When it comes to solving the world’s water challenges, capital allocation matters as much as technological innovation. Enter Apax Funds, a private equity powerhouse that has quietly but decisively emerged as a catalyst in the water technology sector. With over four decades of investment experience and $50 billion in assets under management, Apax brings institutional muscle to an industry thirsting for transformation. Their approach combines rigorous due diligence with a deep understanding of how water technologies can scale to create both financial returns and lasting environmental impact.

Apax Funds is part of my Ultimate Water Investor Database, check it out!

Investor Name: Apax Funds

Investor Type: PE

Latest Fund Size: $12000 Million

Dry Powder Available: Yes

Typical Ticket Size: >$75M

Investment Themes: Stormwater & Infrastructure Solutions, Decentralized/Residential Water Services, Consumer Water Services

Investment History: $ spent over deals

Often Invests Along:

Already Invested In:

Leads or Follows: Lead

Board Seat Appetite: High

Key People: Ashish Karandikar, David Kim, Irene Zou, Nedu Ottih

The Apax Water Technology Thesis

Apax’s strategic approach to water technology investments centers on a sophisticated framework that combines market analysis with technological evaluation. Their thesis rests on identifying solutions that address critical water challenges while offering scalable business models and defensible intellectual property.

The firm’s investment criteria emphasizes three core pillars: market opportunity, technological differentiation, and execution capability. When evaluating market opportunity, Apax analyzes factors like regulatory drivers, industry pain points, and total addressable market size. They particularly focus on segments where water technology can enable cost reduction or operational efficiency improvements.

On the technological front, Apax employs a rigorous due diligence process that assesses both the innovation’s technical merits and its commercial viability. The firm leverages its network of industry experts to validate claims and evaluate competitive advantages. Learn more about smart water technology investment criteria

Execution capability assessment examines the strength of the management team, scalability of the business model, and potential barriers to adoption. Apax places significant weight on companies that demonstrate clear paths to profitability and the ability to capture recurring revenue streams.

Their market analysis methodology combines both top-down and bottom-up approaches. The top-down analysis examines macro trends like urbanization, climate change, and industrial water demand. The bottom-up approach involves detailed customer interviews, pilot project analysis, and competitive landscape mapping.

Apax particularly values opportunities where water technology intersects with other transformative trends like digitalization, sustainability, and circular economy principles. This convergence often signals stronger growth potential and multiple paths to value creation.

The firm’s evaluation process also considers regulatory compliance requirements, environmental impact, and social benefits – factors increasingly critical in water technology adoption. Their thesis emphasizes solutions that can demonstrate measurable improvements in water efficiency, quality, or resource recovery.

Portfolio Success Stories

Apax’s strategic investments in water technology companies have yielded remarkable transformations and industry-defining achievements. Their portfolio showcases the firm’s ability to identify and scale innovative solutions addressing critical water challenges.

One standout success illustrates Apax’s expertise in accelerating growth through digital transformation. A water analytics company, after Apax’s investment, expanded its AI-powered leak detection capabilities across three continents. The firm’s operational expertise helped optimize the company’s software deployment model, resulting in a 300% increase in recurring revenue within 36 months.

Another portfolio company revolutionized industrial wastewater treatment through advanced membrane technology. Apax’s guidance helped this venture partner with leading semiconductor manufacturers, turning a promising technology into an industry standard. Their proprietary filtration system now processes millions of gallons daily while reducing energy consumption by 40% compared to conventional methods.

Apax’s investment thesis proved particularly successful in the municipal water sector. Their backing enabled a smart infrastructure company to develop an integrated platform for utility operations. This solution now manages critical water assets for over 50 million consumers across multiple regions.

Beyond individual company successes, Apax’s portfolio demonstrates powerful synergies. Their water technology companies frequently collaborate, sharing expertise and creating integrated solutions. This collaborative approach has accelerated innovation cycles and expanded market reach.

The firm’s ability to attract top talent and build robust management teams remains crucial to these successes. Portfolio companies consistently cite Apax’s extensive network and strategic guidance as key factors in achieving rapid market penetration and sustainable growth.

