In the realm of water technology investment, XPV Water Partners stands as a beacon of innovation and strategic foresight. Founded with a clear vision to accelerate the deployment of water technologies that address critical global challenges, XPV has established itself as North America’s premier water tech investment firm. Through a combination of deep sector expertise, patient capital deployment, and hands-on operational support, XPV has built an impressive portfolio of companies that are revolutionizing how we manage, treat, and conserve water resources. Their approach goes beyond mere financial returns, embracing a dual mandate to generate both profitable growth and meaningful environmental impact.

XPV Water Partners is part of my Ultimate Water Investor Database, check it out!

Investor Name: XPV Water Partners

Investor Type: PE

Latest Fund Size: $200 Million

Dry Powder Available: Yes

Typical Ticket Size: $250k – $1M

Investment Themes: water technology, utilities, water sector infrastructure

Investment History: $132528571.43 spent over 27 deals

Often Invests Along: KKR Global Impact, True North

Already Invested In: ATAC Solutions, Aquatic Informatics, Atlas-SSI, Axius Water, BCR Environmental, Environmental Dynamics (EDI), Environmental Operating Solutions (EOSi), Holland Pump Company, Isle Utilities, LuminUltra, Metasphere, Metron-Farnier, Mobiltex, Mobiltex Data Ltd., Napier-Reid, Natural Systems Utilities, Newterra Ltd, Nexom, Organica Water, SmartCover Systems, Soli Organic, Transcend Software Inc.

Leads or Follows: Lead

Board Seat Appetite: High

Key People: Dave Henderson, John Coburn, Elaine Stewart, Khalil Maalouf, Adam Bates, Shiv Jani, Elisabeth Wightwick

The Genesis of XPV Water Partners

Born from a vision to transform the water technology landscape, XPV Water Partners emerged as a pioneering investment firm focused exclusively on water innovation. The firm’s founding in 2008 coincided with growing recognition of global water challenges and the critical need for technological solutions.

The founders brought together decades of operational experience in water technology with sophisticated investment expertise. This unique combination allowed XPV to identify promising innovations while understanding the complexities of bringing new technologies to market in the conservative water sector.

From its earliest days, XPV differentiated itself through deep sector expertise and an active investment approach. Rather than simply providing capital, the firm worked closely with portfolio companies to accelerate their growth and maximize impact. This hands-on strategy proved particularly valuable in navigating the water industry’s lengthy sales cycles and complex stakeholder relationships.

Key milestones in XPV’s evolution include the successful deployment of multiple investment funds, each larger than the last, and the development of a robust network spanning utilities, industrial players, and technology innovators. The firm’s portfolio companies have introduced breakthrough solutions in areas like digital water, resource recovery, and infrastructure optimization.

XPV’s investment thesis has remained remarkably consistent: back exceptional teams developing technologies that address critical water challenges while generating attractive financial returns. This focused approach, combined with patient capital and deep domain knowledge, has established XPV as North America’s leading water technology investor.

Investment Philosophy: The Water Technology Edge

XPV Water Partners stands apart in the investment landscape through a meticulously crafted approach focused on identifying and scaling transformative water technologies. The firm’s investment thesis centers on three pivotal criteria: proven technology validation, clear market demand, and scalable business models demonstrating tangible environmental and social impact.

At the core of XPV’s strategy lies a comprehensive value creation framework that goes beyond traditional capital deployment. The firm actively partners with portfolio companies to accelerate commercial adoption through its extensive network of water industry relationships. This hands-on engagement includes facilitating strategic partnerships, optimizing go-to-market strategies, and providing operational expertise to drive sustainable growth.

XPV’s differentiated approach also emphasizes the intersection of innovation and practical application. The investment team, composed of water industry veterans and technology experts, conducts rigorous technical due diligence to validate solutions that address critical water challenges while delivering measurable efficiency gains. This expertise enables XPV to evaluate both the technological merit and commercial viability of potential investments with remarkable precision.

The firm’s value creation playbook has evolved to incorporate emerging trends in digitalization, resource recovery, and infrastructure resilience. XPV particularly seeks technologies that enable water reuse, energy efficiency, and smart water management – areas where innovation can drive both environmental benefits and attractive financial returns.

By maintaining a laser focus on water technology while embracing a collaborative approach to value creation, XPV has established itself as a catalyst for innovation in the water sector. Their investment philosophy, as explored in How to actually admit value and overcome the economic risk of water, continues to shape the future of water technology deployment and adoption.

