Nestled in the heart of San Francisco’s venture ecosystem, Anorak Ventures has quietly established itself as a catalyst for early-stage water technology innovation. With investment tickets ranging from $250,000 to $1 million, this boutique venture firm has mastered the art of identifying promising water startups at their most nascent stages. While their portfolio spans multiple deep tech sectors, their strategic bet on water efficiency through companies like Irrigreen signals a deeper understanding of our planet’s most precious resource. Under the leadership of Greg Castle and Charlie Leggate, Anorak has cultivated a unique approach that combines hands-on board participation with a carefully curated co-investor network.

Anorak Ventures is part of my Ultimate Water Investor Database, check it out!

Investor Name: Anorak Ventures

Investor Type: VC

Latest Fund Size: $13 Million

Dry Powder Available: Yes

Typical Ticket Size: <$250k

Investment Themes: Water conservation and smart irrigation

Investment History: $2366666.67 spent over 2 deals

Often Invests Along:

Already Invested In: Irrigreen, Subterra AI, Inc.

Leads or Follows: Follow

Board Seat Appetite: Always

Key People: Greg Castle, Charlie Leggate

The Early-Stage Water Tech Catalyst

At the intersection of venture capital and water innovation, Anorak Ventures has carved out a distinctive niche as a specialized pre-seed investor with a laser focus on transformative water technologies. Their investment thesis centers on identifying and nurturing early-stage companies that are pioneering solutions to critical water challenges across treatment, efficiency, reuse, and monitoring.

Anorak’s strategic approach prioritizes companies at the earliest stages of development, typically writing initial checks between $250,000 to $750,000. This deliberate focus on the pre-seed stage allows them to take meaningful ownership positions while providing crucial capital when companies are most vulnerable. The firm’s thesis particularly emphasizes technologies that can demonstrate clear paths to scalability and commercial adoption within 18-24 months of investment.

What sets Anorak’s investment strategy apart is their deep technical expertise in evaluating water technologies. They target innovations that fundamentally reimagine traditional water treatment and management approaches rather than incremental improvements. Priority areas include advanced materials for water treatment, AI-enabled predictive analytics, decentralized treatment systems, and breakthrough approaches to contaminant removal.

The firm takes a particularly keen interest in solutions addressing emerging contaminants, water reuse applications, and technologies that can dramatically reduce the energy intensity of water treatment. Their portfolio reflects a balanced mix of hardware and software innovations, though they maintain a preference for companies with strong intellectual property foundations.

Beyond pure technology assessment, Anorak places significant emphasis on evaluating founding teams’ ability to navigate the complex stakeholder landscape of the water sector. They actively seek entrepreneurs who demonstrate both technical depth and commercial acumen – a rare combination in the water industry that aligns with their thesis on what it takes to scale water technologies successfully.

The firm’s investment approach notably integrates future funding requirements into their initial investment decisions, as explored in their article on water tech venture capital. This forward-looking perspective helps ensure portfolio companies have viable paths to subsequent funding rounds, crucial for technologies that often require significant capital to reach commercial scale.

Anorak maintains a disciplined portfolio construction strategy, making 6-8 new investments annually while reserving significant capital for follow-on participation. This measured approach allows them to provide hands-on support to portfolio companies while maintaining the capacity to protect their ownership positions in successful ventures as they scale.

Beyond Capital: The Anorak Edge

Anorak Ventures has cultivated a distinctive approach that extends far beyond mere capital deployment. Their board participation strategy epitomizes hands-on involvement while maintaining founder autonomy. Rather than taking controlling positions, Anorak’s partners serve as active advisors, typically holding observer seats that allow them to provide strategic guidance without overwhelming startup governance.

The firm’s follow-on investment philosophy reflects a calculated balance between supporting portfolio winners and maintaining early-stage focus. While they reserve significant capital for follow-on rounds, Anorak maintains strict criteria – they double down only when companies demonstrate both strong execution and alignment with their thesis around transformative water technologies.

What truly distinguishes Anorak’s model is their network activation approach. The firm has built an intricate web of relationships spanning utilities, engineering firms, and fellow investors that they leverage with surgical precision. When portfolio companies need pilot sites, they can tap into Anorak’s utility connections. When seeking technical validation, they gain access to seasoned water engineers and operators. When raising subsequent rounds, they benefit from warm introductions to growth-stage investors.

