with 🎙️ Alexander Loucopoulos, Partner at both Sciens Capital Management and Sciens Water

💧 Sciens Water is a research-driven investment fund that identifies uncovered, under-researched, or misunderstood opportunities in the water sector that are hence undercapitalized.

This episode is part of my series on Water Finance. Check it out! 😀

What we covered:

🌱 How Water – maybe against the odds – is a very big growth market!

🍎 As teased in the title: the 3 main challenges US water companies face today

🍏 How Sciens Water leverages institutional capital from many investors worldwide to trigger an impact on the Water Industry

🍏 How public awareness shall generate a change in the approach to Water in the future

🌱 How hypergrowth is possible in the Water Industry, yet not in a Twitter or Uber fashion

🧮 How bottled water may well overtake utility water in the residential segment; it doesn’t necessarily matter when you put it in perspective with the much larger industrial and agriculture pieces of the puzzle

🍏 How water doesn’t work in isolation: just look beyond the silo

🍎 How the Water space very much resembles an orchestra, currently producing a cacophonous noise.

🍏 The distributed benefits of Water, Water as an investment good, Financial and Societal benefits not being mutually exclusive… and much more!

🔥 … and of course, we concluded with the 𝙧𝙖𝙥𝙞𝙙 𝙛𝙞𝙧𝙚 𝙦𝙪𝙚𝙨𝙩𝙞𝙤𝙣𝙨 🔥

Teaser: US Water Sector

Resources:

➡️ Send your warm regards to Alex on LinkedIn

🔗 Check Sciens Water’s website

🔗 Visit Sciens Capital Management’s website

is on Linkedin ➡️

Infographic: US Water Sector

Alex-Loucopoulos-Sciens-Water-InfographicTable of contents

- What we covered:

- Teaser: US Water Sector

- Resources:

- Infographic: US Water Sector

- Full Transcript:

- Alex’s postcard: New York

- Introducing: Alexander Loucopoulos

- The 3 major challenges, the US Water Market shall overcome

- Why is it problematic to have so many utilities in the US?

- Is the US Water Market up for consolidation?

- How Sciens Water triggers Market Consolidation

- Adressing the recurring lack of water

- Is Hypergrowth possible in the US Water Market?

- How to address the US Water Market challenge #3: aging infrastructure?

- Residential vs Industrial & Agriculture

- The impact of impact investing

- Is Water a Finance Good like any other?

- How the Water Market could get inspiration from outside its silo

- Rapid fire questions:

- Conclusion: US Water Sector

- Other Episodes:

Full Transcript:

These are computer-generated, so expect some typos 🙂

Antoine Walter: Hi, Alex, welcome to the show.

Alex Loucopoulos: Great. Thank you for having me Antoine.

Antoine Walter: We have a packed agenda for today, but traditions, I have to open with a postcard and actually a fancy postcard because you’re sending us a postcard from New York. So can you tell me something I would ignore about New York.

Alex Loucopoulos: Lots to talk about in New York.

Alex’s postcard: New York

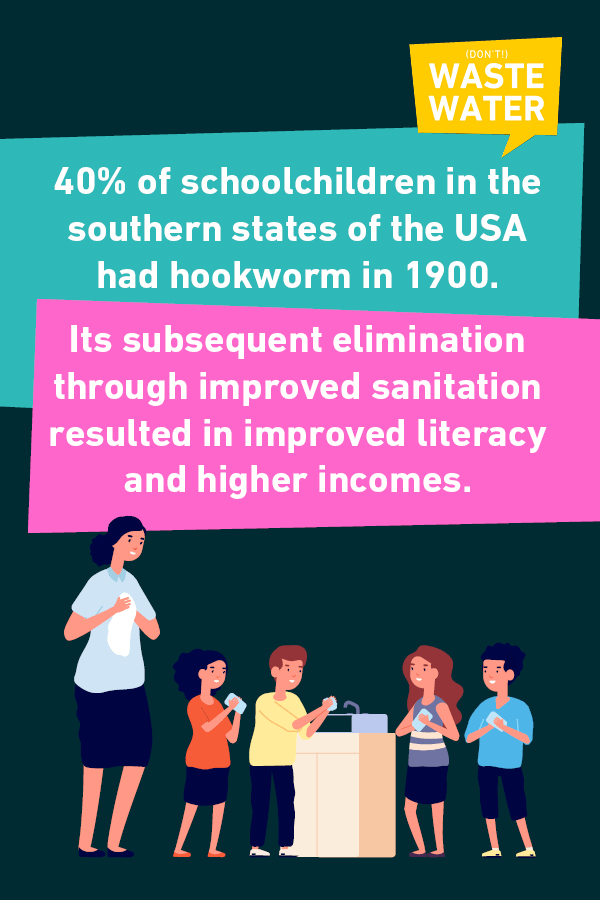

But the one thing I think that also is interesting, that I didn’t know about a lot of people who have heard about the Broadway show Hamilton and how Hamilton originally came from New York. I think what a lot of people don’t know is that his nemesis who eventually ended up killing him, Aaron Burr was actually one of the first people that helped start the first wastewater treatment plant in the U S, which happened to be in New York.

And so being in the New Yorker for the last several decades, And being somebody in water. I always think it’s fascinating when people equate the first large metropolitan us wastewater treatment plant with Hamilton and Aaron Burr and the long history that’s brought to New York. And the one other point that I’d like to say about that is that it was funded by Hamilton to iron bird to start in New York.

And instead of building a world-class wastewater treatment plant Ehrenberg. Funding his own projects, which ended up being the chase Manhattan bank, which now we know is one of the largest global companies in the world, which again, I think also speaks to a lot. Yeah. The changes in a lot of the large companies that have come out of water.

I think a lot of things are known about New York. Not so much is known about the wastewater treatment in New York and Ehrenberg, but hopefully we can try to connect some of those dots

Introducing: Alexander Loucopoulos

Antoine Walter: today. We’re talking of banking, talking of finance and of the connection to water that reminds me a bit of your path somehow.