Portfolio Success Stories

XPV Water Partners has built an impressive track record of nurturing innovative water technology companies into market leaders. A standout portfolio company pioneered an energy-efficient wastewater treatment approach that reduces carbon emissions by up to 80% while maintaining exceptional water quality. This breakthrough technology is now deployed across multiple municipal facilities, validating XPV’s thesis that sustainability and profitability can align.

Another portfolio success revolutionized water quality monitoring through advanced sensor technology and predictive analytics. By enabling real-time contaminant detection and treatment optimization, this solution helps utilities reduce operational costs while ensuring regulatory compliance. The company’s rapid growth and subsequent acquisition by a major industry player demonstrated XPV’s ability to identify and scale transformative technologies.

XPV also backed a company tackling water infrastructure challenges with innovative asset management software. By combining IoT sensors with machine learning, the platform helps utilities prevent costly failures and extend infrastructure lifespans. This investment showcases XPV’s focus on digital transformation in the water sector.

A common thread among these success stories is XPV’s hands-on approach to value creation. Beyond capital, the firm provides strategic guidance, industry connections, and operational expertise to accelerate commercialization. By focusing on solutions that deliver both environmental and economic benefits, XPV helps portfolio companies achieve lasting impact in the water sector.

Innovation Ecosystem Development

XPV Water Partners has cultivated a vibrant innovation ecosystem that transcends traditional investment boundaries. By fostering deep connections between portfolio companies, research institutions, and industry leaders, XPV creates a multiplier effect that accelerates water technology advancement.

At the core of XPV’s ecosystem approach is their unique collaboration model that pairs emerging technologies with established market players. Through strategic partnerships, portfolio companies gain invaluable market access and validation while industry incumbents benefit from cutting-edge solutions. This symbiotic relationship has proven particularly powerful in addressing complex water challenges that require multi-disciplinary approaches.

The firm has also pioneered several innovative funding mechanisms that de-risk early-stage water technology development. Their milestone-based funding approach allows promising solutions to receive capital infusions aligned with key technical and commercial achievements. This structured yet flexible model has dramatically improved success rates for water technology commercialization.

XPV regularly convenes technology roundtables and innovation workshops that bring together diverse stakeholders across the water sector. These forums serve as crucial platforms for identifying emerging challenges, sharing best practices, and forming new collaborative ventures. The resulting cross-pollination of ideas has led to numerous breakthrough solutions, particularly in areas like digital water, resource recovery, and advanced treatment technologies.

Additionally, XPV’s deep industry expertise allows them to provide highly specialized technical and commercial guidance to portfolio companies. This hands-on approach, combined with their extensive network of water industry veterans, creates an environment where innovative solutions can rapidly evolve from concept to commercial success.

Environmental Impact Metrics

XPV Water Partners’ investment portfolio delivers measurable environmental benefits that demonstrate the firm’s commitment to sustainable water management. Through strategic investments in water technology companies, XPV has helped achieve significant reductions in water consumption, energy usage, and carbon emissions.

The firm’s portfolio companies collectively save over 50 billion gallons of water annually through innovative treatment and reuse technologies. This represents enough water to meet the annual needs of approximately 500,000 households. Beyond water conservation, these solutions have enabled industrial facilities to reduce their energy consumption by an average of 30-40% compared to conventional treatment methods.

Particularly noteworthy are the advances in resource recovery, where XPV’s investments have facilitated the extraction and beneficial reuse of valuable materials from wastewater streams. Portfolio companies have successfully recovered thousands of tons of nutrients and minerals annually, transforming waste into valuable products while preventing environmental contamination.

Carbon footprint reduction remains a key focus, with XPV-backed technologies enabling an estimated 2 million metric tons of CO2 equivalent emissions avoided each year. This impact stems from both direct energy savings and the prevention of methane emissions through improved biosolids management. The firm actively monitors these metrics using advanced data analytics and reporting frameworks aligned with international sustainability standards.

These quantifiable results underscore XPV’s thesis that environmental stewardship and strong financial returns are complementary goals. As discussed in “how to mitigate 4 shades of water risk through impact investing“, the firm continues to demonstrate that addressing water challenges creates measurable positive impact while generating attractive returns for investors.