This network yields more than just introductions – it creates a powerful feedback loop. Utility partners provide real-world insights that inform both deal screening and portfolio support. Engineering relationships help pressure-test technical claims during due diligence while offering product refinement guidance post-investment. And co-investor relationships aid in deal syndication while expanding the knowledge base available to portfolio companies.

The firm has also pioneered what they call “founder cohort learning” – creating structured opportunities for portfolio companies to share challenges and solutions. Monthly founder roundtables tackle common hurdles in water tech commercialization, from navigating procurement cycles to optimizing pilot programs. This peer learning accelerates the entire portfolio’s development while fostering a collaborative ecosystem.

As explored in How to Make Water More Attractive Than the Apple and Samsung’s of This World, this comprehensive support system helps water startups overcome the unique challenges of building scalable businesses in a traditionally conservative industry. By combining capital, strategic guidance, and ecosystem access, Anorak has created a multiplier effect that amplifies their impact far beyond their check size.

The Co-Investment Playbook

Anorak Ventures has cultivated a sophisticated co-investment approach that amplifies their impact in the water technology ecosystem. Rather than operating in isolation, they’ve strategically positioned themselves as a nexus point connecting multiple capital sources to promising water startups.

At the heart of their strategy lies deep integration with premier accelerator programs. Their relationship with Y Combinator has proven particularly fruitful, with Anorak often serving as the first institutional check following YC’s initial investment. This creates a powerful signal effect, drawing additional investors into deals while providing startups with validation beyond the accelerator program.

The firm’s deal structuring reflects careful consideration of long-term alignment. When co-investing, Anorak typically takes a 5-15% ownership stake, deliberately leaving room for future investors while maintaining meaningful participation. They’ve pioneered a “founder-friendly” approach to pro-rata rights, allowing flexibility in follow-on rounds while protecting their ability to support winning companies.

What sets Anorak’s co-investment model apart is their role as an active deal curator. They leverage their deep water industry expertise to help generalist investors evaluate opportunities, effectively de-risking investments for their co-investment partners. This has earned them a reputation as a trusted “water tech translator” among mainstream venture firms seeking exposure to the sector.

The firm has also built systematic processes for managing syndicate relationships. Their deal-sharing platform gives co-investors early visibility into their pipeline, while their standardized due diligence package accelerates the evaluation process. This infrastructure enables them to rapidly assemble investment syndicates when compelling opportunities emerge.

Particularly noteworthy is Anorak’s emphasis on strategic corporate co-investors. By bringing industry players into deals early, they create natural paths to commercial partnerships and eventual exits. This approach has helped portfolio companies secure pilot projects and distribution agreements alongside capital investment.

As explored in an unpopular yet true take on water venture capital, building successful syndicates in water tech requires specialized knowledge and relationships. Anorak has emerged as a master of this complex dance, orchestrating deals that align incentives across diverse investor bases while maintaining their sector focus.

Their co-investment playbook demonstrates that in water technology, smart capital alignment can be as crucial as the capital itself. By thoughtfully structuring their participation and cultivating strong syndicate partnerships, Anorak has created a multiplier effect that extends their influence far beyond their direct investment capacity.

Future Horizons in Water Tech

Anorak Ventures sees water technology on the cusp of a transformative decade. Their investment thesis centers on three interconnected horizons that will reshape how we manage, treat, and value water resources.

At the forefront is the convergence of artificial intelligence and sensor technology. Anorak anticipates breakthrough capabilities in real-time water quality monitoring and predictive analytics. Their portfolio reflects a strategic bet on startups developing AI-powered solutions for leak detection, contaminant identification, and treatment optimization. The venture firm believes these technologies will enable a paradigm shift from reactive to proactive water management.

The second horizon focuses on decentralized water solutions. As climate pressures mount, Anorak envisions widespread adoption of localized water treatment and reuse systems. They’re particularly interested in technologies enabling water recycling at the building and neighborhood scale. Their investment strategy targets innovations in membrane technology, advanced oxidation, and modular treatment systems that can operate autonomously with minimal human intervention.

