From the historic Ferry Building in San Francisco, Anthropocene Ventures is charting an ambitious course in water technology investment. Under the seasoned leadership of Jim Boettcher, this venture capital firm combines deep climate tech expertise with a laser focus on transformative water solutions. With a $10 million fund and check sizes ranging from $100,000 to $3 million, they’re backing early-stage innovators in coastal resilience, smart water systems, and advanced treatment technologies. Their portfolio reflects a careful balance of technological innovation and environmental impact, making them a key player for entrepreneurs and co-investors alike in the evolving water tech landscape.

Anthropocene Ventures is part of my Ultimate Water Investor Database, check it out!

Investor Name: Anthropocene Ventures

Investor Type: VC

Latest Fund Size: $10 Million

Dry Powder Available: No

Typical Ticket Size: $1M – $3M

Investment Themes: Coastal Resilience & Living Seawalls, Smart/Connected Water Infrastructure, Advanced Water/Waste Treatment

Investment History: $946428.57 spent over 2 deals

Often Invests Along: Closed Loop Partners, Michigan Capital Network, Oxcart Equity Partners

Already Invested In: Accelerated Filtration, Inc.

Leads or Follows: Follow

Board Seat Appetite: High

Key People: Jim Boettcher, Alicia Cha Umphreys, Matt McGraw

The Strategic Vision

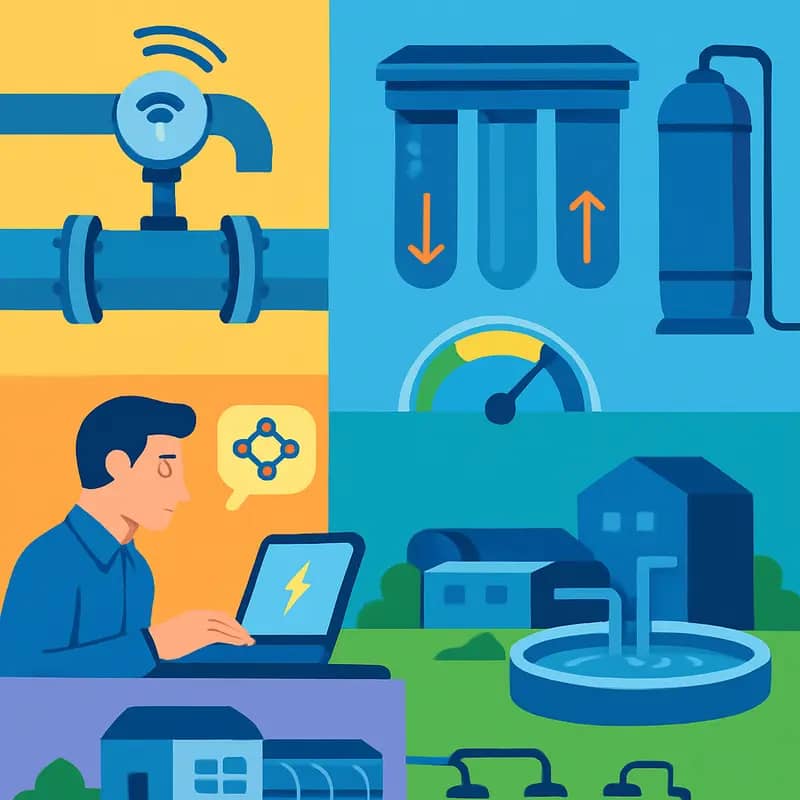

Anthropocene Ventures has carved out a distinct position in the water technology investment landscape by focusing on transformative early-stage innovations that address critical water challenges. At the core of their investment philosophy lies a deep understanding that water sits at the nexus of climate change, population growth, and resource scarcity.

The firm’s strategic vision centers on three key investment themes. First, they target technologies that enhance water infrastructure resilience and efficiency. This includes advanced sensors, predictive analytics, and smart infrastructure solutions that help utilities and industrial operators optimize their operations while reducing water losses and energy consumption.