Market Analysis and Future Trends

The water technology investment landscape is experiencing unprecedented growth driven by increasing water scarcity, aging infrastructure, and climate change impacts. Investment opportunities in water tech are expected to reach $1 trillion by 2030, with particular momentum in digital solutions, resource recovery, and advanced treatment technologies.

Key market dynamics indicate a shift toward decentralized treatment systems and smart water infrastructure. Utilities and industrial users are prioritizing solutions that optimize operational efficiency while reducing energy consumption and chemical usage. This has created strong demand for technologies leveraging artificial intelligence, IoT sensors, and advanced analytics.

Significantly, regulatory pressures around emerging contaminants like PFAS are catalyzing innovation in destruction and removal technologies. The paradigm is shifting from conventional treatment to more sustainable approaches focused on resource recovery and circular economy principles. Investors recognize that water tech solutions delivering both environmental and economic benefits represent the highest potential returns.

Looking ahead, several trends will shape market trajectories. Climate resilience is becoming a central investment theme, driving interest in drought-resistant infrastructure and flood mitigation technologies. The water-energy nexus presents opportunities in energy-neutral treatment processes and renewable power integration. Additionally, the digitalization of water systems is opening new frontiers in predictive maintenance and real-time optimization.

Noteworthy growth areas include direct lithium extraction, micropollutant removal, and decentralized water reuse systems. These segments align with broader sustainability goals while offering attractive economics. As outlined in a recent analysis of water technology investment dynamics, successful investments will increasingly require deep domain expertise combined with patient capital deployment strategies.

Global Expansion Strategy

XPV Water Partners is strategically positioning itself to capture emerging opportunities across key international markets, with a particular focus on regions facing acute water challenges. The firm’s expansion priorities target areas where innovative water technologies can deliver maximum impact while generating strong financial returns.

Asia Pacific stands as a primary focus, with XPV establishing strategic partnerships in Singapore, Japan, and Australia. These markets offer a compelling combination of sophisticated water infrastructure needs, supportive regulatory frameworks, and growing demand for advanced treatment solutions. The firm is particularly interested in technologies addressing industrial wastewater treatment, water reuse, and smart water management systems in these regions.

Europe represents another key expansion vector, where XPV is leveraging its expertise in sustainability-focused investments to tap into the continent’s ambitious environmental goals. The firm has identified opportunities in water-stressed Mediterranean countries and is exploring partnerships with local technology clusters in Germany and Scandinavia. As outlined in How to Take Mid-Market Green Tech Companies to the Next Level, these markets present unique scaling opportunities for water technology companies.

In emerging markets, XPV is taking a measured approach, focusing on partnerships that combine proven technologies with local expertise. The firm’s strategy emphasizes solutions that can be rapidly deployed and scaled while maintaining robust risk management protocols. This includes exploring opportunities in Latin America’s industrial sectors and Middle Eastern desalination markets, where water scarcity drives innovation adoption.

Investment Opportunities and Partnership Models

XPV Water Partners offers multiple pathways for entrepreneurs and investors to engage with its mission of advancing water technology innovation. At its core, the firm provides growth capital investments ranging from $2 million to $20 million to established companies with proven technologies and market traction. However, XPV’s partnership approach extends far beyond traditional funding models.

For early-stage companies, XPV operates an accelerator program that pairs promising water technology startups with industry mentors and potential customers. This program helps validate technologies while providing crucial market feedback and networking opportunities. The firm also facilitates strategic partnerships between portfolio companies and established industry players, creating symbiotic relationships that drive innovation and market adoption.

Institutional investors can participate through XPV’s dedicated water technology funds, which provide exposure to a curated portfolio of high-potential companies across the water sector. The firm’s deep industry expertise and extensive network help identify and nurture companies poised for significant growth.

XPV also engages in co-investment opportunities with corporate partners, allowing strategic investors to leverage the firm’s deal flow and due diligence capabilities. For entrepreneurs, this means access to not just capital, but also potential customers and distribution channels through XPV’s corporate relationships.

The firm’s flexible partnership approach allows it to structure investments that align with both company needs and market opportunities, while its hands-on operational support helps portfolio companies accelerate growth and maximize value creation.

The XPV Investment Philosophy

At the core of XPV Water Partners’ approach lies a distinctive investment thesis that seamlessly merges financial returns with meaningful water impact. Rather than chasing unproven concepts, XPV focuses on accelerating the adoption of validated technologies that are ready to scale commercially.