And you’ve. Starting in finance. If I get that right. Can you get us through your steps from that very start of your career, up to the point where you are today, at Sciens water?

Alex Loucopoulos: Sure. Thank you for asking that. So the path for me and water has not been one straight line. I’ve done many things in my career over the last 25 years.

I think the main thread that I started my career with now, focusing a lot on water is doing something that’s impactful to the world. And doing it with something that, that I had some knowledge with. So the first part of my career was really dedicated to finance and entrepreneurship building startup technology companies doing investment banking and finance took some paths along the way to, to follow some of my passions, including the Olympics, including the aviation sector.

And for the last about 15 years have been focusing on specifically finance and identifying opportunities in the world of finance. Where we can build sustainable returns. And more specifically for the last seven have been just focusing on water and water, where they came. As we were looking at identifying where capital needs to go, where there would be massive amounts of impact and where somebody from with my background and the background of Sciens, which is building businesses, investing institutional capital.

Sciens Water – a Sciens Capital Spin-Off to target the US Water Sector

Would have a big role to play. And we started looking at water because I think everyone can acknowledge that the trends are massive and the need is massive from an impact perspective. I think what enticed us and what led us to really focus on water was the opportunity set really needed people to understand the different parts of it and put those pieces together.

Sort of like a puzzle. What led me to be extremely excited about it is that, you know, I like to put different puzzles together. And water representing one of those big puzzles given my skillset and finance and entrepreneurship, and also driven by the need personal need and the companies need to do something that was impactful.

So it sort of all came together with the launch of science water a few years ago, and frankly has been extremely exciting and something that I hope to do for the next, you know, 20 plus years. As I write out the rest of my career, but it certainly wasn’t a straight path. And certainly wasn’t a path that I would have anticipated 25 years ago.

But looking back on it actually kind of makes sense

The US Water Market as a Growth Market

Antoine Walter: regarding that specific Barch with Sciens Water. It’s interesting to see that you spinned off from Sciens. So you spinned off from a finance body. And usually, I mean, I hadn’t met, he gets on that microphone telling me how difficult it was to get the finance word’s involvement in water.

And you went that same route, but from the other end, I mean, starting in finance and feeling that something was happening in water. Can you tell me a bit more about that specific tipping point where you said, okay. Sciens in general. Can be doing something in water, but let’s be more specific and let’s spin off into Sciens Water

Alex Loucopoulos:Yeah. So Sciens it’s a global institutional asset management. We’ve invested in many different types of asset classes, including private equity, venture capital growth equity. For the last about 15 years, we started focusing on real assets, which is taking something that’s sort of a hard asset, which is, you know, could be real estate, could be a physical infrastructure, things of that nature and deploying capital to it.

So we did that successfully in multiple asset classes, but when we were looking to focus on just one asset, We wanted to find something that was a very big growth market, where we could find ourselves really driving away and water. As you pointed out there, hasn’t been a lot of interest from the finance field into water, because it happens to be so confusing and difficult to understand that not a lot of people have.

… but also a special beast

You know, the years, I think you need to really understand and appreciate the complexities and see through that to be able to put together the puzzle. So I think in terms of the evolution of Sciens, it’s logical in the fact that we started kind of broadly doing finance, private equity, and then real assets.

And then now specifically just one asset class, which is water, which kind of put all those pieces together and. It’s extremely exciting to approach water from the finance field because frankly, I don’t think enough attention has been spent on it. And hopefully it will. Because as you know, the movement of capital is essential to a lot of things.

The 3 major challenges, the US Water Market shall overcome

Antoine Walter: Well, I think we will come back to that capital aspect, but right before going into that, I mean, when I was preparing for a discussion. Reading your website and your website states that you want to identify the biggest challenges which are faced by the us water and wastewater industry. And it was wondering out of the many challenges out there.

What is the biggest challenge you identified?

Alex Loucopoulos: Great question. I think I’ll start with. Water. I like to say is literally everywhere, but nowhere. Because it is so confusing. We can sit here and talk about water and you’ve talked about it on our program. And many, I, you know, it’s part of texts, you know, textiles, it’s part of industry, it’s part of health.

It’s part of everything that, so the main problem. We want it to just begin and try to solve one of the main big problems, right? Because I think that’s one of the main issues with water is that because it is too complicated, it kind of gets lost out there in terms of people trying to make sense of it.

So I think the key is focus and that took us a long time to even begin to understand that. And then we said, okay, let’s just start with one of, or a couple of the main problems of water. And as we sat here in New York, and as we sat here, you know, in the United States, We started pinpointing a few of the large problems right now, as you pointed out, there are many problems.

US Water Market Challenge #1: Too Many Utilities

If I was sitting in Africa, if I were sitting in France, if I was sitting in wherever the problems are different than they are in New York as they are in the United States. So we said, let’s just focused on the U S and let’s focus on what we see as some of the main problems, and then work our way down in terms of actually trying to solve them.

Because otherwise, literally your head will go spinning around and around thinking of all the problems with water, frankly, I don’t know any problem that doesn’t involve water, you know, a bit of an exaggeration but also kind of too. So we said let’s just be specific and focused. And the first issue we found was.

They’re just way too many systems of water and wastewater utilities in the United States. Every time I still say the fact that there’s 60, 70,000 systems in the U S people, even in the industry don’t believe me. Because as you know, in France, there’s a couple of dozen, right? So in the U S I think that’s problem.

US Water Market Challenge #2: Not enough Water Reuse

Number one that we set out to solve problem. Number two. Is recycle, reuse, again, I think people also don’t realize in the U S because it is so such a big market that, you know, we recycle and reuse such a small percentage of our water. And yet every headline, every three days in August and September and October is of the lack of water on the west coast of the United States.