Second, Anthropocene places significant emphasis on water quality and treatment innovations. They seek out companies developing breakthrough approaches to contaminant removal, particularly emerging compounds like PFAS, microplastics, and pharmaceutical residues. Learn more about how innovative water technologies can mitigate different types of water risks.

Their third focus area encompasses water resource recovery and circular economy solutions. This includes technologies that extract valuable resources from wastewater streams, reduce industrial water consumption through recycling, and enable decentralized treatment systems.

What sets Anthropocene’s approach apart is their emphasis on scalability and commercial viability alongside environmental impact. They specifically target companies at the seed and Series A stages, where their capital and strategic support can accelerate the path to market adoption. The firm maintains a disciplined focus on technologies that demonstrate clear economic benefits while delivering measurable environmental improvements.

Anthropocene’s investment thesis recognizes that successful water technology companies must navigate complex stakeholder ecosystems, including utilities, regulators, and end-users. They favor solutions that can demonstrate rapid payback periods and clear value propositions to multiple stakeholders. This practical approach helps portfolio companies overcome the traditionally long sales cycles and conservative adoption patterns in the water sector.

The firm also places strong emphasis on founding teams that combine deep technical expertise with commercial acumen. They look for entrepreneurs who understand both the scientific fundamentals of their innovations and the business model innovations needed to achieve market penetration. This dual focus on technology and commercialization has become a hallmark of their investment strategy.

Investment Framework & Approach

Anthropocene Ventures employs a systematic yet flexible investment framework centered on identifying transformative water technology solutions. The firm’s investment criteria emphasize three core pillars: technological innovation, market potential, and team capabilities.

When evaluating potential investments, Anthropocene conducts rigorous technical due diligence, focusing on solutions that demonstrate clear competitive advantages and scalability. The firm particularly values technologies that can deliver measurable environmental impact alongside strong financial returns. Portfolio companies must show potential for at least 10x returns while contributing to water conservation, quality improvement, or infrastructure resilience.

Typical deal structures involve initial investments ranging from $500,000 to $3 million in Seed and Series A rounds, with significant capital reserved for follow-on funding. Anthropocene takes a hands-on approach, typically securing board seats or observer rights to actively guide portfolio companies’ strategic development.

The firm’s engagement model goes beyond traditional capital provision. Portfolio companies receive extensive support through Anthropocene’s network of industry experts, potential customers, and strategic partners. This includes assistance with pilot project development, regulatory navigation, and commercial scaling strategies. Learn more about taking mid-market green tech companies to the next level.

Follow-on investment decisions are based on clear milestone achievement and market validation. The firm maintains a structured framework for evaluating follow-on opportunities, considering factors like customer traction, technical validation, and market timing. This systematic approach helps portfolio companies optimize their growth trajectories while managing risk.

Board participation is viewed as a critical component of value creation. Anthropocene’s partners take active board roles, providing strategic guidance on everything from product development to go-to-market strategy. The firm leverages its deep industry expertise to help portfolio companies navigate complex regulatory environments and build sustainable competitive advantages.

The firm’s portfolio management approach emphasizes collaboration and knowledge sharing across companies, creating opportunities for strategic partnerships and shared learning. Regular portfolio reviews ensure alignment with investment theses and enable proactive identification of both challenges and opportunities for value creation.

Portfolio Innovation Spotlight

Anthropocene Ventures has built an impressive portfolio of water technology companies that are revolutionizing how we manage and protect our most precious resource. At the core of their investment thesis lies Kind Designs, whose breakthrough smart water infrastructure solutions exemplify the fund’s commitment to transformative innovation.

Kind Designs has developed an integrated network of sensors and AI-powered analytics that provides unprecedented visibility into water distribution systems. Their technology can detect leaks with 95% accuracy while predicting maintenance needs weeks in advance. This preventive approach has helped utilities reduce water losses by up to 40% and extend infrastructure lifespans by 15-20 years.

