People: Kalthoum Bouacida, Geneviève Harland, Audrey Gagniere, Louis Saint-Jacques

The AQC Capital Investment Philosophy

At the heart of Quebec’s burgeoning water technology ecosystem lies AQC Capital’s distinctive investment approach, which combines deep regional roots with global ambitions. The Montreal-based venture capital firm has crafted a meticulous investment philosophy that prioritizes Quebec-based startups while maintaining a broader vision for international market potential.

AQC Capital typically deploys initial investments ranging from $500,000 to $2 million in early-stage companies, primarily focusing on Series A rounds. This strategic positioning allows them to provide meaningful capital injections while maintaining sufficient reserves for follow-on funding in subsequent rounds. Their investment thesis centers on water technology innovations that demonstrate clear commercial viability and scalable impact.

What truly sets AQC Capital apart is their collaborative investment model. Rather than operating in isolation, they have cultivated a robust network of angel investors and industry experts who often co-invest alongside the firm. This approach serves multiple purposes – it provides portfolio companies with access to deeper pools of capital, diverse expertise, and valuable industry connections while helping to validate investment decisions through collective due diligence.

The firm’s core thesis revolves around three fundamental pillars: technological innovation, market readiness, and sustainability impact. They specifically seek out water technologies that can demonstrate measurable environmental benefits while maintaining strong commercial potential. This dual focus on impact and returns aligns with the growing demand for sustainable water solutions while ensuring the financial viability necessary for scaling these innovations.

Particularly noteworthy is AQC’s hands-on approach to portfolio management. Unlike traditional VCs that may take a more passive stance, AQC Capital actively engages with their portfolio companies, providing strategic guidance, operational support, and access to their extensive network of industry partners. This high-touch model has proven especially valuable for early-stage companies navigating the complex water technology landscape.

The firm’s investment committee employs a rigorous evaluation process that examines not only the technical merits of potential investments but also their market positioning and team capability. They place significant emphasis on founders who demonstrate both technical expertise and commercial acumen – a rare combination in the water technology sector. As explored in how private capital can change the world of water for the better, this balanced approach to investment evaluation has become increasingly crucial for success in the water technology space.

By maintaining a focused geographic scope while targeting globally relevant solutions, AQC Capital has positioned itself as a crucial bridge between Quebec’s innovative water technology startups and the broader international market. Their investment philosophy reflects a deep understanding that successful water technology ventures require not just capital, but a comprehensive support system to achieve meaningful scale and impact.

Ripple Effects: AQC’s Water Technology Portfolio

AQC Capital’s water technology portfolio reflects a deep conviction in Quebec’s potential to drive sustainable water innovation. At the heart of their investment thesis lies a focus on breakthrough technologies that address pressing water challenges while delivering strong commercial potential.

The firm’s flagship investment in Oneka Technologies exemplifies their strategic approach to water technology funding. Oneka’s innovative wave-powered desalination systems align perfectly with AQC’s emphasis on energy-efficient and environmentally sustainable solutions. The technology harnesses ocean wave energy to produce fresh water, eliminating the enormous energy costs typically associated with conventional desalination.

Beyond standalone innovations, AQC demonstrates a particular interest in solutions that create powerful synergies across the water sector. Their portfolio companies frequently combine cutting-edge hardware with sophisticated data analytics and automation capabilities. This integrated approach helps utilities and industrial customers optimize their operations while reducing their environmental footprint.

Climate resilience forms another crucial pillar of AQC’s investment strategy. The firm actively seeks out technologies that help communities and businesses adapt to climate change impacts on water resources. This includes advanced water reuse systems, smart stormwater management solutions, and precision irrigation technologies that maximize water efficiency in agriculture.

AQC’s investment approach also reveals a strong emphasis on scalability and commercial viability. Rather than pursuing purely theoretical innovations, they focus on technologies that have demonstrated real-world applications and clear paths to market adoption. Their portfolio companies typically target specific pain points in municipal water systems, industrial processes, or agricultural operations.