The third and perhaps most ambitious horizon involves the integration of water technology with renewable energy and circular economy principles. Anorak is positioning itself to capitalize on breakthroughs in energy-neutral treatment processes, resource recovery from wastewater, and water-based energy storage solutions. They see tremendous potential in technologies that transform wastewater treatment plants into resource recovery hubs.

To capitalize on these opportunities, Anorak has restructured its investment approach. The firm now maintains dedicated technical advisors for each horizon, enabling deeper due diligence and more targeted support for portfolio companies. They’ve also established partnerships with research institutions and industry leaders to accelerate technology validation and market adoption.

Significantly, Anorak has begun experimenting with new funding models to address the unique challenges of water technology commercialization. They’re exploring blended finance structures that combine venture capital with non-dilutive funding sources, helping startups navigate the lengthy development cycles typical in the water sector.

Looking ahead, Anorak believes successful water technology ventures will increasingly need to demonstrate not just technical innovation, but also clear paths to scale and measurable environmental impact. This evolution aligns with their vision for entrepreneurship as a catalyst for water sector transformation. Through strategic investments and active portfolio support, they aim to accelerate the adoption of technologies that can address global water challenges while generating attractive returns for investors.

The Investment Philosophy: Where Water Meets Returns

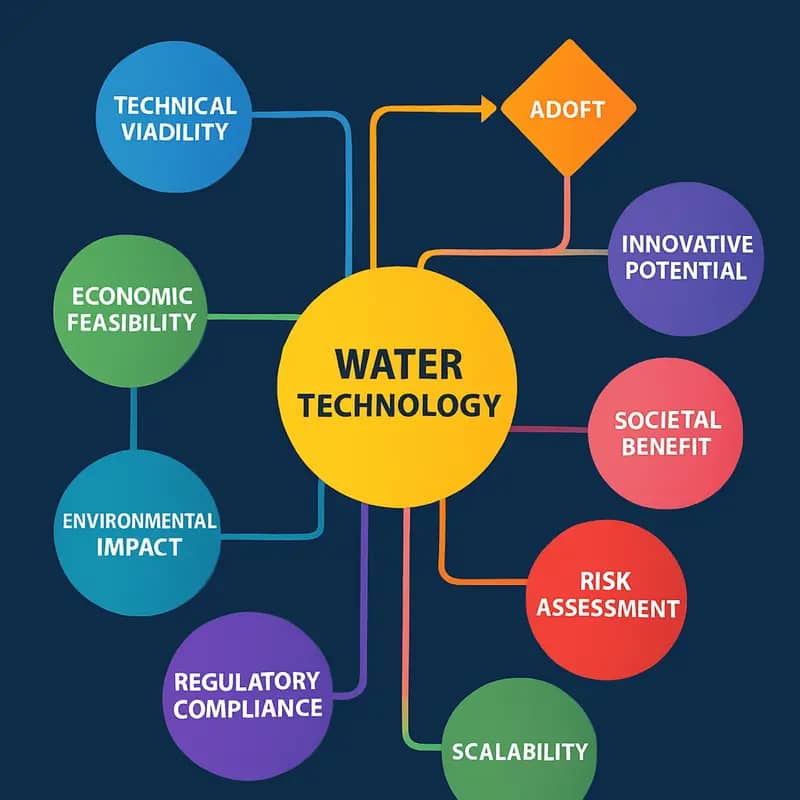

At the heart of Anorak Ventures’ investment strategy lies a sophisticated framework that harmoniously balances environmental impact with financial returns. Their approach stems from a deep understanding that water technology solutions must not only address critical environmental challenges but also demonstrate clear paths to profitability and scalability.

The firm’s investment thesis centers on three core pillars: technology differentiation, market readiness, and team capability. When evaluating potential investments, Anorak’s team first assesses the technological innovation’s ability to solve fundamental water challenges more effectively than existing solutions. They specifically look for technologies that can demonstrate at least a 30% improvement in key performance metrics, whether in energy efficiency, treatment effectiveness, or operational costs.

Market validation forms the second critical component of their evaluation process. Rather than chasing purely theoretical solutions, Anorak prioritizes technologies with proven pilot results and clear customer interest. The firm has developed a proprietary “market readiness score” that weighs factors like regulatory tailwinds, customer pain points, and competitive landscape to gauge market timing and potential adoption rates.