Beyond infrastructure monitoring, Anthropocene’s portfolio showcases innovations across the entire water cycle. Their investments include companies pioneering advanced filtration technologies that remove contaminants like PFAS while consuming 80% less energy than conventional methods. Another portfolio company has developed a groundbreaking decentralized wastewater treatment system that enables water reuse at a fraction of traditional costs.

The fund’s approach to portfolio support goes far beyond capital deployment. They take an active role in accelerating commercialization through strategic partnerships, pilot programs, and customer introductions. This hands-on engagement has helped portfolio companies secure major utility contracts and expand into new markets rapidly.

A defining characteristic of Anthropocene’s investment strategy is their focus on solutions that deliver both environmental and financial returns. Portfolio companies must demonstrate clear pathways to profitability while measurably advancing water sustainability goals. This dual mandate has attracted co-investment from major strategic players and helped portfolio companies raise subsequent funding rounds at higher valuations.

Looking ahead, Anthropocene continues to seek out entrepreneurs developing breakthrough technologies in areas like digital water management, resource recovery, and decentralized treatment. Their portfolio serves as a blueprint for how targeted investment in water innovation can generate compelling returns while addressing critical environmental challenges.

Read more about investing in water technology companies and what you need to know

Partnership & Co-Investment Strategy

Anthropocene Ventures has cultivated a sophisticated network of strategic partnerships that amplifies their impact in water technology innovation. Their partnership approach centers on creating value-multiplying relationships between portfolio companies, corporate partners, and co-investors.

At the core of their strategy is the belief that successful water innovation requires ecosystem collaboration. Rather than operating in isolation, they actively seek partnerships with water utilities, industrial end-users, and technology providers who can become early adopters and provide real-world validation for portfolio companies’ solutions.

Their co-investment philosophy emphasizes alignment with partners who bring complementary expertise and resources. By syndicating deals with like-minded investors, they can provide portfolio companies with not just capital, but also strategic guidance, industry connections, and potential customer relationships.

The firm maintains deep relationships with corporate venture arms of major water industry players, viewing them as both potential co-investors and future acquirers. This strategic alignment helps create clear paths to commercialization and exit opportunities for portfolio companies.

A unique aspect of their partnership model is the creation of innovation testbeds through utility partnerships. These arrangements give portfolio companies access to real-world testing environments while providing utilities early access to promising technologies. The firm leverages these partnerships to de-risk investments and accelerate technology adoption.

Beyond traditional venture partnerships, Anthropocene has built relationships with research institutions, accelerators, and industry associations. These connections provide deal flow, technical validation, and market intelligence that inform investment decisions. The firm also participates in water innovation clusters and industry working groups to stay connected to emerging trends and technologies.

Their co-investment strategy is selective, focusing on partners who share their long-term vision for water technology innovation. They typically lead or co-lead early-stage rounds while bringing in strategic co-investors for later stages. This approach helps maintain strong governance rights while leveraging external expertise and capital.

The firm has also pioneered innovative financing structures that align interests across stakeholders. These include milestone-based funding rounds, strategic technology licensing agreements, and creative partnership models that help bridge the gap between early-stage innovation and commercial deployment.

The Investment Philosophy

At the core of Anthropocene Ventures’ strategy lies a profound understanding that water technology represents one of the most critical yet undervalued investment opportunities in climate tech. Their investment philosophy centers on identifying solutions that can transform how we manage, treat, and preserve water resources while generating compelling financial returns.

The firm employs a distinctive three-pillar approach to evaluating potential investments. First, they assess a technology’s potential to create measurable impact in water conservation, quality improvement, or infrastructure efficiency. This impact-first lens ensures portfolio companies address pressing environmental challenges while maintaining commercial viability.

Second, Anthropocene scrutinizes the scalability of solutions across different markets and applications. Learn more about their assessment framework. The ideal investment target demonstrates the ability to solve water challenges in multiple sectors, from municipal infrastructure to industrial processes. This cross-sector applicability helps de-risk investments while maximizing potential returns.