US Water Market Challenge #3: Aging Infrastructure

So we said, problem, number two, problem. Number three. Was, you know, just a deep infrastructure problem is the fact that the infrastructure in the U S is really old Europe’s is even older, but has tackled it in a very, more different way because they’ve had to face the same issues the United States faced, you know, earlier, but people, I think oftentimes headline that number and see the pipes breaking, and then they forget about it.

But I think what’s largely been ignored is how bad that is. And. How bad, you know, the airport is, you know, everyone lands in the Guardia lands and JFK it’s awful, or the bridges are bad. It’s the real infrastructure, which is the part that you can’t see that sometimes you can’t even smell, which, which is largely related to the underground systems and the water systems that people just don’t.

Don’t see. So again, to summarize, we started with specific big problems in our area of expertise right now, which is the United. And started working our way down, but again, you know, I think the list can go on and on, and hopefully we’ll solve a lot more than three problems, you know, start to solve a lot more than just those three problems over the next 20 years.

I think the key is to just start somewhere and to start something that’s action.

Why is it problematic to have so many utilities in the US?

Antoine Walter: The first perimeter list here is that too many players. I mean too many different players. And I remember that number of this 50,000 something, which was given on that microphone by Elongo Thevar and he was mentioning that he found that number in a book from Seth Siegel.

And I think you’re working with Seth Siegel within Sciens Water. So I think there’s a logical. Link here between all those different parts. But once we’ve said that there are 50,000 utilities and it’s probably far too much, and I’ve heard that from people telling me they’re far too many utilities in France as well in Germany, the only exception probably being the UK.

12 players, but how much of a problem is it that there are too many? Is that the real problem is it’s just a symptom of the problem?

Alex Loucopoulos: No, that’s, I mean, in the U S the statistics that you keep hearing about you’re about 50,000 water utilities, and then about 20 plus thousand wastewater utilities. That’s the number.

I frankly think it’s probably even higher. And what makes the U S so unique is the way that the infrastructure group. You know, 60, 70 years ago, right? It’s a vast land. It’s very much not as centralized as Europe, didn’t develop in a centralized, smaller geographical footprint area with a much more pro private sector growth.

A by-product of the Endemic American Growth

The real estate developers would just go to a new city, 30, 40, 50, 60 years ago and just grow and they would grow and it would be like weeds. So the by-product of that 67 years later is that you have. Big Metro areas, right? But then you have suburbs or areas that have kind of grown in all these decentralized private wastewater and water systems.

And so the problem is very real. The reality is that many of those systems are in the middle part of the United States, which, you know, doesn’t get the amount of air time and the amount of recognition that somebody does from New York, from San Francisco. And it also doesn’t have the capital or the political federal.

Which is where a lot of that comes from in the United States to be able to fix those systems. The second problem is that a lot of these systems are actually completely private. You know, there’s thousands of these smaller systems that are actually completely private, which is, I think very different from the rest of, you know, the rest of the world in Europe.

Because in Europe, there may be a lot of systems, but I don’t think they’re private in the U S you have these 70,000 plus or minus systems and people talk about one other statistics that I’m sure you’ve heard about. 85% of the population is serviced by municipally run systems. But on the flip side, it’s not 85% of the 70,000 systems are not public.

A scale issue in the US Water Market

It’s actually the inverse, most of the systems are actually small and private, which is leads to even more confusion even more issues and an area that we identified that needs to consolidate. Unless that’s kind of like the base, just the baseline of what you need for good water, you know, in a wastewater system is good utilities.

And if they happen to be private, we felt that as private investors, we could make the biggest difference on that.

Is the US Water Market up for consolidation?

Antoine Walter: So you were saying that they are very distributed on the curve, which means that there are many, many small one share privates. And you’re saying that a us science water, you’re not necessarily acting on the real large one, which are public, but you, you have something to do on that lower end of the market, but can you define that?

Something, what would you actually do? Just support those smaller size and to maybe to consolidate them and just to, was to send some buzzwords at you just to see if that’s where you head. Yeah. So

Alex Loucopoulos: that’s one of our platforms is that, which is consolidating these small private systems that need upgrading.

So we go and we have a company called central state’s water resources, which is probably one of the fastest growing privately owned water utilities that operates in eight states. And he goes in and buys these smaller systems that are, some of them are very much out of compliance, fixes them, rewrites them and gives people, you know, better cleaner water.

And these are systems that would largely either continue to be out of compliance. The government can’t really handle them, and we’re doing it in a very efficient, more centralized manner. And so that obviously, as you can imagine, you know, you can build upon that, but we view that and that’s been our first investment from a couple of years ago to really understand, you know, the backdrop of us water, because I think a lot of people and you’ve talked about this and you’ve had, you know, guests from the super large water companies, but we approached it from the exact opposite side, which is from the grassroots.

How the US Water Market could evolve from decentralized to distributed

As opposed to let’s approach problems with, you know, a billion dollar, you know, names and billion dollar solutions. We think that a lot of, you know, a lot of it from water has to come from the grassroots and work its way up because that’s fundamentally how we viewed our ability to create value for everybody.

And we viewed that as the biggest, you know, kind of hole, if you will, in the market.

Antoine Walter: So would it be right for me to summarize that into saying that you’re transferring from de-centralized to distributed? So that was organically grown a bit everywhere and you’re saying, okay, the assets are there. Let’s keep the asset where they are.

Act on them with a more centralized matter. So having this true path, I mean, sometimes people link that between the decentralized nature of the assets themselves, and then having a more digital approach to them saying, you can be running those from remote, but in a central manner, which gives you this scale effect.

Is that a right translation now in my own words, but what you’re explaining.

Building Scale in the US Water Market

Alex Loucopoulos: The fact of the matter is it’s very, decentral last market, right? Taking the utilities as an example, but we can talk about treatment. We can talk about other aspects of it. So you need to take that decentralized and create something that’s scalable and distributed, if you will.

Whether you call that distributed in terms of. Operations, because you’re distributing it over a larger piece. If you’re talking about it in terms of technology, if you’re talking about it in terms of evolution, in terms of you using products and spreading them over a larger area, I think that’s absolutely right.