The firm’s philosophy centers on identifying solutions that address critical water challenges while demonstrating clear market demand and revenue potential. By focusing on proven technologies that need growth capital, XPV minimizes technology risk while maximizing the potential for both environmental impact and financial returns.

XPV evaluates potential investments through a dual lens. First, they assess the technology’s ability to solve pressing water-related challenges like scarcity, quality, or infrastructure efficiency. Second, they analyze the business fundamentals – examining factors such as market size, competitive dynamics, and path to profitability. This balanced approach ensures portfolio companies can achieve meaningful scale while delivering measurable environmental benefits.

The firm’s emphasis on commercial-ready solutions rather than early-stage research reflects a pragmatic understanding of the water sector’s needs. By targeting companies with proven technologies, XPV accelerates the deployment of solutions that can make an immediate difference while generating attractive returns. This strategy allows them to bridge the critical gap between innovation and widespread market adoption in the water technology landscape.

Portfolio Success Stories

XPV Water Partners has demonstrated remarkable success in identifying and scaling promising water technologies, as evidenced by several notable investments and exits. Their portfolio companies have consistently achieved strong commercial growth while delivering meaningful environmental impact.

One standout example illustrates XPV’s ability to recognize transformative potential in proven technologies ready for scale-up. After rigorous evaluation of the company’s patented water treatment process that reduced energy consumption by 50% compared to conventional methods, XPV provided not just capital but also hands-on operational support. Within three years, the portfolio company expanded from regional operations to serving customers across North America and Europe, ultimately leading to a successful acquisition by a global water technology leader.

This pattern of combining strategic investment with deep water industry expertise has been replicated across XPV’s portfolio. Their approach to growth acceleration aligns perfectly with what the most successful water tech companies need. Beyond financial returns, XPV’s investments have enabled the treatment of over 100 billion gallons of water annually while reducing operating costs for utilities and industrial customers.

The firm’s exits have generated strong returns for investors while creating platforms for portfolio companies to achieve broader market impact. By focusing on technologies that have proven their effectiveness but need support to scale, XPV has built a track record of transforming promising solutions into market-leading companies. This success stems from their deep understanding of both the technical and commercial challenges unique to the water sector.

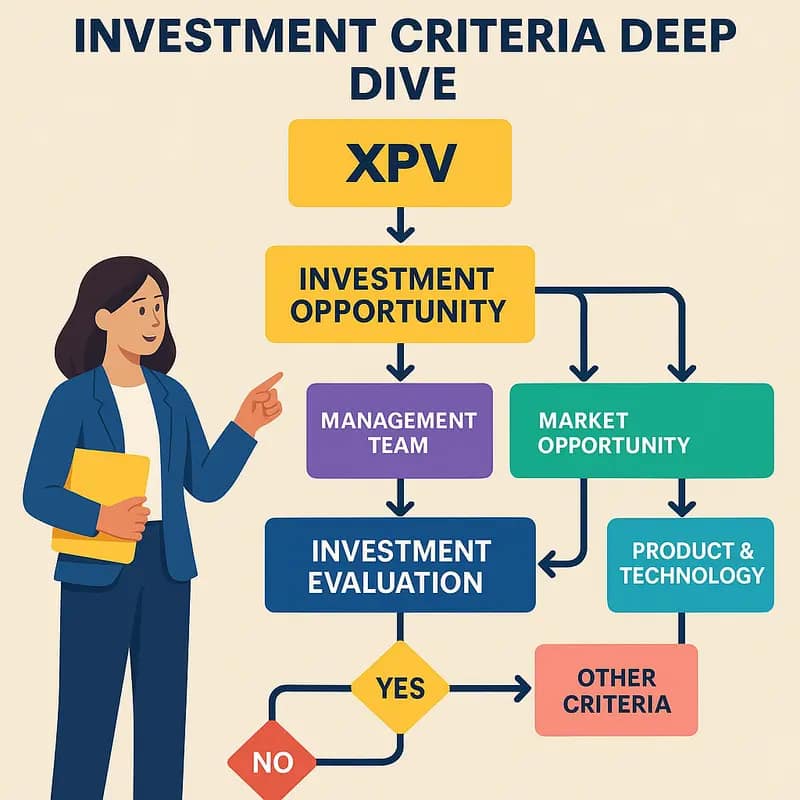

Investment Criteria Deep Dive

XPV Water Partners employs a sophisticated, multi-layered approach to evaluating potential water technology investments. The firm’s rigorous due diligence process begins with assessing three fundamental criteria: market opportunity, technology differentiation, and team capability.