Recognizing the water-energy nexus, many of AQC’s investments address both water conservation and energy efficiency. This dual focus makes their portfolio companies particularly attractive to utilities and industrial customers seeking to reduce both their water footprint and operating costs. Some of their funded technologies achieve energy savings of 40-60% compared to conventional approaches.

The firm’s commitment to sustainable water solutions extends beyond individual investments. They actively foster collaboration between portfolio companies, creating opportunities for technology integration and market expansion. This ecosystem approach has proven particularly valuable for early-stage companies looking to accelerate their growth and market penetration.

As explored in “how to mitigate 4 shades of water risk through impact investing”, AQC’s investment strategy demonstrates how targeted capital deployment can address multiple dimensions of water risk while generating attractive returns. Their portfolio showcases the potential for Quebec-based innovation to create ripple effects across the global water sector.

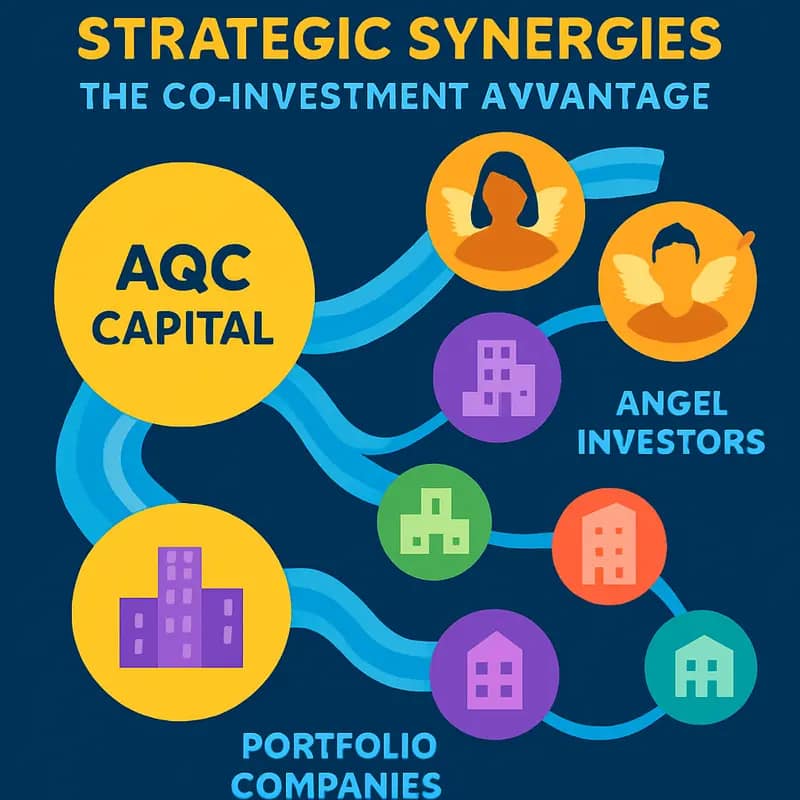

Strategic Synergies: The Co-Investment Advantage

AQC Capital has masterfully orchestrated a co-investment strategy that amplifies their impact in Quebec’s water technology landscape. By cultivating deep relationships with strategic partners, the firm has created a powerful multiplier effect that extends far beyond mere capital deployment.

At the heart of their approach lies a carefully curated network of angel investors who bring specialized expertise in water technology, environmental engineering, and cleantech commercialization. These angels don’t just provide additional funding – they serve as technical validators and market advisors, helping portfolio companies navigate complex regulatory environments and industry-specific challenges.

The firm’s partnership model particularly shines in their deal structuring. Rather than competing for deals, AQC positions itself as a collaborative force that brings together complementary investors. A prime example is their recent collaboration with Cycle Capital, where both firms pooled their resources and expertise to support breakthrough water purification technologies. This partnership approach has proven especially valuable in capital-intensive projects requiring significant scale-up funding.

AQC’s co-investment framework follows a hub-and-spoke model, with the firm acting as the central coordinator while maintaining flexibility in deal structures. This allows them to accommodate various investor preferences while ensuring alignment with their core mission of advancing sustainable water solutions. Their typical deal involves 2-3 co-investors, with AQC taking lead on due diligence and post-investment management.