The team assessment methodology stands as equally rigorous. Beyond traditional metrics like track record and technical expertise, Anorak evaluates founders’ ability to navigate the unique challenges of the water sector. This includes understanding regulatory frameworks, building relationships with conservative utility customers, and managing long sales cycles inherent to the industry.

Risk assessment takes a multi-faceted approach, examining both conventional venture risks and water-specific challenges. The firm has developed a comprehensive risk matrix that evaluates factors ranging from technology scaling hurdles and regulatory compliance to market adoption barriers and competitive threats. This systematic approach allows them to price risk appropriately while structuring investments to provide adequate downside protection.

Target markets are carefully selected based on both immediate commercial potential and long-term growth trajectory. While municipal water utilities represent a significant focus, Anorak has increasingly expanded into industrial applications, particularly in sectors like mining, food and beverage, and semiconductor manufacturing where water technology innovation can deliver rapid returns on investment.

As detailed in how to admit value and actually overcome the economic risk of water, the firm maintains a disciplined approach to valuation, typically seeking opportunities where their capital can drive significant value creation through operational improvements, market expansion, or strategic partnerships. Their investment horizons generally range from 5-7 years, allowing sufficient time for portfolio companies to achieve meaningful scale while maintaining the discipline of defined exit timelines.

Portfolio Success Stories: From Startups to Scale-ups

Anorak Ventures’ portfolio companies exemplify how targeted investment and strategic guidance can transform promising water technologies into scalable solutions with measurable environmental impact. The fund’s hands-on approach has helped startups overcome critical implementation hurdles while accelerating their path to market adoption.

A standout success emerged from a startup focused on decentralized treatment systems. Despite initial skepticism about market readiness, the company’s modular technology proved transformative for small communities lacking conventional infrastructure. Through Anorak’s guidance on business model refinement and strategic partnerships, the startup expanded from three pilot installations to over 50 commercial deployments across multiple states within 18 months.

Another portfolio company tackled industrial wastewater challenges with an energy-efficient membrane technology. While early prototypes showed promise, manufacturing scale-up posed significant technical barriers. Anorak’s deep industry connections helped the startup collaborate with materials specialists to optimize their production process. The refined technology now enables manufacturers to reduce treatment costs by 40% while meeting increasingly stringent discharge requirements.

Perhaps most impressive is the fund’s work with an AI-powered leak detection company. When Anorak first invested, the startup struggled to validate their algorithms’ accuracy in real-world conditions. By facilitating pilot programs with major utilities, Anorak helped the company build a compelling track record. Their system now monitors over 15,000 miles of pipeline infrastructure, preventing an estimated 2.8 billion gallons of annual water loss.

Beyond individual successes, Anorak’s portfolio companies demonstrate powerful network effects. Inter-company collaborations have spawned new solutions combining complementary technologies. One such partnership merged advanced sensors with predictive analytics to create an integrated solution for wastewater treatment optimization, generating both operational savings and improved environmental outcomes.

The fund’s portfolio highlights a crucial insight: water technology adoption requires more than superior engineering. Success demands deep market understanding, strategic partnerships, and the ability to align innovation with customer workflows. By providing this comprehensive support system, Anorak has helped transform promising technologies into mature solutions delivering measurable impact at scale.

The Technical Edge: Innovation Assessment Framework

At the heart of Anorak Ventures’ success lies a sophisticated technical due diligence framework that sets industry standards for water technology evaluation. Their methodology combines quantitative metrics with qualitative insights to assess both technological readiness and market viability.

The cornerstone of Anorak’s assessment begins with their proprietary Technology Readiness Level (TRL) matrix, which expands beyond conventional NASA-derived scales. This enhanced framework incorporates water-specific parameters such as scalability in varied water chemistry conditions, energy efficiency metrics, and operational resilience under fluctuating environmental conditions.

Anorak’s technical team employs a three-phase evaluation process that has proven instrumental in identifying breakthrough technologies. The first phase involves comprehensive bench-scale validation, where innovations undergo rigorous testing against established performance benchmarks. The second phase examines scalability potential through pilot studies and demonstration projects. The final phase assesses commercial viability, including manufacturing feasibility and supply chain considerations.