And that’s kind of phase two and that’s even more value accretive, right? But I don’t think certainly in the US you can ignore the decentralized aspect of it, because it’s always going to be there. You just need to figure out the right way of creating more of a, what you used distributed type of approach, or what I’m talking about is scalable.

You need to get to some sort of scale, which becomes even more efficient for everybody. In what we’re trying to do, we’re trying to do that in certain sectors, using private capital, private innovation, private technology, and continue to create more value in it.

How Sciens Water triggers Market Consolidation

Antoine Walter: So when you mentioned the private utility, your building, which is now active in eight states, if I recall right.

Do you act a science watch, right? There is it’s 100% you that own that company. Are you an investor in that company? Or rather seeding that company? Are you a startup studio coming with the idea of the company and someone who builds it? What is your path there?

Alex Loucopoulos: We are. We’re private equity investor, right? We manage institutional capital for many investors worldwide.

So we take that money and invest it. And that was our first company, central states water resources, where we own the company and we drive the strategy and we work with them to help scale it. And that business started with a couple of utilities. Now it’s got, you know, a couple of hundred utilities, hopefully a lot more, but it’s really, we’re private equity investors.

So the way that’s viewed is we’re controlling and building a budget.

Adressing the recurring lack of water

Antoine Walter: Very clear. So that covers the first problem you identify these two menu utilities. If we go to the second one, which has the lack of water, where do you see the most pressing issues with the lack of water and how can you act on those?

So,

Alex Loucopoulos: yeah, that’s a bit broader, right? Because you’re talking about treatment. So there, I would put it into two categories. One is a mismatch between supply demand or put it simply the need for the U S to recycle more water. So what is that? That means treating it better because as we’ve seen, you know, in other parts of the world, you know, you can reuse so much more of the water than in the U S so we approach that with identifying parts of treatment that exhibited an ability to do that really well and ability to focus in areas where the big there’s the biggest need for that.

And to solve it using construction in technology. So there we invested in a business called integrated water services, which essentially construct engineers constructs and builds and manufacturers, MBRs, which as, you know, create the highest quality, one of the highest quality effluent one. And can we increase recycle, reuse.

Developing Reuse with a Technology Company

So we viewed that as our first foray into helping spur more recycle reuse. And the second point is we didn’t do that in terms of let’s increase, recycle, reuse for the big Metro areas we decided to, and what the, this company focuses on is the more decentralized part of the market, which is less than 250,000 gallons a day.

Again, it started with a big theme recycle, reuse. It went into a specific part of that theme, which in our case, in this specific case is the growth of MBRs in decentralized treatment, in a specific region in the us. Because again, I think the other point that people don’t do as much in water. I hate to generalize, right?

Because what, I just talked to you about the utilities, it does not apply to the UK, as you said, does not apply to France. It applies to the U S and within the U S it applies to certain states within the U S so our approach was very similar in what I just described with treatment. It applies if I wanted to build MBRs in long island city right here.

That doesn’t make any sense, but when you’re talking about areas that have a lack of supply that need more recycle, reuse that need that higher effluent quality water, then yeah, sure. De-centralize MBRs would work. So again, it’s not a one size fits all. You gotta be in pinpoint your specific parts of the market you’re going after and water.

And again, we approached this very much from a grassroots perspective, as opposed to. Yeah, I want to solve all the recycle reuse. So I’m gonna, you know, increase the recycling Manhattan from 12.5% to 15%. We will leave that problem for others.

Reuse as a Local Solution to Water Scarcity

Antoine Walter: I’ve seen you in interviews saying that in the us, there’s 10% of the water, which is recycled.

Do I recall that, right?

Alex Loucopoulos: It’s somewhere in that low

Antoine Walter: teens, I’ve been discussing on that microphone, for instance, with Ravid levy, about how Israel recycles its water. In of course in Israel, you’re such an, a level of water scarcity that you’re reusing close to 90% and on the other end or the lower end of the scope, I’m sitting in French right now.

And I think the number in France is 0.6%, which is recycled just because it’s hard to build the equilibrium and the economic rational for reuse. If you have sufficient water available where I’m trying to head here is on the principle. I mean, reusing the podcast is called don’t waste water. So it’s very close to my heart.

But how do you build the economic rational to reuse? How do you convince people that beyond the increased cost of treatment, there is a balance between benefits and costs. I see how it applies in Florida, in California or in Texas. And it’s probably more difficult to build in Illinois or the state of Washington, just from a very foreign perspective.

Water Reuse, a specific challenge for Southern US States

Alex Loucopoulos: No, that, that’s a great question. And so the way we approach it is we’re going to ask. Like you pointed out, you know, places like California, places like Texas, that exhibit strong macro trends where they need to recycle their water even more because of lack of supply or where the regulations are changing, where you, whether you recycle or not, you need to produce higher quality effluent.

So that’s the trigger for us today. But eventually I think as people are getting more conscious, Which I think they are, right? Because there’s a lot of water groups out there and get her saying, we need to take that responsibility ourselves. I think people more and more are recognizing it, but until they, it becomes much more widespread and people realize, you know, that water needs to be recycled.

We need to take care of it better. Whether you have an abundance of it or not. There is a cost that keeps going up. I think until that happens, we’re focusing on the areas. Absolutely needed where it’s necessary and where the need is there. And so we’re not relying on, you know, everyone’s mind shift to change over the next two years.

… that shall be supported by regulations

We’re relying on baseload fundamentals and in certain cases, local regulations that are spurring it with the fact that there was this massive kind of global. Let’s call it Tsunami the saying, Hey, I’m going to wake up and be, be more conscious of this. You have young kids. I have young kids. I mean, you know, th they get it right.

That nobody was telling me at the age of five, stop doing this, do this be more friendly to them. I mean, but now you see that. And so, I think that’s going to happen and that’s going to be even bigger tailwind to the whole industry, but we’re not. Building our investment thesis on that changing dramatically, which is why we’re focusing on certain specific areas where the macro trends are there even

Is Hypergrowth possible in the US Water Market?