What sets AQC’s strategy apart is their emphasis on strategic fit over financial engineering. When evaluating potential co-investors, they prioritize partners who can contribute meaningful industry connections or technical expertise alongside their capital. This approach has led to a remarkably high success rate in follow-on funding rounds, with portfolio companies benefiting from an expanded network of supporters.

The firm has also pioneered innovative co-investment structures that protect early-stage technologies while enabling broader participation. By creating special purpose vehicles for specific investments, they’ve made it possible for smaller angels to participate in deals that would typically be beyond their reach. This democratization of water tech investing has helped expand the pool of capital available to promising innovations.

Linking their approach to broader industry trends can we turn finance astoundingly into the water sector’s new best ally?, AQC’s co-investment strategy represents a new model for accelerating water technology adoption. Their success demonstrates how thoughtful collaboration can overcome the traditional challenges of commercializing water innovations, creating a blueprint for other impact-focused venture firms to follow.

Future Flows: Growth Trajectory and Opportunities

AQC Capital stands at an inflection point in Quebec’s water technology landscape, with substantial dry powder and an expanding portfolio that signals strong growth potential. Building on their successful co-investment approach, the firm is strategically positioned to deploy significant capital into the next wave of water innovations.

With over $150 million in available investment capital, AQC maintains the flexibility to support both early-stage startups and growth-stage companies. Their investment thesis increasingly focuses on technologies addressing climate resilience, water reuse, and digital transformation – three areas experiencing accelerated adoption across North America.

Quebec’s unique innovation ecosystem provides AQC with distinct advantages. The province’s hydroelectric infrastructure and established cleantech clusters create natural synergies for water technology development. AQC leverages these regional strengths while maintaining a global perspective, actively seeking international partnerships to scale portfolio companies beyond Quebec’s borders.

The firm’s role in shaping the local water innovation ecosystem extends beyond capital deployment. They’ve established key partnerships with research institutions, including École Polytechnique and McGill University, to create technology validation pathways. This academic-industry bridge helps de-risk innovations and accelerates commercial adoption.

Looking ahead, AQC is particularly focused on technologies that integrate artificial intelligence, advanced materials, and circular economy principles. Their investment strategy anticipates growing demand for solutions that address water scarcity while reducing energy consumption and operational costs. The firm’s deep technical expertise allows them to evaluate complex technologies and provide hands-on support to portfolio companies.

Perhaps most significantly, AQC is helping establish Quebec as a global water technology hub. Their investments attract international attention and capital, creating a virtuous cycle of innovation and growth. The firm’s portfolio companies benefit from this ecosystem effect, gaining access to talent, customers, and strategic partners.

As water challenges intensify globally, AQC’s specialization in sustainable water technologies positions them to capitalize on growing market opportunities. Their proven ability to identify and scale promising innovations, combined with substantial investment capacity, suggests continued expansion of their influence in shaping water technology solutions.

Learn more about venture capital’s role in water innovation

The Investment Philosophy: Beyond Traditional Venture Capital

AQC Capital’s investment approach stands apart through its deliberate fusion of water industry expertise and strategic capital deployment. Rather than pursuing a conventional venture capital playbook, the firm has cultivated a distinctive philosophy centered on water technology’s unique dynamics and challenges.

At the core of AQC’s thesis lies a deep understanding that water innovation requires patient capital aligned with longer commercialization cycles. The firm typically invests between $500,000 and $3 million in initial rounds, providing enough runway for thorough technology validation while maintaining reasonable valuations. This measured approach reflects how to take better investment decisions in water technologies.

What truly distinguishes AQC’s methodology is its dual focus on technological merit and commercial viability. The investment team conducts rigorous technical due diligence, leveraging decades of collective water industry experience to evaluate not just the innovation itself, but its practical applicability and market fit. This expertise allows them to identify solutions that can scale while delivering measurable impact.