Third, the firm places significant emphasis on team composition and execution capability. They seek founders who combine deep technical expertise with business acumen and a profound understanding of the water sector’s complexities. This human capital focus has proven crucial in navigating the often lengthy sales cycles and regulatory hurdles characteristic of the water industry.

Beyond traditional venture metrics, Anthropocene has developed proprietary frameworks for evaluating water tech opportunities. These include detailed assessments of regulatory tailwinds, water stress indicators in target markets, and potential cost savings for end-users. This methodology helps identify technologies that not only solve critical problems but also present compelling value propositions to customers.

The firm maintains a disciplined approach to deal structure, typically investing in Series A and B rounds where companies have demonstrated product-market fit and initial commercial traction. This stage focus allows them to support scaling efforts while managing technology and market risks effectively.

Unlike generalist investors, Anthropocene leverages its deep sector expertise and extensive network to accelerate portfolio company growth. Their hands-on approach includes facilitating pilot projects, making strategic introductions, and providing operational guidance – particularly valuable in the complex water sector where relationships and industry knowledge significantly impact success rates.

Portfolio Success Stories

Anthropocene Ventures’ portfolio companies exemplify breakthrough innovations addressing critical water challenges while delivering measurable environmental and financial impact. Their successes demonstrate how targeted investment in water technology can drive transformative change.

One standout portfolio company has pioneered an energy-efficient wastewater treatment approach that reduces carbon emissions by 80% compared to conventional methods. By reimagining the traditional activated sludge process through advanced microbial fuel cell technology, they’ve enabled utilities to generate clean energy while treating water. Early pilot programs with municipal partners have validated both the technology’s effectiveness and its compelling economic benefits.

Another portfolio company has revolutionized water quality monitoring through a novel biosensor platform. Their automated system provides continuous, real-time detection of contaminants at parts-per-trillion levels – a 100x improvement over existing solutions. This technology has been deployed across multiple utilities, helping them identify and respond to water quality issues before they impact public health.

Perhaps most notably, an Anthropocene-backed startup has developed a breakthrough approach to removing forever chemicals (PFAS) from water supplies. Their selective extraction technology achieves 99.9% removal while generating no hazardous waste stream – a longstanding challenge in PFAS treatment. The solution has garnered significant commercial traction, with several Fortune 500 companies already implementing it at scale.

Beyond individual technology wins, these companies showcase how strategic investment can accelerate adoption of sustainable solutions. Through Anthropocene’s guidance and network, portfolio companies have been able to rapidly validate their technologies, establish key partnerships, and scale deployment. Many have secured follow-on funding at increased valuations, validating the firm’s thesis around water technology as an attractive investment sector.

Critically, these successes extend beyond financial returns to create meaningful environmental impact. Collectively, Anthropocene’s portfolio companies have helped partners reduce water consumption by billions of gallons annually while preventing millions of pounds of pollutants from entering waterways. They exemplify how solving water challenges can generate both strong returns and positive impact.

These portfolio wins have established important precedents for the broader water technology ecosystem, demonstrating viable paths to commercialization and scale. Their continued growth provides a powerful proof point for other investors and entrepreneurs looking to tackle water-related challenges through technology innovation.

Strategic Partnerships and Network Effects

At the core of Anthropocene Ventures’ success lies an intricate web of strategic partnerships that amplifies its impact across the water technology ecosystem. The firm has cultivated relationships with utilities, corporations, research institutions, and fellow investors to create powerful network effects that benefit its portfolio companies.

This collaborative approach manifests in several key ways. First, Anthropocene maintains close ties with water utilities and industrial water users, providing portfolio companies with real-world testing grounds and early adopter customers. These partnerships help startups validate their technologies in authentic operating environments while generating valuable performance data and customer testimonials.

The firm’s relationships with research institutions and universities serve as pipelines for emerging technologies and technical expertise. These connections enable portfolio companies to tap into cutting-edge research, access specialized testing facilities, and recruit top talent. Learn more about how venture capital can change water for the better.