These achievements validate Apax’s investment methodology, showing how private equity can drive both technological advancement and commercial success in the water sector. Their portfolio companies continue to set new benchmarks for innovation and operational excellence.

Impact Metrics and ESG Integration

Apax Funds has developed a sophisticated framework for measuring and managing the environmental impact of their water technology investments, seamlessly integrating ESG principles with financial performance metrics. The firm’s approach centers on quantifiable outcomes across multiple dimensions of sustainability and resource efficiency.

At the portfolio level, Apax tracks key environmental indicators including water savings, energy reduction, and carbon emissions avoided through implemented technologies. These metrics are standardized across investments to enable meaningful aggregation and comparison. The firm has built proprietary assessment tools that evaluate both direct impacts from operations and indirect benefits achieved through customer implementations.

ESG integration begins during due diligence, where potential investments are screened against established sustainability criteria. Companies must demonstrate clear pathways to measurable environmental benefits while maintaining strong financial fundamentals. This dual lens ensures that environmental impact doesn’t come at the expense of returns.

Post-investment, Apax works closely with portfolio companies to establish baseline measurements and set ambitious but achievable impact targets. Regular monitoring and reporting keeps companies accountable while identifying opportunities for improvement. The firm leverages its deep water industry expertise to help companies optimize both financial and environmental performance.

Notably, Apax has pioneered innovative approaches to valuing environmental benefits. Their model accounts for factors like avoided water losses, reduced chemical usage, and improved water quality – translating these into monetary terms where possible. This helps demonstrate the business case for sustainability-focused investments.

As explored in a recent analysis of impact investing strategies, the firm’s framework has become a model for the industry. Regular reporting to limited partners includes both traditional financial metrics and detailed environmental impact data, providing a comprehensive view of investment performance.

The success of this integrated approach has influenced how Apax structures deals and creates value. Environmental improvements often drive operational efficiencies, creating a virtuous cycle between financial returns and positive impact. This alignment has helped the firm attract both sustainability-focused investors and companies eager to scale their environmental solutions.

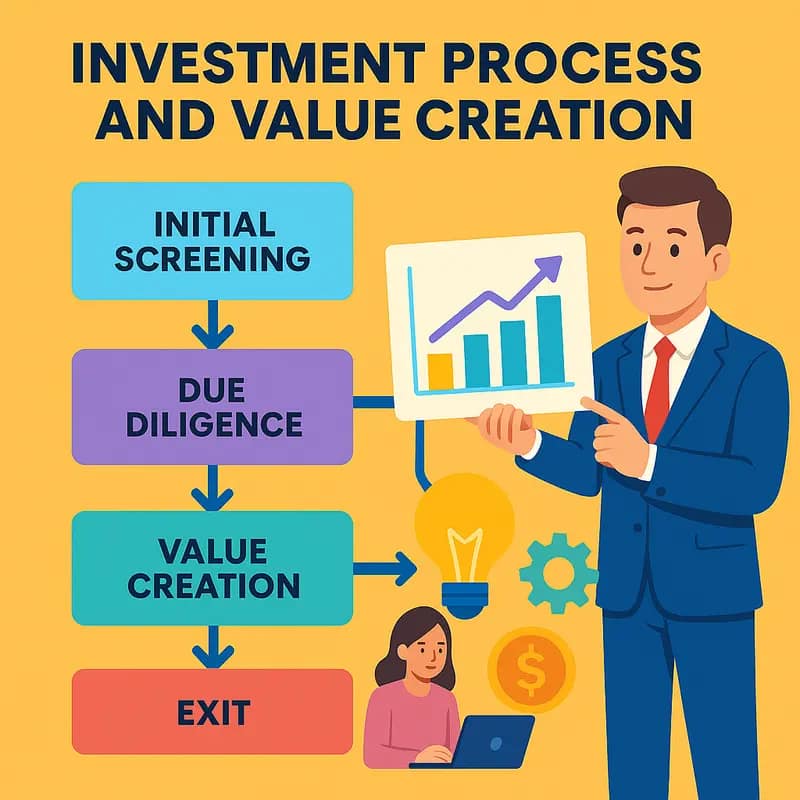

Investment Process and Value Creation

Apax Funds’ rigorous approach to water technology investments follows a carefully orchestrated process that maximizes both financial returns and technological advancement. The firm’s investment thesis centers on identifying companies with proven solutions addressing critical water challenges while demonstrating clear paths to scalability.