The firm maintains strict investment criteria focused on technologies addressing critical water challenges. Priority areas include water quality monitoring, treatment efficiency, infrastructure optimization, and resource recovery. However, AQC goes beyond merely identifying promising technologies – they actively work to de-risk investments through strategic partnerships, pilot programs, and customer validation.

Crucially, AQC’s philosophy emphasizes the importance of founder support beyond just financial backing. The firm takes an active role in helping portfolio companies navigate the complex stakeholder landscape of the water sector, from utilities and municipalities to industrial users and regulators. This hands-on approach includes assistance with business development, strategic planning, and industry networking.

The firm’s investment strategy also recognizes the growing intersection between water technology and sustainability imperatives. They specifically seek out innovations that can deliver both environmental benefits and attractive financial returns, understanding that the most successful water technologies will be those that help customers achieve their sustainability goals while improving operational efficiency.

This comprehensive approach to water technology investment has allowed AQC to build a portfolio that not only shows promise for financial returns but also advances meaningful solutions to global water challenges. Their philosophy demonstrates that patient capital, deep sector expertise, and active portfolio support can successfully bridge the gap between innovative water technologies and widespread market adoption.

Portfolio Success Stories: Where Innovation Meets Impact

AQC Capital’s portfolio reflects a carefully curated collection of water technology innovators making measurable strides in sustainability and efficiency. Through strategic investments ranging from early-stage startups to growth-phase companies, the firm has established itself as a catalyst for breakthrough solutions in water treatment and management.

A standout achievement has been the firm’s work in advanced membrane technology development. By backing companies pioneering novel filtration approaches, AQC has helped bring to market solutions that reduce energy consumption in water treatment by up to 40% while improving contaminant removal rates. These advancements have found applications across municipal utilities and industrial facilities, delivering both environmental benefits and cost savings.

In the digital water space, AQC’s portfolio companies have developed cutting-edge monitoring and analytics platforms that enable predictive maintenance and optimization of water infrastructure. These solutions have helped utilities reduce non-revenue water losses by up to 30% while extending asset lifespans. The real-world impact translates to billions of gallons of water saved annually across implementation sites.

Perhaps most notably, AQC has demonstrated exceptional foresight in identifying and scaling solutions for emerging water challenges. Their early investments in companies developing PFAS treatment technologies have positioned these ventures at the forefront of addressing what has become a critical environmental concern. Several portfolio companies have secured major contracts with municipalities and industrial clients, validating both the technical approach and market demand.

The firm’s impact extends beyond pure financial returns. Portfolio companies have collectively helped preserve over 50 billion gallons of freshwater resources annually through their technologies and solutions. Additionally, these innovations have enabled significant reductions in chemical usage and energy consumption in water treatment processes, advancing the sector’s sustainability goals.

AQC’s hands-on approach to portfolio management has been instrumental in these successes. By leveraging their deep industry expertise and networks, they’ve helped portfolio companies navigate complex regulatory environments, accelerate technology validation, and secure strategic partnerships. This support has proven particularly valuable in the water sector, where commercialization pathways can be challenging to navigate.

These portfolio success stories underscore a key aspect of AQC’s investment thesis – that environmental impact and financial returns need not be mutually exclusive. Their track record demonstrates that strategic investments in water technology innovation can generate substantial returns while addressing critical sustainability challenges.

The Entrepreneur’s Journey: From Concept to Commercialization

Bringing a water technology innovation from concept to market requires more than just capital – it demands deep industry expertise, strategic guidance, and a robust support network. This is where AQC Capital’s hands-on approach sets them apart in enabling entrepreneurs to navigate the complex water sector landscape.

At the core of AQC’s entrepreneur support model is their team of seasoned water industry veterans who work closely with portfolio companies to refine their technology and business strategies. Rather than taking a passive investment approach, AQC’s experts roll up their sleeves alongside founders to accelerate product development cycles and overcome technical hurdles. This collaborative model has proven especially valuable for first-time entrepreneurs who benefit from the practical insights of those who have successfully commercialized water technologies before.