The market analysis focuses on identifying scalable solutions addressing critical water challenges. Target companies must demonstrate a clear path to capturing significant market share within a addressable market exceeding $500 million. The technology evaluation scrutinizes not just the innovation itself, but its practical applicability and barriers to entry. XPV prioritizes solutions with strong intellectual property protection and proven pilot results showing clear advantages over existing approaches.

Team assessment goes beyond traditional management evaluation. XPV specifically looks for leadership teams that combine deep water industry expertise with entrepreneurial track records. The firm evaluates a company’s ability to execute commercial strategies and scale operations efficiently.

A unique aspect of XPV’s process is their comprehensive risk assessment framework that examines regulatory compliance, supply chain resilience, and customer adoption barriers. This systematic approach, refined through years of water sector experience, helps identify potential challenges early in the investment cycle.

The final stage involves extensive technical and commercial validation through XPV’s network of industry experts and potential customers. This real-world feedback provides crucial insights into market fit and adoption potential. As detailed in their investment philosophy, only companies meeting all criteria advance to term sheet discussions, resulting in a highly selective but proven investment strategy.

The Value-Add Partnership Model

XPV Water Partners distinguishes itself through a comprehensive value-add partnership approach that transforms traditional investor-company relationships. Beyond providing capital, XPV functions as an extension of their portfolio companies’ teams, offering multi-faceted support that accelerates growth and maximizes potential.

The firm leverages its deep industry network to facilitate strategic introductions and partnerships. Portfolio companies gain access to XPV’s extensive relationships with utilities, industrial players, and technology integrators. These connections often lead to pilot projects, commercial contracts, and strategic partnerships that might otherwise take years to develop independently.

XPV’s operational expertise proves particularly valuable in scaling water technology companies. The firm’s partners bring decades of water sector experience, helping portfolio companies navigate complex regulatory environments, optimize go-to-market strategies, and build robust management teams. Drawing from their track record of successful exits, XPV guides companies through critical growth phases while avoiding common pitfalls.

The firm’s collaborative approach centers on regular strategic planning sessions where portfolio companies can tap into XPV’s industry insights and problem-solving capabilities. This hands-on engagement extends to areas like organizational development, technology validation, and business model refinement. As explored in “How to Take Mid-Market Green Tech Companies to the Next Level“, this systematic approach to company building has proven essential for scaling water technology ventures.

Through this value-add model, XPV transforms promising water technologies into market-ready solutions while building sustainable businesses that can deliver long-term impact in the water sector.

Market Impact and Innovation

XPV Water Partners has emerged as a pivotal force in transforming the water technology landscape through strategic investment and market-shaping initiatives. Building on their value-add partnership model, the firm has consistently identified and accelerated breakthrough technologies that address critical water challenges.

The firm’s market impact stems from its ability to spot emerging trends early and guide portfolio companies through rapid commercialization. By leveraging deep sector expertise and extensive industry networks, XPV helps innovative solutions achieve widespread market adoption and scale. Their investments have catalyzed advancements in areas like digital water management, resource recovery, and infrastructure optimization.

A key differentiator in XPV’s approach is their focus on technologies that deliver both environmental and economic benefits. This dual-impact strategy has helped establish new industry standards and best practices while generating attractive financial returns. As explored in How to Win in a Competitive Mature Niche Market, the firm’s portfolio companies often reshape existing markets through superior solutions.

Beyond individual investments, XPV’s collective portfolio creates powerful network effects that accelerate innovation across the sector. Their companies frequently collaborate, combining complementary technologies and expertise to develop integrated solutions. This ecosystem approach has helped overcome adoption barriers and created new market opportunities that individual companies couldn’t address alone.

By maintaining a long-term perspective while driving near-term results, XPV has demonstrated how strategic capital can accelerate the transformation of the water sector. Their success has inspired other investors to increase their focus on water technology, expanding the pool of resources available for innovation in this critical field.

Future Investment Focus

XPV Water Partners maintains a forward-looking investment approach centered on transformative water technologies poised to address emerging challenges. Drawing from their deep sector expertise, the firm has identified several high-potential areas for future capital deployment.