Perhaps most significantly, Anthropocene has built a collaborative network among its portfolio companies themselves. Regular portfolio summits and facilitated introductions foster knowledge sharing, potential partnerships, and opportunities to bundle complementary technologies. This internal ecosystem creates multiplicative value as companies combine strengths to tackle complex water challenges.

The firm also maintains strategic relationships with later-stage investors and corporate acquirers. These connections help portfolio companies secure follow-on funding and explore potential exits through strategic sales. By actively nurturing these relationships, Anthropocene smooths the path from early-stage innovation to widespread commercial adoption.

Beyond traditional partnership models, Anthropocene takes an active role in industry organizations and policy discussions. This engagement helps shape the broader market environment while providing portfolio companies with enhanced visibility and credibility. The firm’s position at the intersection of multiple stakeholder groups allows it to spot emerging trends and opportunities early.

Ultimately, these layered network effects create a virtuous cycle. Success stories attract more high-quality entrepreneurs and partners, expanding the network’s value. This growing ecosystem strengthens Anthropocene’s ability to identify promising technologies, accelerate their development, and drive adoption at scale.

Future Vision and Investment Opportunities

As global water challenges intensify, Anthropocene Ventures sees unprecedented opportunities emerging at the intersection of climate resilience and water technology innovation. The firm’s forward-looking investment thesis centers on scalable solutions that can transform how we manage, treat, and reuse water resources.

Anthropocene has identified several high-potential areas poised for breakthrough innovation. Direct lithium extraction technologies show particular promise, offering more sustainable methods to obtain this critical battery metal while minimizing water impacts. The firm actively seeks companies developing selective extraction processes that can revolutionize lithium production.

Another key focus is advanced water treatment and reuse. The growing adoption of decentralized treatment systems, particularly in water-stressed regions, creates opportunities for technologies that can efficiently process and recycle water on-site. Anthropocene evaluates solutions combining traditional treatment methods with cutting-edge approaches like biomimicry and electrochemical systems.

The rise of digital water technologies presents another compelling investment avenue. Smart sensors, AI-powered analytics, and robust data platforms are becoming essential for utilities and industrial users seeking to optimize their operations. The firm sees particular value in solutions that can predict maintenance needs, detect leaks, and improve overall system efficiency.

Critically, Anthropocene recognizes that technology alone cannot solve water challenges. The firm actively seeks opportunities that align technological innovation with sustainable business models and clear paths to market adoption. This includes exploring water-as-a-service approaches that can lower barriers to implementation and create recurring revenue streams.

Looking ahead, Anthropocene anticipates increasing convergence between water technology and other climate solutions. Companies working at these intersections – like those combining water treatment with renewable energy or developing water-efficient carbon capture methods – represent particularly exciting investment prospects.

The firm maintains a structured yet flexible approach to evaluating opportunities, prioritizing solutions that can deliver both environmental impact and attractive financial returns. This dual focus on sustainability and scalability positions Anthropocene to capitalize on the growing demand for innovative water solutions while contributing to broader climate resilience goals.

As water stress becomes more acute globally, Anthropocene expects to see accelerated adoption of breakthrough technologies. The firm stands ready to support entrepreneurs developing solutions that can transform how we value and manage water resources in an increasingly resource-constrained world.

Final words

Anthropocene Ventures stands as a distinctive force in water technology investment, masterfully blending deep sector expertise with strategic capital deployment. Their approach to early-stage investment, particularly in water innovation, reflects a sophisticated understanding of both technological potential and market dynamics. With $10 million in committed capital and a clear focus on transformative water solutions, they’re uniquely positioned to drive forward the next generation of water technology companies. Their emphasis on active board participation, strategic co-investment relationships, and focus on specific water themes demonstrates a thoughtful approach to portfolio building. For water entrepreneurs seeking not just capital but strategic partnership, and for co-investors looking to tap into well-vetted water technology opportunities, Anthropocene Ventures represents a compelling partner in the quest to solve global water challenges.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!