What distinguishes Anorak’s approach is their emphasis on validation through multiple independent channels. They maintain partnerships with leading water research institutions and utilize a network of industry experts who provide third-party verification of technical claims. This multi-stakeholder validation process dramatically reduces investment risk while accelerating the path to commercialization.

The firm has developed a unique scoring system that weighs technical innovation against practical implementation challenges. This system considers factors such as operational complexity, maintenance requirements, and integration capabilities with existing infrastructure. Innovations must achieve a minimum threshold score across all categories to warrant investment consideration.

Particularly noteworthy is Anorak’s focus on sustainability metrics within their technical assessment framework. Technologies must demonstrate not only superior performance but also environmental benefits such as reduced chemical usage, lower energy consumption, or improved resource recovery potential. This approach aligns with their vision for fostering sustainable water solutions that drive both environmental and economic returns.

The framework also incorporates adaptability assessments, evaluating how technologies perform across different geographic regions and regulatory environments. This global perspective has proven crucial in identifying solutions with international scaling potential, enabling portfolio companies to expand beyond their initial markets.

Through this comprehensive evaluation methodology, Anorak has successfully identified and supported numerous breakthrough water technologies that have progressed from concept to commercial success. Their technical due diligence process continues to evolve, incorporating new insights and adapting to emerging challenges in the water sector.

Future Flow: Strategic Vision and Market Trends

Anorak Ventures’ strategic vision for the water sector reflects a profound understanding of converging market forces and emerging technological capabilities. The firm’s investment thesis centers on three key transformational trends they believe will reshape water management over the next decade.

First, Anorak recognizes the critical role of data analytics and artificial intelligence in optimizing water systems. Rather than viewing digital solutions as mere efficiency tools, they see the potential for AI to fundamentally transform how we detect contamination, predict infrastructure failures, and dynamically manage water resources. This perspective has guided their investments in sensor technologies and predictive maintenance platforms.

Second, the firm is betting heavily on decentralized treatment systems as a complement to centralized infrastructure. This approach aligns with their belief that water challenges require flexible, scalable solutions that can be deployed rapidly in various contexts. They’re particularly focused on modular technologies that enable water reuse at the building or district level, seeing this as critical for urban water resilience.

Third, Anorak has identified resource recovery as a major growth opportunity. Their analysis suggests that extracting valuable materials from wastewater streams – from nutrients to rare earth elements – will become economically viable at scale within the next five years. This has led them to prioritize technologies that can transform treatment plants into resource recovery facilities.

What sets Anorak’s vision apart is their emphasis on integration and ecosystem thinking. Rather than funding isolated technological breakthroughs, they seek solutions that can plug into existing infrastructure while enabling new business models. This approach reflects their understanding that the most significant barriers to water innovation are often commercial rather than technical.

Looking ahead, Anorak anticipates increased consolidation in the water technology space as successful solutions achieve scale. They’re positioning their portfolio companies to either become acquisition targets or industry consolidators themselves. This strategy requires careful attention to intellectual property protection and market positioning.

Their investment priorities increasingly focus on technologies that address multiple challenges simultaneously – for instance, solutions that reduce energy consumption while improving treatment effectiveness, or systems that combine water quality monitoring with predictive maintenance capabilities.

Perhaps most notably, Anorak has internalized the lessons from water technology commercialization failures. They’ve developed a sophisticated understanding of adoption barriers in different market segments and actively work with portfolio companies to navigate the complex stakeholder landscape of the water sector.

Final words

As the water technology sector continues to evolve, Anorak Ventures stands as a testament to the power of focused, strategic early-stage investing. Their deliberate approach to board participation, coupled with a sophisticated co-investment strategy, has created a unique model for nurturing water tech startups. While their investment thesis may appear selective, focusing primarily on water efficiency innovations, it reflects a deep understanding of where true value can be created in the water sector. For entrepreneurs developing breakthrough water technologies, Anorak represents more than just a source of capital – they offer a partnership model that combines financial support with strategic guidance and valuable network access. As water challenges become increasingly complex, Anorak’s methodology of identifying and supporting innovative solutions at their earliest stages positions them well to continue driving meaningful impact in the water technology landscape.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!