The firm’s extensive network of industry connections serves as a powerful catalyst for market entry. By leveraging their relationships with utilities, industrial water users, and engineering firms, AQC helps startups secure crucial pilot projects and initial customer deployments. These early reference installations build credibility and generate the real-world performance data needed to drive broader market adoption.

Beyond technical and commercial support, AQC guides entrepreneurs through the nuances of operating in the highly regulated water sector. Their team’s deep understanding of water quality standards, environmental regulations, and certification requirements helps startups navigate compliance challenges that could otherwise delay market entry. This regulatory expertise proves particularly valuable when adapting technologies for different geographic markets with varying requirements.

AQC’s support extends to helping entrepreneurs build out their teams and organizational capabilities. Through strategic hiring guidance, introductions to potential employees, and leadership development coaching, they ensure portfolio companies have the human capital needed to scale. The firm also facilitates knowledge sharing and collaboration between portfolio companies, creating a community where entrepreneurs can learn from each other’s experiences.

This comprehensive support system significantly improves the odds of success for water technology startups. By addressing both technical and commercial challenges while building organizational capacity, AQC’s approach helps entrepreneurs avoid common pitfalls and accelerate their path to market. The result is faster commercialization of innovations that can meaningfully impact water sustainability challenges.

Future Horizons: Scaling Water Innovation

AQC Capital’s strategic vision extends beyond conventional water technology investments, positioning the firm at the forefront of transformative solutions that will shape the industry’s future. Building on their established foundation of supporting entrepreneurs, they are now expanding their investment thesis to embrace emerging technologies that promise to revolutionize water management and conservation.

Artificial intelligence stands as a cornerstone of this evolution, with AQC identifying opportunities in AI-driven predictive maintenance, smart distribution networks, and automated treatment optimization. These technologies not only enhance operational efficiency but also provide real-time insights that enable proactive decision-making in water management.

The firm’s commitment to decentralized treatment systems reflects a deeper understanding of future water challenges. As urban populations grow and climate pressures intensify, centralized water management networks won’t handle 2050. AQC’s investment strategy targets innovations that enable localized water treatment and reuse, reducing infrastructure strain while increasing community resilience.

Circular water solutions represent another crucial focus area. The firm actively seeks technologies that close the loop in water consumption, transforming traditional linear processes into sustainable cycles. This includes innovations in water recovery, resource extraction from wastewater, and zero-liquid discharge systems that maximize water efficiency while minimizing environmental impact.

Beyond individual technologies, AQC recognizes the importance of system integration. Their portfolio companies increasingly collaborate to create comprehensive solutions that address multiple challenges simultaneously. This approach has proven particularly effective in industrial applications, where water, energy, and resource recovery intersect.

The firm’s scaling methodology emphasizes market validation through pilot projects and strategic partnerships. By connecting portfolio companies with industry leaders and potential customers early in their development cycle, AQC helps accelerate the path from innovation to widespread adoption. This hands-on approach includes technical due diligence, market analysis, and strategic guidance throughout the scaling process.

Looking ahead, AQC Capital continues to evaluate emerging technologies that could reshape the water sector. Their investment criteria now include potential climate impact, scalability across different markets, and the ability to integrate with existing infrastructure. This forward-thinking approach positions them to capitalize on opportunities while addressing critical environmental challenges through innovative water solutions.

Final words

AQC Capital stands as a testament to the power of focused, collaborative investment in water technology innovation. Their unique approach of combining local expertise with global ambitions has created a powerful ecosystem for water entrepreneurs in Quebec. By maintaining close partnerships with angel investors and leading co-investment rounds, they’ve demonstrated how strategic capital deployment can accelerate the development of sustainable water solutions. Their success with companies like Oneka Technologies showcases their ability to identify and nurture groundbreaking water technologies while maintaining strong returns. As water challenges continue to grow globally, AQC’s model of deep sector expertise combined with strategic co-investment positions them perfectly to capitalize on emerging opportunities while fostering meaningful innovation in the water sector. For entrepreneurs and co-investors alike, AQC Capital represents not just a source of funding, but a partner in building the future of water technology.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!