Antoine Walter: now talking of investment thesis.

I mean, it’s probably the question I’ve asked the most on that microphone, which is hypergrowth possible. In the water industry. I’ll give it a twist here because you’re addressing the part of that market, which is clearly a growth path, which is reuse. I think, to recall another statistic that David Lloyd Owen was sharing in his book in his global water funding book.

It’s that 9% of the world’s water shall be covered with reuse. 2050. And we are very far from the number right now, which means four times more water shall come from reuse than from desalination, which is much higher today. So you are on a, on the trends, but a trend, which is capital-intensive. The barrier to entry is quite high.

If you’re building MBRs, I mean, you have to really invest quite a lot at the entry. So that is somehow the perfect path for hyper-growth here. You could just win the market by. Investing a lot upfront. Is that your investment thesis or what is your take here?

Alex Loucopoulos: That’s a brokerage firm and I’ve heard you ask that question many times and believe me, I think about it.

Yes, but not in the shape you expect

So the answer is yes, I do think hyper-growth is possible. But let let’s define that. So hypergrowth. Yeah. You know, 20 to 50% growth. I think oftentimes people think growth is an Uber, a Twitter, you know, on Facebook and just massive, you know, unicorns. That’s not going to happen at water. Water is such a local market, but to have growth that is well above market 20 to 50%.

Absolutely. If you find the right sector, And you do it, whether it’s on the infrastructure side, like, you know, the two businesses that I pointed out, I would say, you know, our utility business is growing exponentially, which would be defined as hypergrowth in the water market, the MBR business and the demand and the need and the construction in certain parts of the market are undergoing that 20 to 50%, if not more growth.

But I think, and I want to define this because I think about this question. There isn’t going to be one technology that is going to be used across the board, in every water utility in the United States that it’s going to cause you know, multi-billion dollar water technologies, right? That’s not. In my view going to happen.

The US Water Market is growing, but won’t grow unicorns

But if you start putting the right pieces together, you can see pockets of water that are exhibiting that, that strong growth rate. And I’m hopeful that you will begin to see those case studies in the next few years. And those case studies will fuel more business cases to keep at it. From where I sit, there is no lack of opportunity to solve all these problems.

And when there are big problems to solve with smart innovation capital and the right framing, you will have that. Hopefully we’ll be part of that to some extent, but there will hopefully be a lot more people that do that. And more case studies because it’s a self-fulfilling prophecy. So. Generally, you know, incredibly optimistic about it, but at the same time, I’m not delusional to think that you’re going to have a billion dollar, you know, technology company coming out in the next two years in the water space.

That’s going to be applied universally. With that type, but I don’t think that’s how you would define hyper-growth and that’s certainly not how I would define hypergrowth.

How to address the US Water Market challenge #3: aging infrastructure?

Antoine Walter: So, so far we’ve covered two of your three main risks and the two, which to me make quite obvious sense number to explain it. So the first one was this utilities and they’re, if you’re an investor, you can trigger it.

A consolidation of the market. So that makes absolutely sense to me. The second was this increased reuse. And then of course, if you’re an investor and you can really push forward in that MBRs sphere are similar-ish technologies. That’s clearly the go-to for reuse that again makes a lot of sense. The third one you mentioned was all the infrastructure and that’s, to me gets a bit more tricky because I fully agree with you.

I mean, when I prepare it, that interview. Recalling again, the numbers which you find on the market, you find the EPA studies, which show you that the number of drinking water pipes in the U S which were classified as very poor in the eighties, compared to today, that number was multiplied by 10.

And if we look at the one, which were excellent on the same timeline, they were divided by two. So just clearly there is an infrastructure problem in the U S so. I heard you in interviews talking about that. And I read a lot of stuff, which support. That’s absolutely fine with me. The points where I have a disconnect is what can you, as Sciens water do on that infrastructure level to move the needle?

Like the Hummingbird: from the Grassroots, doing your part

Alex Loucopoulos: Yeah. So the way we look at the infrastructure piece is above ground below ground, right? Again, I think you can’t generalize. One investment that we’ve made an infrastructure is we bought a business that makes pre-stressed concrete tanks, which have been, you know, best for storing water, the way they’re built the efficiency.

And that is building upon an existing business. That is trying to be more innovative, trying to come up with more service type of solutions that make it more efficient later on. So the cost of the infrastructure and the cost of the infrastructure upgrade ends up becoming less later on. So that’s, that’s one example of how we attack that because it’s very unique to that particular part of infrastructure.

The second piece that I’ve spent a lot of time and talking about is pipe rehab, right? We all know there’s a million and a half million miles of pipe in the us. They’re all old. Some of them are from 200 years ago in Europe, you have the same issue. So there are certain amounts of technologies that can help rehab that.

So we’ve been looking at that space for a long time, but the way we approach infrastructure is identifying what parts of that you can put. An upgrade in a more efficient way utilizing the technologies of today. So I’m not saying, you know, we’re going to invest in a new type of CIP technology or a new type of lining.

Aging Infrastructure needs simple concrete steps

It’s really that middle part, which is taking that technology and commercializing it in a scalable infrastructure way to be able to benefit both the end consumer the business. And the technologist, I think it’s combining that value chain, if you will, that I think is what’s going to. Infrastructure in water to improve.

And again, I don’t think it’s going to come from the super large billion dollar businesses, I think. And this is just the U S again, it’s going to come from the grassroots. It’s going to come from helping, you know, pre-stressed concrete tank is not a multi-billion dollar market, but it’s a fairly big market, right?

It’s a critical part of the market. You know, pipe rehab, you can spend time. You know, refurbishing a eight foot pipe, or you could start with the laterals, which is a smaller, more fragmented piece that’s left for the plumber. So we’re always trying to figure out how to do that from a grassroots perspective, because not every infrastructure project, not everything infrastructure is a bridge, a multi-billion dollar project.