Decentralized water treatment solutions represent a key focus, particularly technologies enabling water reuse and recycling at the point of use. This aligns with growing water scarcity concerns and the need for resilient local water supplies. Digital water technologies, including advanced sensors, AI-driven analytics, and smart infrastructure management systems, form another crucial investment vertical as utilities and industries increasingly embrace digital transformation.

The firm sees significant opportunity in technologies addressing emerging contaminants like PFAS, microplastics, and pharmaceutical compounds. Novel treatment approaches using advanced oxidation, specialized filtration, and biological processes are garnering attention. Additionally, resource recovery solutions that extract valuable materials from wastewater while reducing environmental impact have caught XPV’s interest.

Energy efficiency and carbon reduction technologies in water operations present another compelling investment avenue. This includes innovations in low-energy treatment processes, renewable energy integration, and solutions for capturing and utilizing biogas from wastewater treatment. The firm recognizes that water-energy nexus solutions will become increasingly critical as utilities strive for net-zero operations.

Entrepreneurial Support System

XPV Water Partners has built a comprehensive ecosystem that empowers water technology entrepreneurs beyond mere capital investment. At the core of their support system lies an extensive network of industry veterans, technology experts, and successful founders who provide strategic guidance and mentorship to portfolio companies.

The firm’s entrepreneur-in-residence program pairs emerging water technology leaders with experienced operators who have successfully scaled similar businesses. These mentors work closely with founding teams to refine business models, optimize go-to-market strategies, and navigate complex regulatory environments unique to the water sector.

XPV maintains strong partnerships with leading research institutions, testing facilities, and pilot sites across North America. This infrastructure allows portfolio companies to validate their technologies in real-world conditions while building credibility with potential customers. The firm’s deep connections with municipal utilities and industrial water users create opportunities for companies to secure early adopters and reference customers.

Beyond technical validation, XPV provides founders with comprehensive business development support through their Growth Advisory practice. This includes assistance with strategic planning, recruitment of key personnel, and introductions to potential customers and partners. The firm regularly organizes knowledge-sharing events and forums where portfolio company leaders can learn from peers and industry experts.

As highlighted in their success story of turning water innovation into market impact, XPV’s support extends throughout a company’s growth journey, from early commercial validation through international expansion and eventual exit planning. This holistic approach has proven essential in helping water technology startups overcome the unique challenges of scaling in this complex market.

ESG Integration and Impact Metrics

XPV Water Partners demonstrates a sophisticated approach to integrating Environmental, Social, and Governance (ESG) principles across their investment portfolio while maintaining rigorous impact measurement standards. The firm employs a multi-layered ESG assessment framework that evaluates potential investments through both risk mitigation and value creation lenses.

At the core of their ESG integration lies a proprietary scoring system that examines water conservation metrics, energy efficiency improvements, and waste reduction achievements. Portfolio companies must demonstrate measurable progress in reducing their environmental footprint while delivering positive social impacts through improved water access, quality, or infrastructure resilience.

The firm’s impact measurement framework aligns with the UN Sustainable Development Goals, particularly SDG 6 (Clean Water and Sanitation) and SDG 13 (Climate Action). XPV requires portfolio companies to report quarterly on key performance indicators including gallons of water saved, metric tons of CO2 emissions avoided, and number of people gaining improved water access. This data-driven approach enables precise tracking of both financial returns and environmental impact.

XPV has pioneered an innovative ‘impact multiplier’ methodology that quantifies the ripple effects of water technology implementations across communities and ecosystems. This approach has proven particularly valuable in demonstrating the broader societal benefits of water infrastructure investments, helping secure additional capital from impact-focused limited partners.

Their commitment to ESG integration extends beyond measurement to active engagement with portfolio companies, providing resources and expertise to enhance sustainability practices and strengthen governance structures. This comprehensive approach to ESG integration and impact measurement has become a model for other water technology investors, as outlined in their landmark study on mitigating water risk through impact investing.

Final words

XPV Water Partners has established itself as more than just an investment firm – it’s a catalyst for innovation in the water technology sector. Through strategic investments, operational expertise, and a commitment to environmental impact, XPV continues to shape the future of water resource management. Their success demonstrates that profitable growth and environmental stewardship can go hand in hand, creating a model for sustainable investment in the water sector. As global water challenges intensify, XPV’s approach to technology investment and impact measurement provides a blueprint for addressing these issues while generating attractive returns. For entrepreneurs and investors looking to make a difference in the water sector, XPV Water Partners offers a compelling partnership opportunity that combines financial acumen with environmental purpose.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!