The due diligence process begins with a comprehensive technical assessment of the core technology, evaluating factors like energy efficiency, operational reliability, and competitive advantages. Apax’s specialized water technology team collaborates with industry experts to validate performance claims and market potential. Environmental impact metrics, regulatory compliance, and intellectual property protections receive particular scrutiny given their outsized importance in the water sector.

Deal structuring emphasizes alignment between Apax and portfolio company management through carefully designed incentive mechanisms. The firm typically takes significant minority or majority positions while ensuring management retains meaningful equity stakes. Investment terms often include performance-based earnouts tied to specific technical and commercial milestones.

Post-investment, Apax deploys a hands-on value creation approach focusing on three key pillars: operational excellence, commercial acceleration, and strategic positioning. The operational workstream targets manufacturing optimization, supply chain enhancement, and quality system advancement. Commercial initiatives emphasize expanding market access through Apax’s global network while refining go-to-market strategies.

Strategic value creation involves identifying and executing both organic growth opportunities and strategic acquisitions. Apax leverages its deep sector knowledge to help portfolio companies expand into adjacent markets, develop new applications, and form strategic partnerships. The firm’s track record in guiding water technology companies through critical growth phases has established it as a partner of choice in the sector.

This systematic approach to investment and value creation has enabled Apax to consistently generate strong returns while advancing solutions to global water challenges. The firm’s ability to bridge the gap between promising technologies and widespread market adoption has made it an influential force in shaping the future of water infrastructure.

Future Growth Horizons

Apax Funds is strategically positioning itself at the forefront of several transformative water technology trends that promise substantial growth opportunities in the coming years. By analyzing emerging market signals and technological advances, the firm has identified key areas poised for exponential development.

Decentralized water treatment systems represent a prime focus area, as urbanization and climate pressures drive demand for localized solutions. The shift toward distributed infrastructure enables more resilient and efficient water management while opening new revenue streams through Water-as-a-Service business models.

Technology convergence presents another critical opportunity, particularly in the integration of artificial intelligence and advanced analytics with traditional water infrastructure. Smart water networks that leverage real-time monitoring, predictive maintenance, and automated optimization are becoming essential for utilities and industrial operators seeking operational excellence.

The circular economy for water is emerging as a transformative force, with water reuse and resource recovery technologies gaining momentum. Apax recognizes the growing imperative to extract value from wastewater streams through nutrient recovery, energy generation, and water recycling.

Addressing emerging contaminants, particularly PFAS and microplastics, represents both an urgent need and significant market opportunity. Novel treatment technologies that can effectively and efficiently remove these substances are witnessing accelerated adoption and regulatory support.

The firm is also closely monitoring advancements in nature-based solutions and green infrastructure, which offer sustainable alternatives to traditional gray infrastructure while delivering multiple environmental benefits. This aligns with growing ESG priorities among institutional investors and regulatory frameworks promoting resilient water systems.

Leveraging its deep sector expertise and global network, Apax is uniquely positioned to identify and scale breakthrough technologies addressing these opportunities. The firm’s approach combines rigorous technical evaluation with strategic foresight to select innovations with the highest potential for market transformation and sustainable value creation.

Partnership Opportunities

Entrepreneurs and companies seeking to partner with Apax Funds have multiple pathways to engage with the private equity giant’s water technology investment initiatives. The firm employs a systematic evaluation process focused on scalable solutions addressing critical water challenges.

Prospective partners should first align their value proposition with Apax’s strategic focus areas. The firm prioritizes technologies enabling water reuse, smart infrastructure, and resource recovery. Companies should demonstrate proven technical validation, a clear path to commercialization, and potential for significant market impact.