And I think that’s also. Seven that’s even more relevant in water is that infrastructure could be small and can start small and can start grassroots. It doesn’t have to be something massive and or something that the government controls and runs,

Residential vs Industrial & Agriculture

Antoine Walter: but to do that specific thing of infrastructure and aging infrastructure.

If I now take a very, I try from my European premises to take a very north American view on that question. In Mexico, there is more money spent in bottled water than in utility water. And the tipping point for the us is very close. So it’s expected to happen in the next years that there will be more money spent in bottled drinking water than in utility water.

And if it takes states like California, 80% of people simply don’t drink tap water. So where I’m trying to go here. Does it really matter to improve that I’m really playing the devil’s advocate here, but does it really matter to improve that infrastructure? If any ways the customers are moving away from

Alex Loucopoulos: tap water?

Good question. I think we always have to strive for basic, you infrastructure, I think. Yes. Certainly people can drink more bottled water, but I, again, I look at the water industry more than. You know, the residential piece, right? You’ve got the industrial, you’ve got the commercial, you’ve got the agricultural piece, all of that needs infrastructure and all of that needs even more upgraded infrastructure. And all we’re advocating with that is to approach it from a grassroots perspective and layer on, you know, more innovation, that innovation. Can be, oh, I have a new type of lighting technology that will make it faster, cheaper, or that could be a business model innovation.

The important battle of storytelling in the US Water Market

I’m going to help finance this using a different structure that hasn’t been used before for any municipality. Or that can be an innovation in terms of, you know, you use the example, know, sensory for a utility so that I don’t have to send my guy on a truck to go test the water every three days, or I can turn the valve remote.

So it’s putting the pieces together from a grassroots perspective to be able to do that. And I think now there is no better time to do that. Again, I think you’ve got to put your lens on in terms of, you know, water is, it’s just such a broad, you know, piece to it that it’s oftentimes agriculture, it’s industrial.

And, you know, we try to focus on solutions for. Specific types of customers, which I think there’s no lack of, if the conviction isn’t so strong in terms of bottled water, you know, then we won’t focus on that piece of it for that particular area. We’ll go after other infrastructure. But the reality is the, I mean the infrastructure is just, you know, anybody who has a home knows you need to maintain your home to do it.

Money won’t fall from the sky

And in the us, the infrastructure is a Bismal. I bet. And, and getting worse. The reality is the federal government is not going to drop money from the sky. And if they do, it’s probably going to go to the big cities. Everything else will probably not get too much. And it definitely won’t be enough.

So we want to just be part of that solution to help do it so people can get, you know, cleaner water, agriculture, cleaner water, industrial can remove some of the contaminants. And so, and the list goes on and on, but that’s the basic high-level macro things.

Antoine Walter: You mentioned your investment thesis, and you mentioned at the very beginning of that interview, you mentioned impact investing.

And now you just said, that’s the federal government. There’s just so much that they can finance, but actually besides financing, they could be regulating. Let me just give you a short extract from a previous discussion had on that microphone. And I’ll take my question from there.

The impact of impact investing

Antoine Walter: So that was an extract from Julian Kölbel and Florian Heeb, who are researchers in the field of impact investing. And they were trying to set the middle point between what’s impact investing actually can trigger and what’s regulation shall bring to support there.

Do you share their vision there or what would be your point here? What do you need to trigger in terms of regulations to increase your strength there?

Alex Loucopoulos: Yeah I tell you, and I think this is one of the fascinating things about water. Is that you cannot work in isolation, right? You need to work with all the different constituents, right?

Policy, government, technology, engineering, finance, operations, marketing said, you know, you gotta be able to navigate all of that. And so when I talk about impact, I am in no, you know, under no view is that it could just be with money from science water. You need to do that in concert. With the federal government, whether it’s regulations, whether it’s it’s a regulated industry, right?

Financing the US Water Market requires a holistic approach

Water wastewater, right? So you know, you need to work with them hand by hand. You need that with the technologists, you need that with the engineers, right? You need that with, you know, the operators. So it’s really much putting all those pieces together. I send it. It’s a puzzle.

You need a puzzle and you need structures to put that. You need to know. What you want to build, right? So you need to see the framework, you have the pieces, you need to see the framework, and then you need somebody to actually physically put those different puzzle pieces together. So all we’re advocating is to work with the other.

You know, stakeholders to do that, and you’ve gotta do that all along the way. It can’t be just developing this in some sort of lab in my dorm room. And it’s going to be a trillion dollar business, which can happen in many parts of technology. We’ve seen that we’ve, you know, and I think that in many parts of finance remain parts of technology, operation, water, and that’s what makes it unique is you need to do that in concert with everybody else.

The Water Market is a Cacophonous Orchestra

In some cases may take a little bit longer to find that, but in reality, there is no other way of doing that. So, we spent a lot of time with regulators and we spent a lot of time with policy academia, operations and putting that together in concert because you know, I heard a great analogy.

I was on a forum the other day. People in the water space, you know, it’s an orchestra, which is right now creating cacophonous noise. And it’s a matter of who’s going to conduct it to make good music. And my point to that was, yes, you need conductors to make good music. You need many conductors because it’s not one orchestra, one type of music.

And one solution you need multiple conductors. We want to be part of that conducting. And we want to be part of making some of that good music because no matter what the conductor needs an orchestra,

Is Water a Finance Good like any other?

Antoine Walter: that leads me to my last question. That deep dive, which is you are one of the players in that orchestra because you’re investing in that sphere.

And you’re investing in guiding your investments towards certain outcomes, but the results. Of all of that. Won’t be only financial. I mean, not directly financial it, I mean, th the water sector is distributed, but the outcome of the water sector are distributed as well. Treating better your water then probably your environment is going to be better than on the long run.

You need to invest less in solving the environmental crisis. And if the river is a bit more beautiful in the center of the city, then people will be more happy. And then you will have more leisure around the river. More business built around the river. I mean, what I’m trying to say here is that.

It’s hard to put a direct financial equation to say, I invest so much. And the outputs of so many billions, which is estimated by several studies, which are very serious about that. It’s not going to fall in one spot and to say, Hey, I can reap all the benefits because I invested no, the benefits are gonna be further.

So shitty globally. And I find that fascinating from an external point of view. But if I was an investment company, it may be hard to explain to my investors that all the money I put in serves generally the wellbeing of the social team, but not directly my financial interests. So as investment. Good. How different is water from any other type of investments?

The Water Market is not a zero-sum game

Alex Loucopoulos: Great question. I think the reality is. There’s so much inefficiency. And if one is able to identify the value creation, you can get value creation, economic, societal benefits that go hand in hand. Um, this isn’t a zero sum game here, right? Which is, I think that’s part of the water sector is that you can have the types of returns that our investors ask us to get because of the value creation we are producing.

And the impact and sustainability to it. I don’t think they’re mutually exclusive by any stretch of the imagination and anyone that would believe that is probably looking at a very small part of the water market, which I think is changing and growing. And I’m incredibly encouraged by the fact that you can actually do both.

And that’s what personally excites me is to do that and to do it well, and to do it at scale. But I definitely don’t think, you know, making money and water and doing good are at all mutually exclusive. If you’re focusing in the right areas and creating enough value for everybody to win. I honestly don’t think there’s any lack of opportunity for anybody who can see it and can see it from a grassroots basis.

Water investment is still (a bit) of a beast of its own

Antoine Walter: So does that mean that people. Invest into water deliberately. Like they say, they want to be in water and they will have financial benefits, but as it’s not mutually exclusive, when you fully right by saying that there will be a win-win or is it like really some it’s part of their portfolio in one part of the portfolio is water and they simply don’t care.

Alex Loucopoulos: Yeah. I think that’s changing. I mean, if I would love to say that you have people call us up every day and say, I, you know, I get it about water and I want to invest. You know, we’re still a small asset manager in the grand scheme of things. I I’m hopeful that will change as they seem more success.

And as they see what we’ve done for others to do similar things so I’m hopeful that will happen. But right now it’s still very much top line driven and you know, it’s still a part of it, but I think in a few years, I’m hopeful that just like people, you know, say, I just want, you know, carbon, I just want, you know, electric utility, you know, I am just wind or solar or what have you.

Because of the impact, people will say the same thing about water, but I don’t think there’s enough products financial product out there right now to be able to do that. But I think soon that will be the case successful investment products.

How the Water Market could get inspiration from outside its silo

Antoine Walter: It’s very interesting that you say that because by coincidence, I was reading a report by a, from pollination today, which was saying that we shall the water industry get inspired by how.

Climate activists have been playing the masses education towards one single goal, which was reduced to carbon emissions. And we don’t have that single goal in what industry, which makes it a bit more difficult to have a metric to measure and to get all the people that would actively ask to. I want to invest in water as people would be.

Actively divesting from oil and fossil fuels. So there’s probably one of the battles to come when it comes to the water industry. And just one closing question for you here. Do you see a major trends which is booming in terms of water investing, or is it something which is slowly growing as would any kind of sustainable investors?

Alex Loucopoulos: Great question. You know, I’ve been in the water space for, you know, a little bit over seven years right now. So I definitely think there’s a lot more interests, right? There’s a lot more investor interests than I’ve seen before. And there’s certainly a lot more understanding from a consumer basis about the importance of this.

And I certainly think there’s no lack of opportunity or products, or, or solutions to solve. So. Um, I do think that we’re in some sort of inflection point, but I would say, I think it’s still early. We got a long way to go because the sector is so vast and so broad and so complicated, but I do see a lot more entrance.

The US Water Market is currently evolving

I do see a lot more excitement and I’m hopeful that it will be driven by a lot more action and success. Then high level notes, right? Because the one thing I don’t want to happen is, you know, you have some high profile transactions where people in the industry and it just doesn’t go right. In which case that hampers the industry.

So I’m cautious that we can produce the right types of case studies and results. That will cause a lot more change in the future because. Other macro trends are there. I mean, it’s, it’s silly to think otherwise. Everyone, you know, water is literally everywhere, but nowhere, but people are beginning to pay attention.

But you need to do it in the right understanding way researched way. And you know, like I tell my kids, I mean, if I just throw a bunch of puzzle pieces out there and you don’t know what you’re building, will you ever finish? The answer is no, you will never finish. So I’m hopeful that the right people will help put the puzzle pieces together.

In the right way over the next decades,

Who shall have a vision from where this is heading?

Antoine Walter: I was thinking that was the last question where that I cannot just close on that one, because that means people need to have a vision. Someone needs to have the vision for it to happen, who if there is one person or which body shall be the one, bringing that vision.

Alex Loucopoulos: You know, I, again, I don’t think it’s because water is so important where you need multiple constituents and where it is so local, there isn’t one person. It’s just some, a group of people that work together. And, you know, I’ve worked in many sectors as I pointed out in the beginning. The thing that fascinates me about water is that people care and declaring this about the environment and each other.

Right now is that it’s all time high. And that’s the only way, you know, people will work together. I think people really work together in the water. It’s not like working in certain parts of wall street or hedge funds or certain other industries where, you know, the opportunity set keeps shrinking or it gets too competitive because there’s too many people, water, people like to work together.

The Water Market Players shall unite

They have a common vision, they all care about the world. And that unifies everybody. And, you know, you’ve told a bunch of stories. On your podcast about that. And I think that’s the unifying trend of people in water nights. So I don’t think it’s one person. I think it’s a lot of these people working together for a long period of time.

And some people will be leaders. Some people will be followers, but the reality is, you know, you have a whole shifting a mindset of people and hopefully that will drive change. And, you know, you’re central to that with your podcast and getting the word out there and telling those stories.

That’s what makes it unique is the stories in, so it won’t be one individual

Antoine Walter: that makes a perfect conclusion for that deep dive while I’m blushing. I propose it to switch to the rapid fire questions.