The formal engagement process typically begins with an initial screening submission through Apax’s dedicated water sector team. This includes detailed information about the technology, market opportunity, financial projections, and investment requirements. Companies that pass preliminary review advance to deeper technical and commercial due diligence.

Apax takes a hands-on approach with portfolio companies, providing not just capital but also strategic guidance, operational expertise, and access to its global network. The firm looks for opportunities where it can leverage these capabilities to accelerate growth and market adoption.

Beyond direct investment, Apax facilitates strategic partnerships between portfolio companies and major industry players. This ecosystem approach helps promising technologies achieve commercial scale through established channels. The firm actively works to create synergies across its water technology investments.

Successful partnerships require alignment on both timeline and scale. Apax typically targets companies seeking growth capital of $50 million or more, though exact parameters vary. The firm maintains a long-term investment horizon, usually 5-7 years, focused on building sustainable market leaders.

Entrepreneurs can strengthen their position by demonstrating rigorous validation of both technology and business model. Case studies, pilot results, and market feedback carry significant weight. Companies should also show how Apax’s capital and capabilities can specifically accelerate their growth trajectory.

The Evolution of Water Tech Investment

Apax Funds has pioneered a transformative approach to water technology investment, fundamentally reshaping traditional private equity models to address the unique challenges of the water sector. The firm’s investment thesis has evolved through deep analysis of water market dynamics and recognition of critical industry pain points.

At the core of Apax’s strategy lies the understanding that water technology requires longer development cycles compared to typical private equity horizons. While conventional PE firms often seek 3-5 year returns, Apax has adapted its approach to accommodate the 7-10 year commercialization pathways common in water innovation. This patient capital perspective enables deeper technology development and proper market validation.

The firm has developed sophisticated frameworks for evaluating water technologies that go beyond traditional financial metrics. These frameworks assess factors like regulatory compliance potential, operational reliability at scale, and integration capabilities with existing infrastructure. This comprehensive evaluation helps identify truly transformative solutions while managing risk.

A key evolution in Apax’s approach has been the emphasis on platform technologies that can address multiple water challenges simultaneously. Rather than pursuing single-solution companies, the fund prioritizes technologies with versatile applications. This strategy maximizes potential returns while providing essential solutions for diverse water issues.

Apax has also pioneered innovative deal structures that align incentives between investors, technology developers, and water utilities. These structures often include milestone-based funding, technology validation partnerships with major utilities, and creative licensing arrangements that accelerate market adoption.

The firm’s water investment strategy increasingly focuses on digital transformation and data analytics capabilities. This reflects the growing importance of smart water solutions in addressing efficiency, monitoring, and predictive maintenance needs across the water sector. By combining deep water industry expertise with digital innovation, Apax has positioned itself at the forefront of water technology evolution.

Portfolio Success Stories

Apax Funds’ strategic investments in water technology companies have yielded remarkable success stories that demonstrate the firm’s commitment to driving innovation in water conservation and efficiency. The portfolio companies showcase diverse approaches to solving critical water challenges while delivering strong financial returns.

A standout example is an advanced membrane technology company that revolutionized industrial water treatment by developing next-generation membrane materials with significantly improved fouling resistance and energy efficiency. This breakthrough enabled manufacturing facilities to reduce their water consumption by up to 60% while cutting operating costs. The technology’s rapid market adoption led to the company’s value increasing fivefold within three years of Apax’s investment.

Another portfolio company pioneered smart water infrastructure monitoring systems that leverage AI and IoT sensors to detect leaks and optimize distribution networks. Their solution helped utilities reduce non-revenue water losses by over 30% on average, conserving billions of gallons annually. The company’s growth trajectory attracted multiple strategic acquirers, resulting in a successful exit that generated compelling returns.

In the agricultural sector, an Apax-backed precision irrigation company developed crop-specific solutions that maximize water use efficiency. Their system combines soil moisture sensors, weather data, and crop modeling to deliver precise amounts of water when and where needed. Early adopters reported water savings of 40% while maintaining or improving crop yields.

Apax also invested in a wastewater treatment technology provider that developed an energy-neutral biological process. The innovative approach generates enough biogas to power treatment operations while producing high-quality reclaimed water. Several municipal installations demonstrated the technology’s ability to reduce both operating costs and environmental impact.

These success stories highlight how Apax’s investment thesis of backing transformative water technologies has created meaningful environmental impact while generating attractive financial returns. The firm’s ability to identify and scale innovative solutions addressing critical water challenges has established it as a leading force in water technology investment.

Investment Criteria and Due Diligence

Apax’s water technology investment strategy centers on a rigorous evaluation framework that examines both technical merit and market potential. The firm’s due diligence process prioritizes solutions that demonstrate scalable impact on water conservation while maintaining strong commercial viability.

The technical assessment begins with validating the core technology through independent expert review. Key criteria include proven performance data, intellectual property protection, and technological differentiation. Apax’s engineers scrutinize pilot results, examining metrics like treatment efficiency, energy consumption, and operational reliability. Solutions must demonstrate clear advantages over existing approaches while maintaining cost-effectiveness at scale.

Market assessment focuses on identifying technologies addressing major industry pain points with substantial growth potential. Apax analysts evaluate what factors investors need to consider when evaluating water technologies, examining market size, competitive landscape, and regulatory drivers. The firm prioritizes solutions with multiple applications across industrial, municipal, and commercial sectors to maximize market opportunity.

Regulatory compliance and environmental impact form another critical evaluation pillar. Technologies must meet or exceed current standards while demonstrating adaptability to evolving regulations. Environmental sustainability metrics, including carbon footprint and waste generation, factor heavily into investment decisions.

The financial model assessment examines unit economics, capital requirements, and profitability potential. Apax seeks technologies with clear paths to commercialization and reasonable timelines to market penetration. The management team’s expertise and track record in bringing water innovations to market receives particular scrutiny.

This comprehensive evaluation approach enables Apax to identify water technology investments with the highest probability of generating both environmental impact and financial returns. The firm maintains flexibility to adjust criteria based on changing market conditions while staying focused on core sustainability objectives.

Value Creation Strategy

Apax’s value creation strategy for water technology investments centers on scaling promising solutions through operational excellence and strategic market expansion. The firm employs a systematic approach focused on three core pillars: operational optimization, market access acceleration, and technological advancement.

The operational optimization process begins with a comprehensive assessment of portfolio companies’ existing capabilities and infrastructure. Apax leverages its deep industry expertise to identify efficiency opportunities across manufacturing, supply chain, and business processes. This often involves implementing lean methodologies, digitalizing operations, and optimizing resource allocation to build scalable platforms for growth.

Market access acceleration represents a critical component of Apax’s strategy. The firm utilizes its extensive global network to help portfolio companies penetrate new geographic markets and industry verticals. By facilitating strategic partnerships, joint ventures, and distribution agreements, Apax enables its water technology companies to rapidly expand their footprint while managing risks inherent in new market entry.

Technological advancement forms the third pillar, with Apax taking an active role in steering innovation roadmaps. The firm promotes cross-pollination of ideas between portfolio companies, encourages strategic R&D investments, and facilitates technology transfer agreements where beneficial. This approach helps portfolio companies maintain their competitive edge while expanding their solution offerings.

Central to success is Apax’s hands-on engagement model, deploying operational experts who work closely with management teams to execute value creation initiatives. These specialists bring deep sector knowledge and proven methodologies to accelerate growth while maintaining focus on sustainable practices and measurable impact.

Importantly, Apax aligns these initiatives with broader environmental and social objectives, ensuring that scaling efforts advance both commercial success and positive impact. This dual focus helps portfolio companies capitalize on the growing demand for sustainable water solutions while building resilient business models.

Impact Measurement Framework

Apax has developed a comprehensive framework for measuring and reporting the environmental and social impact of its water technology investments, reflecting the firm’s commitment to quantifiable sustainability outcomes. The framework operates across multiple dimensions to capture both direct and indirect effects of water innovations.