Rapid fire questions:

Antoine Walter: In that last section, I’ll try to keep the questions short and then it’s up to you. I’m not getting the microphone, but you can have short answers. That would be deeper. My first question is going to be

What is the most exciting project you’ve been working on and why?

Alex Loucopoulos: every day, you know, trying to solve big water problems is just super exciting, right?

Any of the projects for any of the businesses that I just laid out is super exciting, right? Whether it’s, you know, identifying more water utilities to acquire new states that will give people good, clean water at a reasonable price. That’s exciting. Identifying. How much we’re going to help in increasing the recycle, reuse effluent quality in parts of the United States that are in a drought or are in a contaminated area.

That’s exciting to me. So I would say just overall, you know, helping solve issues, big issues and water are very excited.

What’s your favorite part of your current job?

Alex Loucopoulos: working with so many different, interesting people from various backgrounds, right? Like I mentioned earlier, I think the water sector.

Has one common theme, which is everybody really cares and everybody really wants to work together. And I think it’s interesting to talk to so many different people that care, but also come from various different backgrounds and contribute different things. It’s one thing to talk to an engineer, but an anaerobic digester or technologist about, you know, solving bio biogas issues talking track into an academic or talking to a policymaker federal government or a mayor.

Or a financier or an operator of a construction company. I think it’s the different types of personalities, fundamentally all people that care and want to do good.

What is the trend to watch out for in the water industry?

Alex Loucopoulos: There’s certainly a trend. You know, people talk about it. You’ve had people on your show, digital.

I think you can’t ignore that for far too long. The technology and the innovation hasn’t been applied. I think a lot of that innovation on the technological side is there. I think the innovation has to come with, how do you scale? How do you commercialize it? But certainly that’s coming down, whether you’re talking about infrastructure utilities or treatment, all of the above of the macro trends that I talked about, the digital aspect is.

What is this thing you care about the most when you start working on a new project and what is the one you care the least?

Alex Loucopoulos: That I care the most about is that it’s a it fits within our thesis in our plan. And it generates the types of returns that we’ve told our investors.

That’s the beginning of you followed by, you know, is this having the right type of impact? Is this the right type of project that we want have. Is this something that we can add value it’s that logical step? The things that I cared the least about how difficult it is, you know, I like difficult things spent my career trying to solve difficult puzzles.

If this was easy, I think you would see a lot more dedicated S border infrastructure funds. So, I think the part that I cared the least about is how much time and effort it’s going to take to actually get results.

Antoine Walter: I have. Background expertise and fields where you are. You’re working have to add an additional question.

I don’t know how much of a rapid fire question he tees and how much of a difficult question to tease. So you’ll tell me:

What do you think of water futures? And the fact that water is traded on wall street?

Alex Loucopoulos: and, you know, I get that question a lot and to be honest, I focus on other parts of the water market.

I mentioned this, you know, we’re grassroots infrastructure investors. That’s a very different ball game. One that’s more financial engineering driven and much more regulatory driven. So, we’ve shied away from that completely. So I don’t really have an opinion other than to say it’s not

Antoine Walter: something good answer to a curveball question.

Do you have sources to recommend, to keep up with the US Water Sector trends and news?

Alex Loucopoulos: I mean, sources, you know, the, I think the greatest sources outside of publications and listening to podcasts like yours and, you know, global water intelligence, we get our sources from primary research grassroots, right?

Talking to the CEOs every day, you know, getting in the pickup truck and driving around Louisiana and seeing people and seeing the treatment plants, you know, attending trade shows or just talking to people on the water side. I think it’s for us that’s important, but more and more, you’re seeing more sources of water information that are useful.

But I, I think, you know, listening to podcasts and listening to one-on-one conversations about, you know, th the stories and the people of water, I think it’s fascinating. You know, I mentioned I worked at the Olympics. I mean, the Olympics is about stories, right? It’s not so much the nanosecond of a difference, but the story of the individuals.

And so for me, water is the story of those individuals and learning from those

Antoine Walter: individuals. Well, talking of individuals to learn from,

Would you have someone to recommend me to have on that very microphone?

Alex Loucopoulos: You know, a lot of, I mean, I think we, we interact with a lot of interesting stories, you know, certainly assess Siegel.

He’s one of our, you know, members on our on our advisory board. I think he wrote. You know, th the most mainstream book did it helped explain water. We make everybody read it the day they arrive at science. I think it’s a great thing. He, you know, he wrote it. That was the followup book to his original book about water in Israel.

He’s very, well-informed very eloquent. He actually also told me the story about Hamilton. It came from him. He can probably explain it in much better detail than I can professor Lall. You mentioned him, you know, he’s probably the, one of the preeminent academic policy thinkers in water. Somebody, I have tremendous respect for professor law at Columbia at the water center.

And, you know, any of the people that I interact with on a daily basis, any of our CEO’s for our water businesses, I think would be great, but know. There is no lack of stories around water and you know that and, you I think it’s great that you’re bringing some of them to life because you know, people need to get more and more educated on it.

It’s not, like I said, you know, you, you’re not going to put the puzzle pieces together just by thinking you’re building Legos. Isn’t Lego is assistant Playmobile. This is, you real, real puzzle.

Conclusion: US Water Sector

Antoine Walter: Well, I couldn’t agree more. So I think that’s the perfect closing. So thanks a lot, Alex.

Thanks for your time. Great recommendations. I think swiftly follow on because set Siegel was on my watch list for

Alex Loucopoulos: awhile. Yeah, you should. Absolutely. He’s a fantastic speaker and professor of law to

Antoine Walter: his. Great. Thanks

Alex Loucopoulos: my pleasure. Thank you. Thanks for listening to don’t wastewater. This podcast was brought to you by GF piping systems.

Love this. Head over to apple podcast to subscribe, rate and leave a review. See you next time.

5 thoughts on “The 3 Painful Challenges the US Water Sector Desperately Needs to Overcome”