At its core, the framework tracks water-specific metrics including gallons saved, quality improvements, and efficiency gains. Each portfolio company reports standardized key performance indicators (KPIs) on a quarterly basis, enabling consistent assessment across different water technology applications. These metrics get mapped to relevant UN Sustainable Development Goals, particularly SDG 6 (Clean Water and Sanitation) and SDG 14 (Life Below Water).

Beyond pure environmental metrics, the framework incorporates social impact measurements such as number of people gaining improved water access, health outcomes in served communities, and jobs created through water technology deployment. Economic indicators track cost savings for utilities and industrial users, demonstrating the business case for sustainable water solutions.

The evaluation process combines quantitative data collection with qualitative assessment through stakeholder interviews and on-site audits. Independent third-party verification ensures accuracy and credibility of impact claims. Results get compiled into detailed impact reports that inform both internal decision-making and external stakeholder communications.

A standout feature is the framework’s forward-looking component, which models projected impact across different scenarios and time horizons. This helps optimize investment decisions and provides portfolio companies with impact targets linked to value creation milestones.

Significantly, how to mitigate 4 shades of water risk through impact investing, the framework incorporates risk assessment protocols to evaluate potential negative impacts and establish mitigation strategies. This ensures a balanced view that accounts for both opportunities and challenges in water technology deployment.

The measurement system feeds into a broader ESG integration strategy, where impact metrics influence investment committee decisions, portfolio management approaches, and exit planning. Regular review and refinement of the framework ensures it stays aligned with evolving sustainability standards and stakeholder expectations.

Future of Water Investment

As global water challenges intensify, Apax Funds is strategically positioning itself at the intersection of technological innovation and sustainable water solutions. The firm’s forward-looking investment approach focuses on breakthrough technologies that address critical water infrastructure needs while delivering measurable environmental impact.

Advanced data analytics and artificial intelligence emerge as key investment priorities, with potential to revolutionize leak detection, treatment optimization, and predictive maintenance. Apax recognizes that smart water management systems backed by machine learning can reduce operational costs by 20-30% while improving resource efficiency.

Another major focus area is decentralized water treatment technologies that enable water reuse and recovery of valuable resources. These solutions are particularly promising for industrial applications, where water scarcity and discharge regulations drive adoption of closed-loop systems.

The rise of climate resilience as an investment theme shapes Apax’s strategy toward technologies that help utilities and industries adapt to extreme weather events. This includes flood management systems, drought-resistant infrastructure, and technologies for emergency water provision.

Beyond individual technologies, Apax sees tremendous potential in integrated water management platforms that connect various components of the water cycle. By investing in companies developing these comprehensive solutions, the firm aims to accelerate the transition toward more resilient and efficient water systems.

Significantly, Apax’s investment thesis increasingly incorporates nature-based solutions and green infrastructure alongside traditional engineering approaches. This hybrid strategy reflects growing evidence that combining natural and engineered systems often delivers superior results.

Looking ahead, the firm is exploring emerging opportunities in water quality monitoring, micropollutant removal, and resource recovery. These areas align with how impact investing can mitigate different shades of water risk while generating attractive returns.

By maintaining a long-term perspective focused on transformative technologies, Apax continues to shape the future of water infrastructure while delivering both environmental and financial value for stakeholders.

Final words

Apax Funds stands at the forefront of a critical intersection between private equity excellence and water technology innovation. Their strategic approach to investment, combining rigorous financial analysis with meaningful impact metrics, sets a new standard for how capital can drive sustainable water solutions. For entrepreneurs and companies in the water technology space, Apax represents more than just a source of funding – they are a partner in building the future of water resource management. Their track record of successful investments, coupled with their commitment to environmental stewardship, positions them uniquely in the market. As water challenges continue to grow globally, Apax’s approach to investment and value creation will become increasingly relevant. The firm’s ability to identify, nurture, and scale water technology solutions while generating attractive returns demonstrates that profit and purpose can indeed go hand in hand. For those looking to make waves in the water technology sector, Apax Funds offers a compelling partnership opportunity that combines financial acumen with environmental impact.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!